Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fama - French Three - Factor Model. In this problem, you will analyze the risk - factors associated with stocks in a portfolio. To limit

FamaFrench ThreeFactor Model.

In this problem, you will analyze the riskfactors associated with stocks in a portfolio. To limit the

amount of work, consider a portfolio of five stocks that you would put into a portfolio. You may decide

their weight in a hypothetical portfolio.

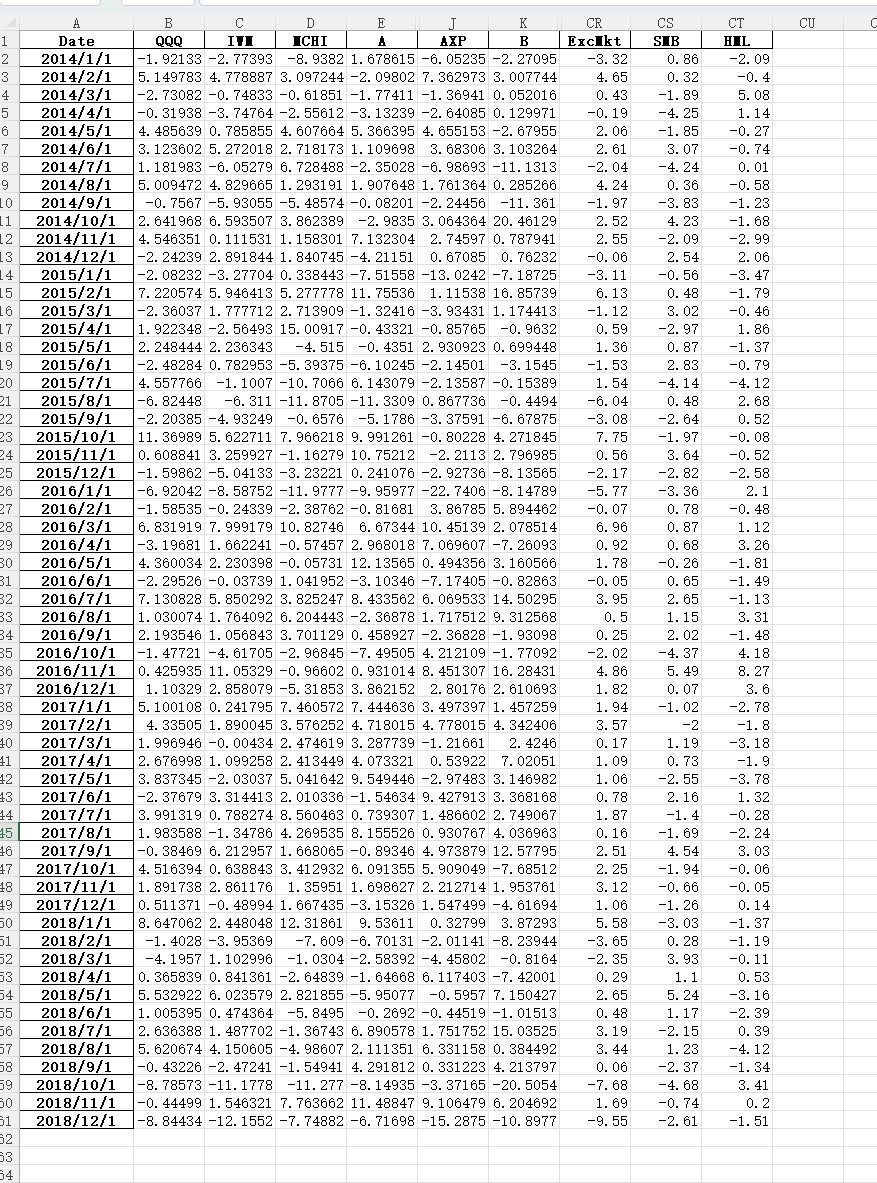

Download the Excel spreadsheet PortfolioReturns.xlsx from Blackboard. The file contains the monthly

excess returns in percent for a wide range of stocks and for QQQ Nasdaq ETF IWM

Russell ETF and MCHI China ETF Additionally, the file contains the time series ExcMkt, SMB and

representing the excess market return, the smallminusbig return, and the highminuslow return

these are the factors of the FamaFrench ThreeFactor model.

With data from the Excel file, solve the following problems:

a Calculate using the singlefactor model for each of the five stocks by rung a regresion in

Excel.

b Estimate their risk systematic and firmspecific according to the singlefactor model.

c Calculate the weights of the stocks in your portfolio. Remember, stocks you're selling short have

negative weights, and the weights need to sum up to one.

d Produce a return time series for your portfolio of the largest three stocks, using

Estimate your portfolio's sensitivity to FamaFrench's three factors,

that is run the regression

Remember: is a proxy to how much market risk your portfolio carries; is your exposure

to small over big firms; is your exposure to firms with a high book value compared to their

market capitalization. These three betas are assumed to be nondiversifiable risk factors, and in

the long run investors should be rewarded for their risk of having greater betas.

e Analyze your results. This includes, but is not limited to: classifying your portfolio in terms of

aggressiveness, small vs large cap, value vs growth; identifying which of your holdings

potentially contribute to the portfolio classification how; using the expected values of

to compute the expected return of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started