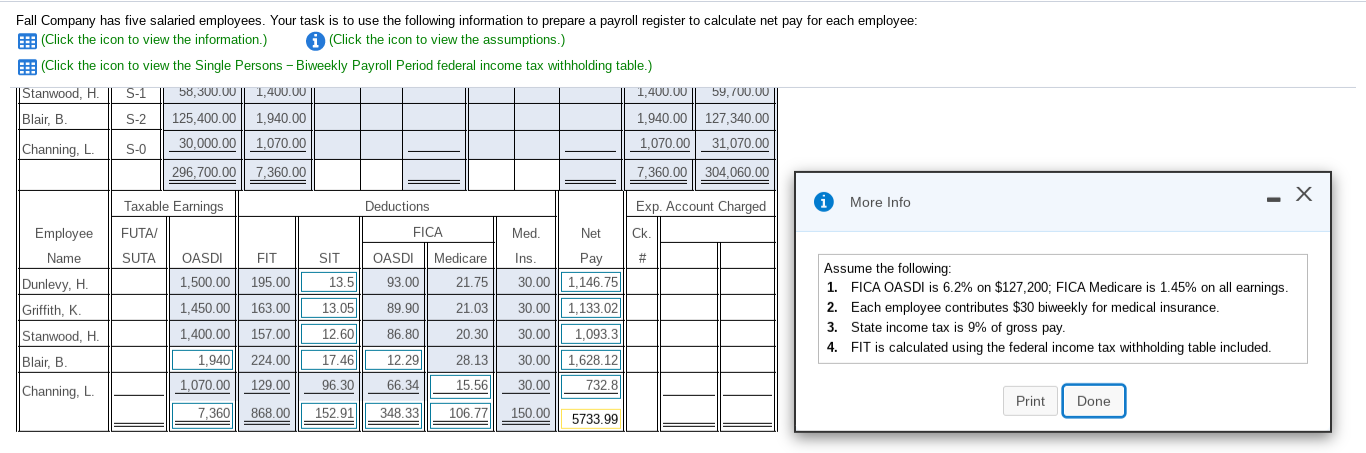

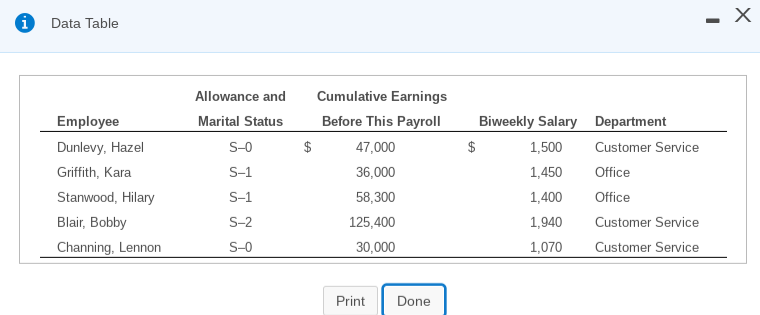

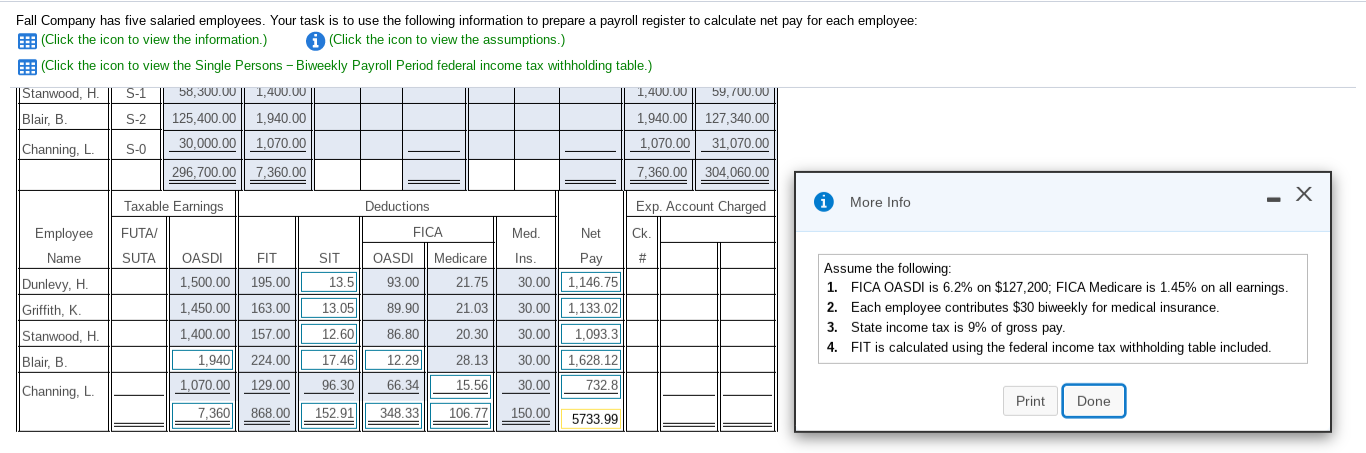

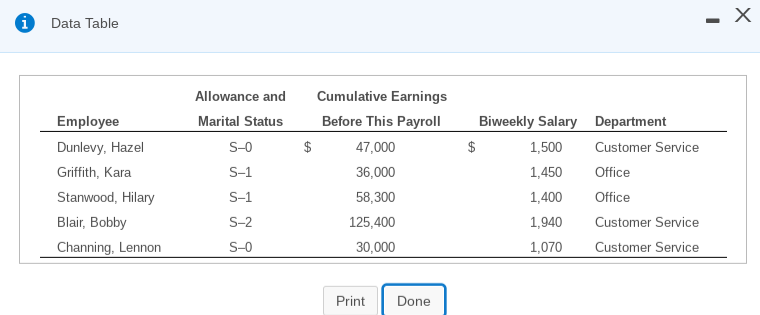

Fall Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: Click the icon to view the information.) (Click the icon to view the assumptions.) F: (Click the icon to view the Single Persons - Biweekly Payroll Period federal income tax withholding table.) Stanwood, H. S-1 58,300.00 || 1,400.00 1,400.00 59,700.00T Blair, B S-2 125,400.00 1.940.00 1,940.00 || 127,340.00 Channing, L S-O 30.000.00 1,070.00 1.070.00 31.070.00 296,700.00 7,360.00 7.360.00 304,060.00 - X Taxable Earnings Deductions Exp. Account Charged More Info FUTAI FICA Med. Net Ck. Employee Name SUTA OASDI FIT SIT OASDI Medicare # Ins. Pay 30.00 ||| 1,146.75 Dunlevy, H. 1,500.00 195.00 13.5 93.00 21.75 Griffith, K. 1,450.00 163.00 13.05 89.90 21.03 30.00 1.133.02 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $30 biweekly for medical insurance. 3. State income tax is 9% of gross pay. 4. FIT is calculated using the federal income tax withholding table included. Stanwood. H. 1,400.00 157.00 12.60 86.80 20.30 30.00 1.093,3 Blair, B 1,940 224.00 17.46 12.29 28.13 30.00 || 1,628.12| 1,070.00 129.00 96.30 66.34 15.56 30.00 Channing, L. 732.8 Print Done 7.360 868.00 152.91 348.33 106.77 150.00 5733.99 . Data Table Allowance and Marital Status S-0 $ $ S-1 Employee Dunlevy, Hazel Griffith, Kara Stanwood, Hilary Blair, Bobby Channing, Lennon Cumulative Earnings Before This Payroll 47,000 36,000 58,300 125,400 30,000 Biweekly Salary Department 1,500 Customer Service 1,450 Office 