Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oriole Repairs has 200 auto-maintenance service outlets nationwide. It performs primarily two lines of service: oil changes and brake repair. Oil change-related services represent

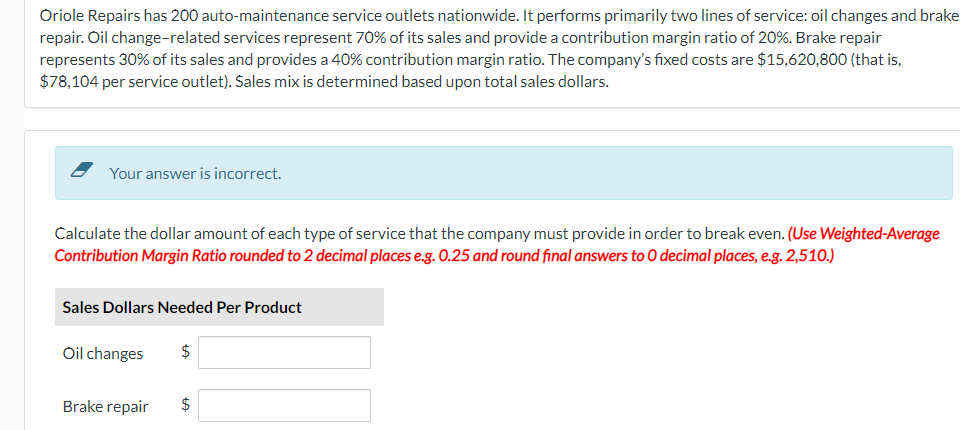

Oriole Repairs has 200 auto-maintenance service outlets nationwide. It performs primarily two lines of service: oil changes and brake repair. Oil change-related services represent 70% of its sales and provide a contribution margin ratio of 20%. Brake repair represents 30% of its sales and provides a 40% contribution margin ratio. The company's fixed costs are $15,620,800 (that is, $78,104 per service outlet). Sales mix is determined based upon total sales dollars. Your answer is incorrect. Calculate the dollar amount of each type of service that the company must provide in order to break even. (Use Weighted-Average Contribution Margin Ratio rounded to 2 decimal places eg. 0.25 and round final answers to 0 decimal places, e.g. 2,510.) Sales Dollars Needed Per Product Oil changes $ Brake repair 2$ The company has a desired net income of $54,990 per service outlet. What is the dollar amount of each type of service that must be performed by each service outlet to meet its target net income per outlet? (Use Weighted-Average Contribution Margin Ratio rounded to 2 decimal places eg. 0.25 and round final answers to 0 decimal places, e.g. 2,510.) Sales Dollars Needed Per Service Outlet Oil changes 350,000 Brake repair $ 150,000

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Oil changes 70 x 20 014 Brake repair 30 x 40 012 Total 026 Total breakeven ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started