Answered step by step

Verified Expert Solution

Question

1 Approved Answer

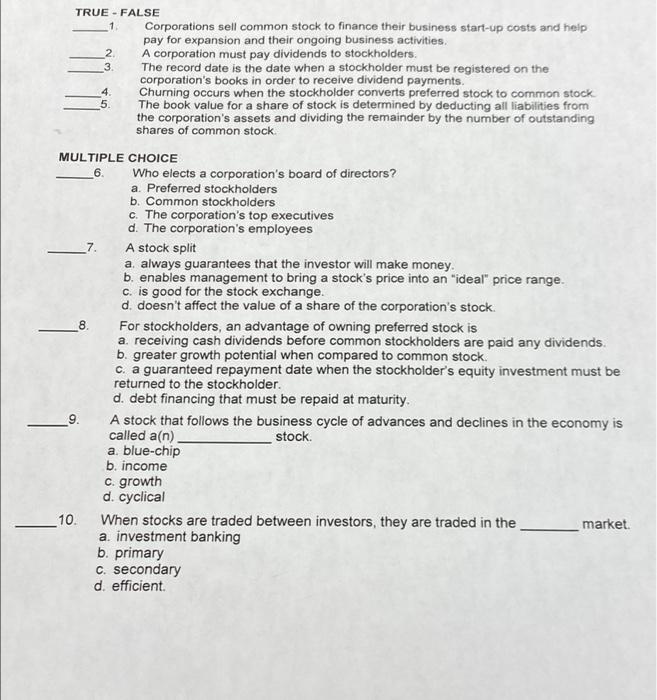

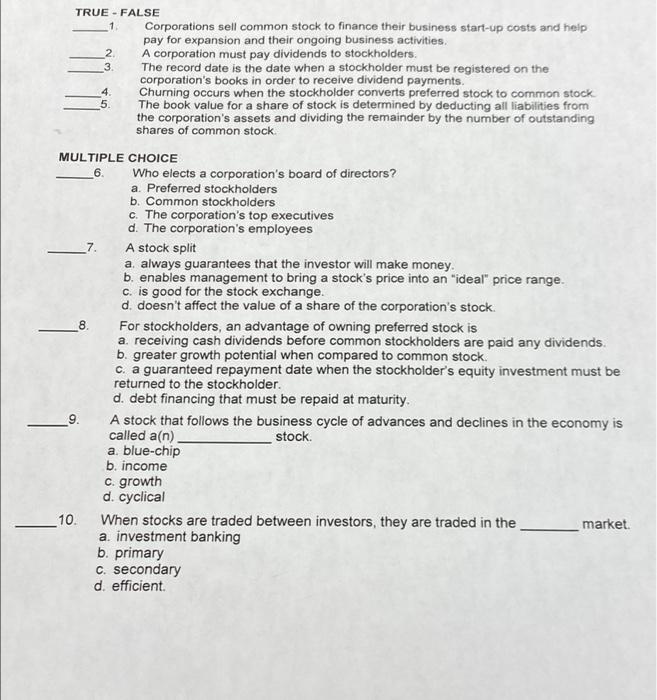

false or true questions 2 4 TRUE - FALSE 1 Corporations sell common stock to finance their business start-up costs and help pay for expansion

false or true questions

2 4 TRUE - FALSE 1 Corporations sell common stock to finance their business start-up costs and help pay for expansion and their ongoing business activities. A corporation must pay dividends to stockholders. 3 The record date is the date when a stockholder must be registered on the corporation's books in order to receive dividend payments. Churning occurs when the stockholder converts preferred stock to common stock 5. The book value for a share of stock is determined by deducting all liabilities from the corporation's assets and dividing the remainder by the number of outstanding shares of common stock MULTIPLE CHOICE 6 Who elects a corporation's board of directors? a. Preferred stockholders b. Common stockholders c. The corporation's top executives d. The corporation's employees 7. A stock split a. always guarantees that the investor will make money. b. enables management to bring a stock's price into an ideal" price range. C. is good for the stock exchange. d doesn't affect the value of a share of the corporation's stock. For stockholders, an advantage of owning preferred stock is a. receiving cash dividends before common stockholders are paid any dividends. b. greater growth potential when compared to common stock c. a guaranteed repayment date when the stockholder's equity investment must be returned to the stockholder. d. debt financing that must be repaid at maturity. A stock that follows the business cycle of advances and declines in the economy is called a(n) stock a blue-chip b. income c. growth d. cyclical 10 When stocks are traded between investors, they are traded in the market a investment banking b. primary c. secondary d. efficient 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started