Answered step by step

Verified Expert Solution

Question

1 Approved Answer

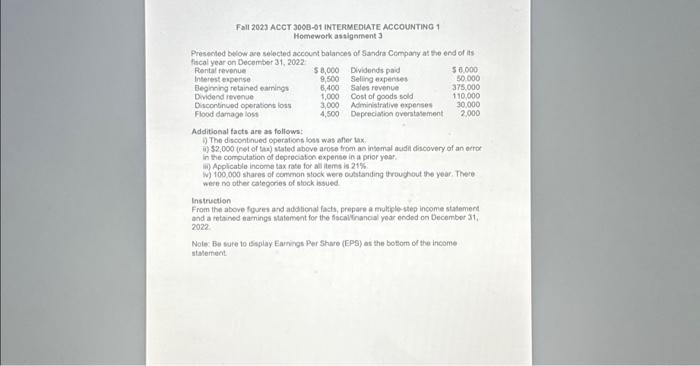

Fall 2023 ACCT 300B-01 INTERMEDIATE ACCOUNTING 1 Homework assignment 3 Presented below are selected account balances of Sandra Company at the end of its fiscal

Fall 2023 ACCT 300B-01 INTERMEDIATE ACCOUNTING 1 Homework assignment 3 Presented below are selected account balances of Sandra Company at the end of its fiscal year on December 31, 2022: Rental revenue Interest expense Beginning retained earnings Dividend revenue Discontinued operations loss Flood damage loss Dividends paid Selling expenses $ 8,000 9,500 6,400 1,000 3,000 Administrative expenses 4,500 Depreciation overstatement Sales revenue Cost of goods sold $ 6,000 50,000 375,000 110,000 30,000 2,000 Additional facts are as follows: i) The discontinued operations loss was after tax ii) $2,000 (net of tax) stated above arose from an internal audit discovery of an error in the computation of depreciation expense in a prior year. iii) Applicable income tax rate for all items is 21%. iv) 100,000 shares of common stock were outstanding throughout the year. There were no other categories of stock issued. Instruction From the above figures and additional facts, prepare a multiple-step income statement and a retained earnings statement for the fiscal/financial year ended on December 31, 2022. Note: Be sure to display Earnings Per Share (EPS) as the bottom of the income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started