1,400 Office 1,940 Customer Service 1,070 Customer Service S-1 S-2 S-0 Print Done Fall Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: Click the icon to view the information.) (Click the icon to view the assumptions.) F: (Click the icon to view the Single Persons - Biweekly Payroll Period federal income tax withholding table.) Stanwood, H. S-1 58,300.00 || 1,400.00 1,400.00 59,700.00T Blair, B S-2 125,400.00 1.940.00 1,940.00 || 127,340.00 Channing, L S-O 30.000.00 1,070.00 1.070.00 31.070.00 296,700.00 7,360.00 7.360.00 304,060.00 - X Taxable Earnings Deductions Exp. Account Charged More Info FUTAI FICA Med. Net Ck. Employee Name SUTA OASDI FIT SIT OASDI Medicare # Ins. Pay 30.00 ||| 1,146.75 Dunlevy, H. 1,500.00 195.00 13.5 93.00 21.75 Griffith, K. 1,450.00 163.00 13.05 89.90 21.03 30.00 1.133.02 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $30 biweekly for medical insurance. 3. State income tax is 9% of gross pay. 4. FIT is calculated using the federal income tax withholding table included. Stanwood. H. 1,400.00 157.00 12.60 86.80 20.30 30.00 1.093,3 Blair, B 1,940 224.00 17.46 12.29 28.13 30.00 || 1,628.12| 1,070.00 129.00 96.30 66.34 15.56 30.00 Channing, L. 732.8 Print Done 7.360 868.00 152.91 348.33 106.77 150.00 5733.99 . Data Table Allowance and Marital Status S-0 $ $ S-1 Employee Dunlevy, Hazel Griffith, Kara Stanwood, Hilary Blair, Bobby Channing, Lennon Cumulative Earnings Before This Payroll 47,000 36,000 58,300 125,400 30,000 Biweekly Salary Department 1,500 Customer Service 1,450 Office 1,400 Office 1,940 Customer Service 1,070 Customer Service S-1 S-2 S-0 Print Done