Answered step by step

Verified Expert Solution

Question

1 Approved Answer

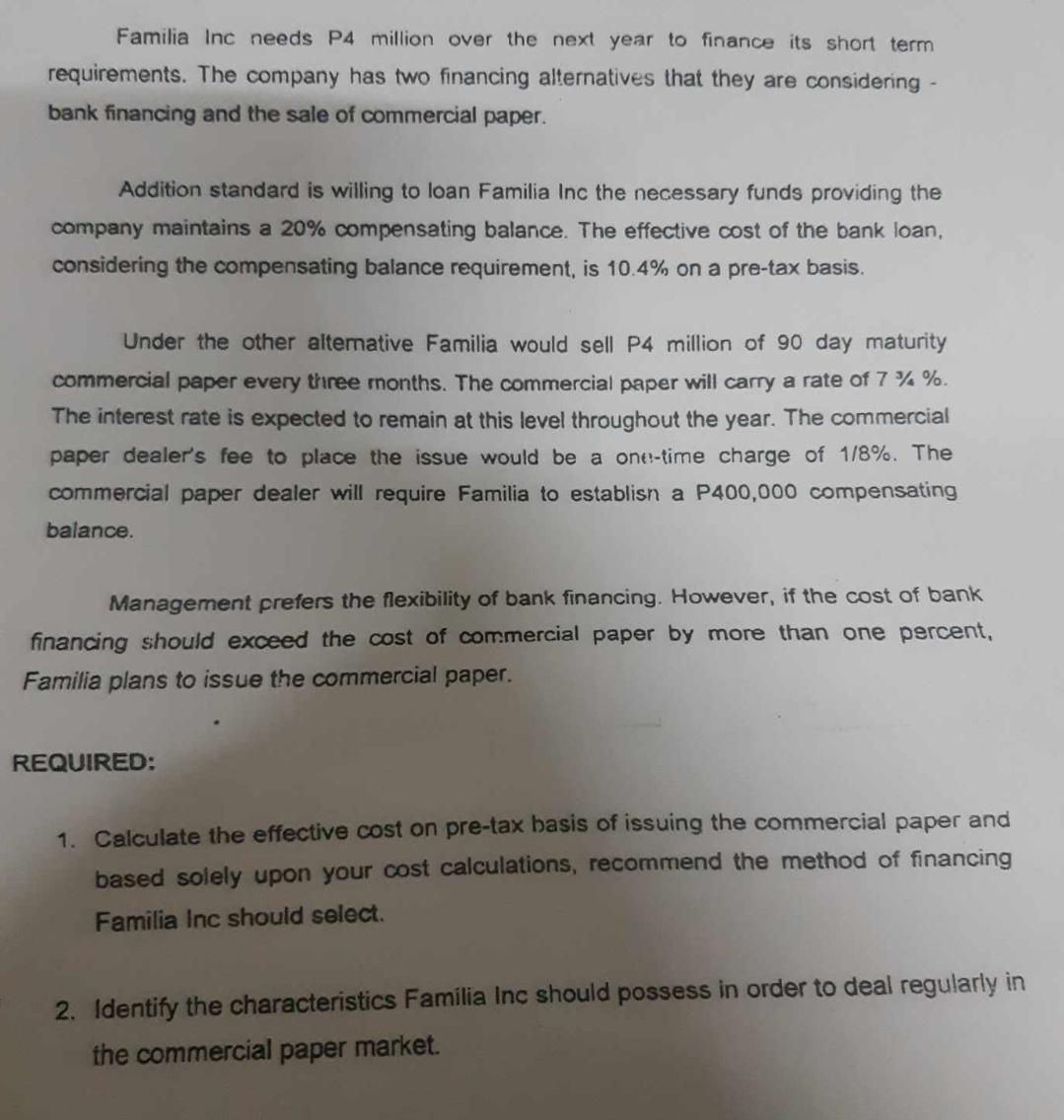

Familia Inc needs P4 million over the next year to finance its short term requirements. The company has two financing alternatives that they are considering

Familia Inc needs P4 million over the next year to finance its short term requirements. The company has two financing alternatives that they are considering bank financing and the sale of commercial paper. Addition standard is willing to loan Familia Inc the necessary funds providing the company maintains a 20% compensating balance. The effective cost of the bank loan, considering the compensating balance requirement, is 10.4% on a pre-tax basis. Under the other alternative Familia would sell P4 million of 90 day maturity commercial paper every three months. The commercial paper will carry a rate of 7%%. The interest rate is expected to remain at this level throughout the year. The commercial paper dealer's fee to place the issue would be a one-time charge of 1/8%. The commercial paper dealer will require Familia to establisn a P400,000 compensating balance. Management prefers the flexibility of bank financing. However, if the cost of bank financing should exceed the cost of commercial paper by more than one percent, Familia plans to issue the commercial paper. REQUIRED: 1. Calculate the effective cost on pre-tax basis of issuing the commercial paper and based solely upon your cost calculations, recommend the method of financing Familia Inc should select. 2. Identify the characteristics Familia Inc should possess in order to deal regularly in the commercial paper market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started