Question

Family Resource Management Exercise This application exercise is designed to give you experience budgeting resources for families under different circumstances. As an additional criterion, at

Family Resource Management Exercise

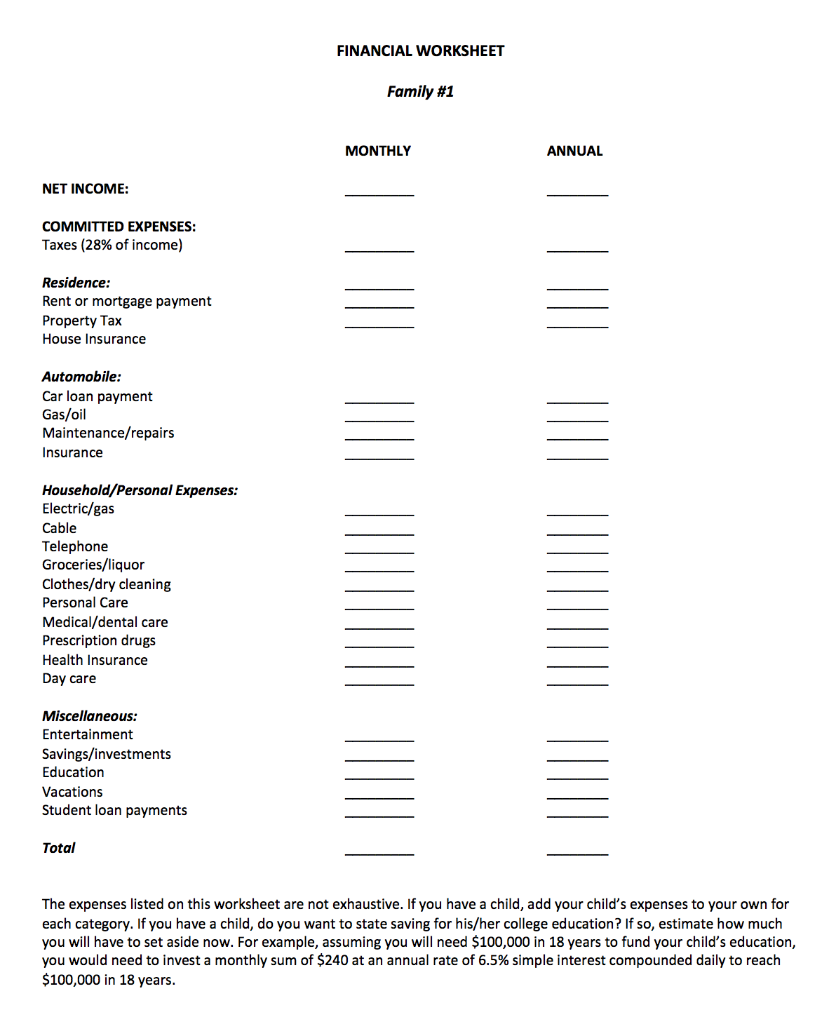

This application exercise is designed to give you experience budgeting resources for families under different circumstances. As an additional criterion, at least one of your families should be a homeowner versus a renter. Complete a financial worksheet for both of the families you have selected using the template that is provided. (You may use a modified version of this template if you wish.) Do your best to figure out what property tax would be for a certain geographic area or what a mortgage payment would be based on a house that is valued relative to the income of the family that you selected. You may use the Internet to find information. As a personal reaction to this assignment, answer the five questions listed below when you have completed the two budgets.

Family 1: Two young career professionals married for about a year, shortly after graduating from college. No children. You have a combined income of $65,000 a year before taxes.

Family 2: Two young career professionals married for about a year with a preschool child. You have a combined income of $75,000 a year before taxes.

- How do these household incomes compare with the annual median household income in the state of Ohio? Provide the source you used to obtain the most recent information on household income in the state of OHIO, e.g., URL/ link). MEDIAN HOUSEHOLD INCOME = $56,111

- Did you have enough money to cover the basics and some of the familys wants? If not, what was the biggest difficulty in making ends meet?

- What could the family do differently to ease this problem?

- What was most difficult about the budgeting process for the families that you selected? Easiest?

- What values were you taught regarding money issues when you were growing up? Did these values come into play when budgeting for the families that you selected?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started