Question

Family Profile Landon and Serena Hayes have come to you, a financial planner, for help in developing a plan to accomplish their financial goals. From

Family Profile

Landon and Serena Hayes have come to you, a financial planner, for help in developing a plan to accomplish their financial goals. From your initial meeting, you have gathered the following information.

Landon Hayes, age 37, is the owner and manager of a store that sells childrens toys. He has Schedule C net income of $65,000. Serena Hayes, age 37, is a paralegal with an income of $55,000. Their net worth is $300,000 consisting of $150,000 equity in their home and $150,000 of investments and cash and cash equivalents.

Landon and Serena have been married for 15 years. They plan to retire in 25 years. They have two children, Taylor and Cavan, and do not plan to have any more children. Taylor, age 15, attends the local public high school and is in the ninth grade. Cavan, age 11, is in the sixth grade at the local grammar school.

Financial Goals and Concerns

Their primary goal, for this example, is to develop an appropriate risk management portfolio. Their goals and concerns are as follows:

- The Hayes want to provide a standard of living post retirement of 80% of their preretirement earnings.

- They want to accumulate sufficient assets to send their children to a state university.

- They want to be mortgage and debt free at retirement.

External Information

- The current market value of their home is $400,000

- Family owns two cars and Serena's has a loan balance of $18,000.

- Family has accumulated approximately $50,000 of personal credit card debt from business expenses;

- $150,000 of investments, cash and cash equivalents is comprised of $40,000 in Serena's 401k; $50,000 in an annuity Landon inherited from his grandfather;

- $15,000 in the joint checking account; $10,000 in a money market; $35,000 in stocks.

- They both will be eligible for social security and plan to retire at their full retirement ages.

Insurance Information

Life Insurance

| Policy 1 | Policy 2 |

Insured | Serena | Landon |

Policy through | Employer | Private |

Face amount | $55,000 | $150,00 |

Type | Term (group) | Term |

Cash value | $0 | $0 |

Annual premium | $102 (employer paid) | $1000 |

Beneficiary | Landon | Serena |

Contingent beneficiary | Two children | None |

Owner | Serena | Landon |

Settlement options | None | Life annuity |

Serena also has an accidental death and dismemberment policy through her employer. She is covered for $100,000 under this policy. She pays a premium of $68 per year for this coverage.

Health Insurance

All family members are covered by Serenas employer under a group health plan with an annual per person deductible of $400. After the deductible is met, the plan pays 100% of the first $2,000 of covered hospital charges for each hospital stay and 80% thereafter. The policy features a $2,000 maximum annual out-of-pocket limit. The plan will then pay 100% of any other covered expenses. The family premium is $460 per month.

- $400 per individual deductible per year

- $1,000,000 lifetime benefit limit per person

The Hayes have dental insurance. The premium is $216 annually.

- Based on the above case facts, answer the following questions:

- Use the multiple earnings approach at the beginning of Chapter 4, an insurance agent has suggested they use 8.6 times their current income if they want to replace 65 percent of their lost earnings. Calculate the total recommended amount of insurance. How much additional insurance should they purchase if they chose to follow his advice?

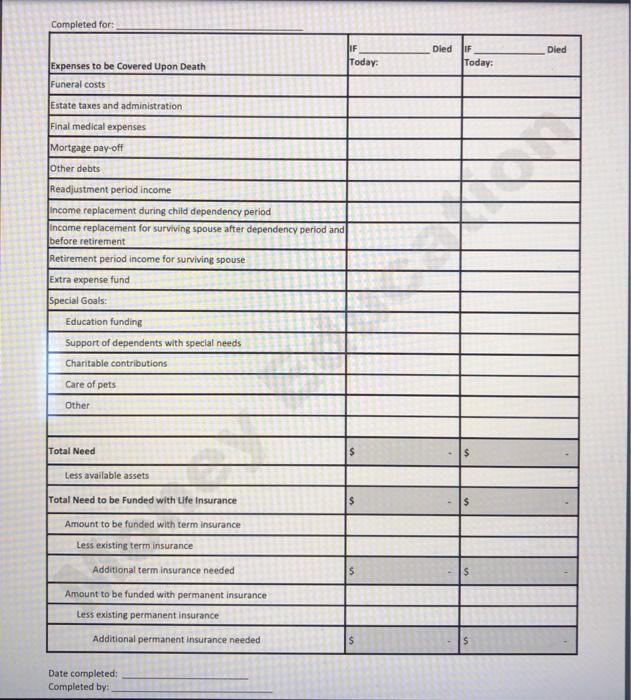

- Use the capital needs approach in Chapter 4 to determine the amount of life insurance which meets the Hayes' goals. Is the Hayes family adequately insured? Download the worksheet and fill it out.

- What types of life insurance policy and what amounts of insurance determined per tool would you recommend for the Hayes family? State your rationale for the recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started