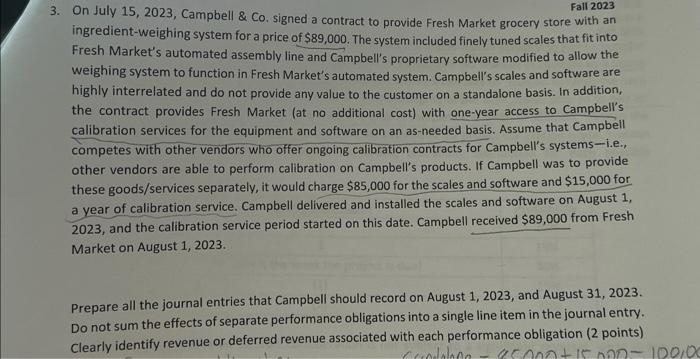

Fall 2023 3. On July 15,2023 , Campbell \& Co. signed a contract to provide Fresh Market grocery store with an ingredient-weighing system for a price of $89,000. The system included finely tuned scales that fit into Fresh Market's automated assembly line and Campbell's proprietary software modified to allow the weighing system to function in Fresh Market's automated system. Campbell's scales and software are highly interrelated and do not provide any value to the customer on a standalone basis. In addition, the contract provides Fresh Market (at no additional cost) with one-year access to Campbell's calibration services for the equipment and software on an as-needed basis. Assume that Campbell competes with other vendors who offer ongoing calibration contracts for Campbell's systems-i.e., other vendors are able to perform calibration on Campbell's products. If Campbell was to provide these goods/services separately, it would charge $85,000 for the scales and software and $15,000 for a year of calibration service. Campbell delivered and installed the scales and software on August 1 , 2023 , and the calibration service period started on this date. Campbell received $89,000 from Fresh Market on August 1, 2023. Prepare all the journal entries that Campbell should record on August 1, 2023, and August 31, 2023. Do not sum the effects of separate performance obligations into a single line item in the journal entry. Clearly identify revenue or deferred revenue associated with each performance obligation ( 2 points) Fall 2023 3. On July 15,2023 , Campbell \& Co. signed a contract to provide Fresh Market grocery store with an ingredient-weighing system for a price of $89,000. The system included finely tuned scales that fit into Fresh Market's automated assembly line and Campbell's proprietary software modified to allow the weighing system to function in Fresh Market's automated system. Campbell's scales and software are highly interrelated and do not provide any value to the customer on a standalone basis. In addition, the contract provides Fresh Market (at no additional cost) with one-year access to Campbell's calibration services for the equipment and software on an as-needed basis. Assume that Campbell competes with other vendors who offer ongoing calibration contracts for Campbell's systems-i.e., other vendors are able to perform calibration on Campbell's products. If Campbell was to provide these goods/services separately, it would charge $85,000 for the scales and software and $15,000 for a year of calibration service. Campbell delivered and installed the scales and software on August 1 , 2023 , and the calibration service period started on this date. Campbell received $89,000 from Fresh Market on August 1, 2023. Prepare all the journal entries that Campbell should record on August 1, 2023, and August 31, 2023. Do not sum the effects of separate performance obligations into a single line item in the journal entry. Clearly identify revenue or deferred revenue associated with each performance obligation ( 2 points)