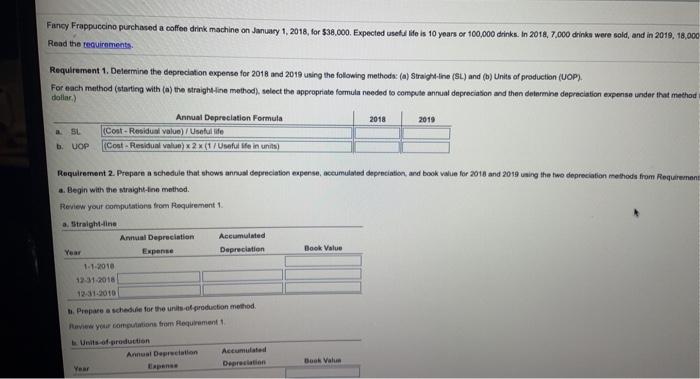

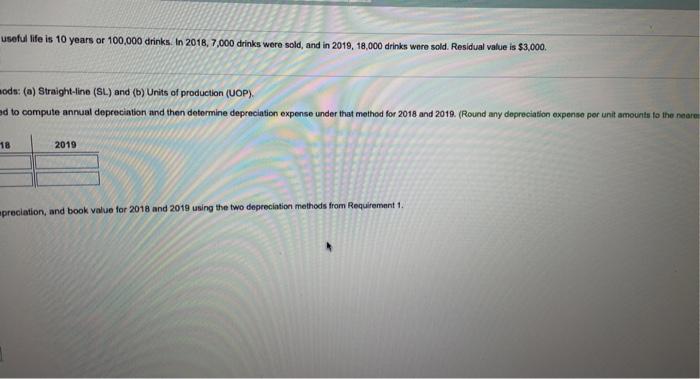

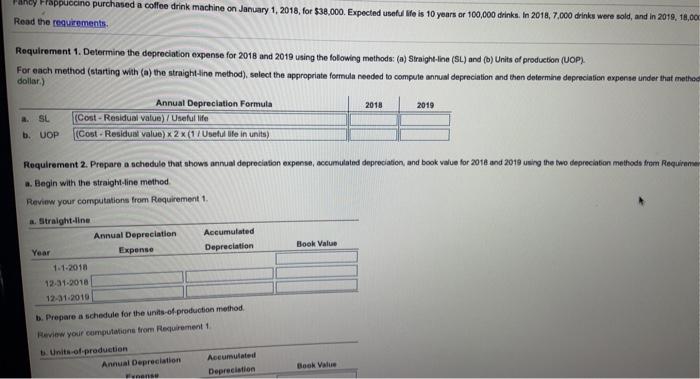

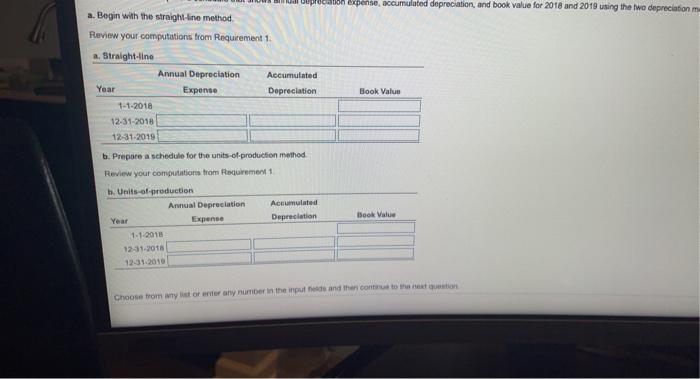

Fancy Frappuccino purchased a coffee drink machine on January 1, 2018, for $38,000. Expected used to in 10 years or 100,000 drinks. In 2018, 7,000 drinks were sold, and in 2019, 18,000 Read the requirements Requirement 1, Determine the depreciation expense for 2018 and 2019 using the following methodo: (a) Straight-line (SL) and (b) Units of production (UOP). For each method (starting with (a) the straight-line method), select the appropriate formulu needed to compute annual depreciation and then determine depreciation expense under that method dollar) 2018 2019 SL E UP Annual Depreciation Formula (Cost-Residual value)/Useful life (Cost-Residual valon) x 2 x (17 Unoful to in units) Requirement 2. Prepare a schedule that shows annual depreciation expense, accumulated depreciation, and book value for 2018 and 2019 using the two depreciation methods from Regurement a. Begin with the straight-line method. Review your computations from Requirement 1. a. Straight-line Annual Depreciation Accumulated Year Esperse Depreciation Book Value 1:1-2010 12-31-2018 12-31-2010 1. Prepare a schedule for the units of production method Review your computation from Requirement Units of production Annual Depreciation Accumulated Book Value Year useful life is 10 years or 100,000 drinks. In 2018, 7,000 drinks were sold, and in 2019, 18,000 drinks were sold. Residual value is $3,000. mods: (a) Straight-line (SL) and (b) Units of production (UOP) od to compute annual depreciation and then determine depreciation expense under that method for 2018 and 2019. (Round any depreciation expense per unit amounts to the neare 18 2019 apreciation, and book value for 2018 and 2019 using the two depreciation methods from Requirement 1. Fabpuccino purchased a coffee drink machine on January 1, 2018, for $38,000. Expected usele lis 10 years or 100,000 drinks. In 2018, 7,000 drinks were sold, and in 2018, 18,00 Read the requirements. 2018 DO Requirement 1. Determine the depreciation expense for 2018 and 2019 using the following methods: (a) Straight-line (SL) and (b) Units of production (UOP). For each method (starting with (a) the straight-line method), select the appropriate formula needed to compute annual depreciation and then determine depreciation expense under that metho dollar) Annual Depreciation Formula 2019 SL (Cost - Residual value) / Usadullife (Cost - Residus value) x 2 x (17 Useful life in units) Requirement 2. Prepare a schedule that shows anual depreciation expense, accumulated depreciation, and book value for 2018 and 2019 uning the two depreciation methods from Requireme a. Begin with the straight line method Review your computations from Requirement 1 a. Straight line Annual Depreciation Expense Depreciation Accumulated Book Value Year 1.1.2018 12-31-2018 12-31.2010 1. Prepare a schedule for the units of production method. Review your computation from Requirement1 Unit of production Annual Depreciation Accumulated Depreciation Book Value deprecation expense, accumulated depreciation, and book value for 2018 and 2019 using the two depreciation m a. Begin with the straight-line method Review your computations from Requirement 1 a. Straight-line Annual Depreciation Year Expense 1-1-2018 12-01-2018 12-31-2019 Accumulated Depreciation Book Value b. Prepare a schedule for the units of production method Review your computations from Requirement1 b. Units-of-production Annual Depreciation Accumulated Year Expense Depreciation 1-1-2018 12-01-2018 12.31.2010 Book Value Choose from any list or enter any number in the input de and then con to the next