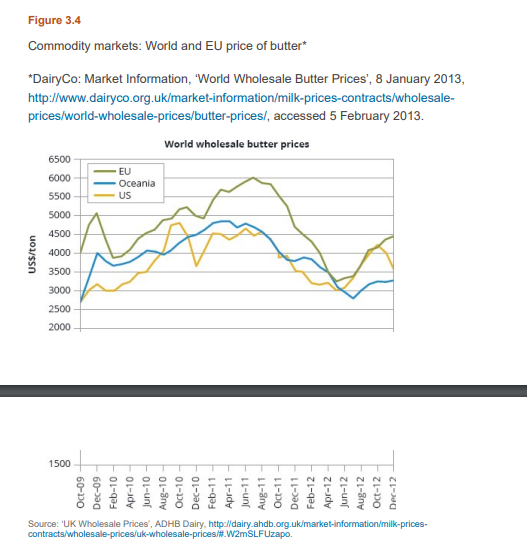

\fall New Zealand exports. With over 95 per cent of its production being exported to more than 140 countries, the company faces trade barriers every day. Fonterra processes 22 billion litres of milk annually and employs more than 22 000 people worldwide. Its brands, such as Anchor (milk and butter), Mainland (cheese products) and Tip Top (ice cream), are well known locally and internationally. Fonterra builds on the long- established international image of the quality of New Zealand farming. A ship named Dunedin transported one of the world's first cargoes of refrigerated meat and butter from New Zealand to London in 1882. Heritage linkages made the UK New Zealand's dominant trade partner for nearly the next 100 years. In the 1970s, when the UK joined the European Economic Community - which later transformed into the EU - historical and trade ties helped New Zealand gain preferential access to the common European market. Specified amounts of butter, cheese, meat and other produce could be exported each year from New Zealand to Europe at tariffs lower than those applicable to other non-EU members. The exporters pocketed extra profit from the resulting quota rents (the difference between the world price at which the produce left New Zealand and the price at which it could then be sold in the EU). In the early 2000s, New Zealand could market as much as 77 000 tons of butter annually at the lower import tariff of 686.88/100 kg instead of the regular rate of (189.6/100 kg. ~. Fonterra was the sole importer of New Zealand butter (worth (128 million annually) to the EU, with quota rents contributing as much as 635 million a year to the company's profits. However, to increase market access through localisation, in early 2002 Fonterra formed a joint venture with UK dairy cooperative Arla Foods to market its Anchor brand for butter, spread and cream products in the EU.Figure 3.4 Commodity markets: World and EU price of butter* *DairyCo: Market Information, 'World Wholesale Butter Prices', 8 January 2013, http://www.dairyco.org.uk/market-information/milk-prices-contracts/wholesale- prices/world-wholesale-prices/butter-prices/, accessed 5 February 2013. World wholesale butter prices 6500 EL 6000 Oceania 5500 US 5000 4500 US$/ton 4000 3500 3000 2500 2000 1500 Aug-11 Apr-10 Jun-12 Jun-10 Oct-10 Apr-11 Oct-09 Aug-12 Feb-10 Aug-10 Jun-11 Oct-11 Feb-12 Apr-12 Oct-12 Dec-10 Feb-11 Dec-11 Dec-09 Der-12 Source: "UK Wholesale Prices', ADHB Dairy, http:/dairy.ahdb.org.uk/market-information/milk-prices- contracts/wholesale-prices/uk-wholesale-prices/#.W2mSLFUzapoIt was believed that the rules governing New Zealand butter imports would remain about the same until 2015, with an interim review being undertaken in 2008. However, in mid-July 2006 the European Court of Justice ruled that the regulations for importing New Zealand butter were illegal and discriminated against firms outside of the UK, because all imports were handled by Fonterra's British subsidiary. Complaints from Germany and Poland - originating principally from Egenberger, a German company that wanted to obtain licences and import some New Zealand butter in 2003 - succeeded in court. The timing for this ruling could not have been worse, coinciding with the British dairy group Dairy Crest's launch of a campaign to promote its Country Life butter brand. Comparative advertisements showed Anchor butter imported to Britain on a rusty ship travelling 11 000 'food miles' from New Zealand, while the locally produced butter avoided the presumed negative environmental effects of such a trip. The European Commission reacted promptly and suspended all New Zealand butter imports before deciding how to proceed further. However, the butter supply chain could not be halted quite that quickly; substantial amounts were already en route on ships or stored in warehouses awaiting formal entry to the European market. Fonterra issued a press release in which it described the Commission's decision as extraordinary and ridiculous. *. New Zealand's then Trade Minister Phil Goff made bold media statements and immediately started to negotiate amendments with Mariann Fischer Boel, the then European Agriculture Commissioner. A few days later, EU officials lifted the ban and allowed 14 000 tons of New Zealand butter already in Europe or on the way, to be sold. However, it was becoming clear that