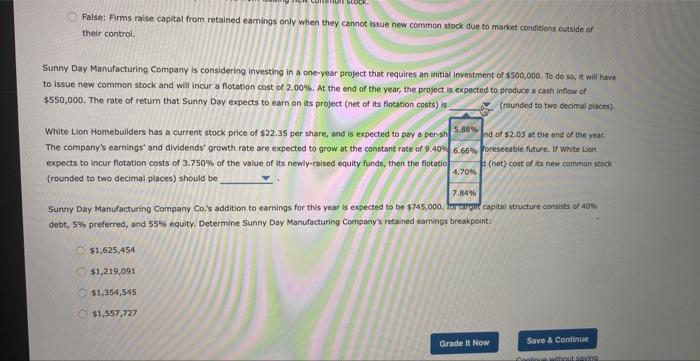

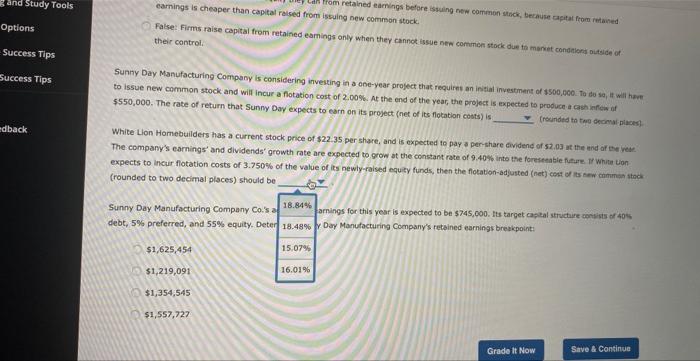

False: Firms raise copital from retained eamings only when they cannot issue new common stock due to market conditions outside of their control. Sunny Day Manufacturing Company is considering investing in a one-year project that requires an initial investment of $500,000. To do so, it will have to issue new common stock and will incur a ffotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $550,000. The rate of retum that Sunny Day expects to earn an its project (net of its flotation costs) it (rounded to two decimal piaces): White Lon Homebuilders has a current stock, price of $22.35 per share, and is expected to pay a per-sh 5.88% hod of $2.03 at the end of the y $ ar. Sunny Day Manufacturing Company Co,'s addition to eamings for this year is expected to be $745,000. itstaigil capital structure corisisis of aChi debt, 5% preferred, and 55% equity. Determine 5 unny Day Manufacturing Company's retained earnings breakpointi $1,625,454 51,219,091 41,354,545 51,557,727 new common stock. False: Firms raise capital from retained eamings only when they cannot issue new cominen stock due to maniet condeisisi outside of their controli Sunny Day Manufacturing Company is considering investing in a one-year project that requirnt an initial investment of 1500,060 . To de sa, if will hwee to issue new common stock and will incur a fiotation cost of 2.00%. At the end of the year, the project is expected to produce a cash infes if a if $550,000. The rate of return that Sunny Day expects to earn on its project (net of its flecation ceats) is: (racinded the twe decomat plases) White Lion Hormebtiiders has a current stock price of $22.35 per share, and is expected to pay a per-share tividenc of st. 03 at the end af the Wiese The company's earnings' and dividends' growth rate are expected to grow at the constant rate of 9.40% into the foreiteatie fifure if White Eion expects to incur flotation costs of 3.750% of the value of its newly-ralsed equity funds, then the flotation-adjusted (net) cott of its sew mimimin stock (rounded to two decimal places) should be $1,557,727 to Issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is eksected tin pradute w caw infou at $550,000. The rate of return that Sunny Day expects to earn on its project (net of its flekation costs) is White Lion Homebuilders has a current stock price of $22.35 per share, and is expected to pay a per-shsre ciuldend of 52.3 a the end of thie yei The company's earnings' and dividends' growth rate are expected to grow at the constant rate of 9,40% into the fareseeable thare if whiz Lion expects to incur fotation costs of 3.750% of the value of its newly-raised equity funds, then the flocaticn-adjusred (nee) cost of tas rew carinish itsa (rounded to two decimal places) should be Sunny Day Manufacturing Company Co.'s addition to earnings for this year is expected to be $745,000. fts target capita stinicm cansts af abi debt, 5% preferred; and 55% equity. Determine 5 unny Day Manufacturing Company's retaked earnings breakpoint: $1,625,454$1,219,091$1,354,545$1,557,727