Answered step by step

Verified Expert Solution

Question

1 Approved Answer

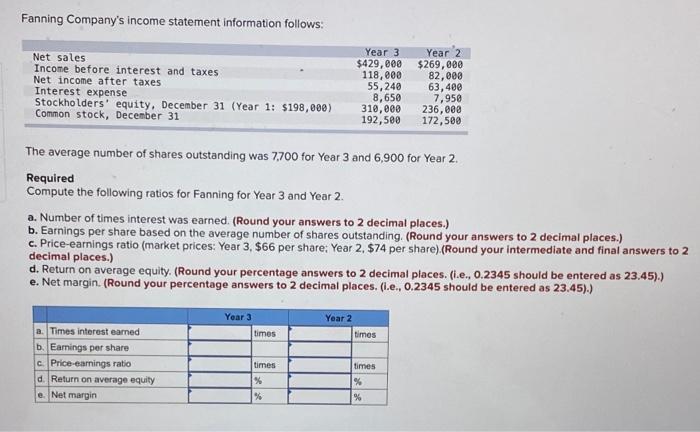

Fanning Company's income statement information follows: Year 2 Net sales Income before interest and taxes Net income after taxes Interest expense Stockholders' equity, December

Fanning Company's income statement information follows: Year 2 Net sales Income before interest and taxes Net income after taxes Interest expense Stockholders' equity, December 31 (Year 1: $198,000) Common stock, December 31 Year 3 $429,800 $269,000 118,000 55,240 8,650 310,000 192,500 82,000 63, 400 7,950 236,000 172,500 The average number of shares outstanding was 7,700 for Year 3 and 6,900 for Year 2. Required Compute the following ratios for Fanning for Year 3 and Year 2. a. Number of times interest was earned. (Round your answers to 2 decimal places.) b. Earnings per share based on the average number of shares outstanding. (Round your answers to 2 decimal places.) c. Price-earnings ratio (market prices: Year 3, $66 per share; Year 2, $74 per share) (Round your intermediate and final answers to 2 decimal places.) d. Return on average equity. (Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) e. Net margin. (Round your percentage answers to 2 decimal places. (I.e., 0.2345 should be entered as 23.45).) Year 3 Year 2 a. Times interest earned b. Eamings per share c. Price-eanings ratio times times times times d. Return on average equity e. Net margin Fanning Company's income statement information follows: Year 2 Net sales Income before interest and taxes Net income after taxes Interest expense Stockholders' equity, December 31 (Year 1: $198,000) Common stock, December 31 Year 3 $429,800 $269,000 118,000 55,240 8,650 310,000 192,500 82,000 63, 400 7,950 236,000 172,500 The average number of shares outstanding was 7,700 for Year 3 and 6,900 for Year 2. Required Compute the following ratios for Fanning for Year 3 and Year 2. a. Number of times interest was earned. (Round your answers to 2 decimal places.) b. Earnings per share based on the average number of shares outstanding. (Round your answers to 2 decimal places.) c. Price-earnings ratio (market prices: Year 3, $66 per share; Year 2, $74 per share) (Round your intermediate and final answers to 2 decimal places.) d. Return on average equity. (Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) e. Net margin. (Round your percentage answers to 2 decimal places. (I.e., 0.2345 should be entered as 23.45).) Year 3 Year 2 a. Times interest earned b. Eamings per share c. Price-eanings ratio times times times times d. Return on average equity e. Net margin

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

X V fr B10 A D E F Year 3 Year 2 2 a Times inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started