Fonterra would not be able to retain its exclusive market position. In September 2006, the European Commission agreed on a system of butter imports from New Zealand. The EU requested that at least six companies be awarded tenders, resulting in Fonterra losing its monopoly. Since 2007, a new system has been set up under which traditional importers such as Fonterra can retain as much as 50 per cent market share. In addition, the new system has reduced the tariff for New Zealand butter imported under the quota to (70/100 kg instead of the previous (86.88/100 kg, *. providing potentially higher profits to importers and granting Fonterra a partial offset for its loss of market share. Despite strong profits, in 2009 Fonterra ended its joint venture with Arla Foods and the Anchor brand, with production being moved locally to Westbury in the UK. The sale, for an undisclosed sum, had a positive impact on Fonterra's annual financial results for the subsequent financial year ending July 2010, in which the company increased its profit to NZ$635 million. Fonterra still supplies Arla with Fonterra bulk butter for use in Anchor products. This move also aligned with global economic contraction, which sent dairy demand down sharply and saw milk prices within the EU fall by more than 30 per cent.European dairy farmers in several countries, including Germany and France (the largest milk-producing countries in the EU, which is itself the world's leading milk producer), marched in protest, repeatedly blocking traffic and pouring excess milk on fields and in city centres throughout 2009. Assisting farmers during this unanticipated period of market turmoil, the EU revived its export subsidies for butter, cheese and skim milk powder in January 2009, effectively threatening all dairy imports to the EU and reducing import butter prices by as much as (10/100 kg. *. The European Commission decided to buy 30 000 tons of butter from local farmers at a guaranteed price of (230/100 kg and 109 000 tons of skim milk powder at (170/100 kg. According to EU officials, the subsidies were to remain in place until 2013 at least. The US followed a similar path and in May 2009 retaliated against the EU policy with the Dairy Export Incentive Program, with the intention of subsidising US dairy exporters (including those exporting to the EU) in direct competition with Fonterra - whereas the New Zealand Government persisted in its policy of providing zero subsidies to agriculture, particularly in terms of export-price assistance. Milk exports to Europe incurred ever-increasing import duties, while demand for dairy products surged in Asia, South America and elsewhere. Fonterra's strategy underwent a logical shift from being a trader of New Zealand milk in Europe to establishing its own European processing operations. In 2011, Fonterra formed a UK-based joint venture with FirstMilk focused on supplying, manufacturing and marketing proteins throughout Europe. Fonterra's appetite for the European market continued in 2012, when it established another joint venture with the Dutch-based A-Ware Food Group to manufacture cheese and dairy ingredients in the Netherlands. Fonterra announced repeatedly that it was looking for similar strategic partners around Europe. In early 2018, it entered into a strategic partnership with German active nutrition start-up Foodspring in the hope of tapping into the active nutrition consumer segment, which is valued at NZ$200 billion globally. * On a 2011 visit to Ireland, Fonterra's then chairman Sir Henry van der Heyden said that 'the milk quota regime benefited New Zealand farmers much more than EU farmers and that is one of the reasons that milk production in NZ has more than doubled while milk production in the EU has remained static since quotas were introduced in 1984'. *. After more than three decades, in 2015 the European Commission finally ended the EU milk quota regime, which had been put in place to prevent overproduction and low prices. *. With an end to the quota regime, European dairy farmers now had the opportunity to play a larger role in competing with international rivals such as Fonterra in supplying fast-growing markets in Asia and Africa. Despite new markets opening up, milk overproduction in the ensuing years forced the European Commission to launch a one-off scheme in 2017, which offered local farmers an incentive to reduce their milk production. *