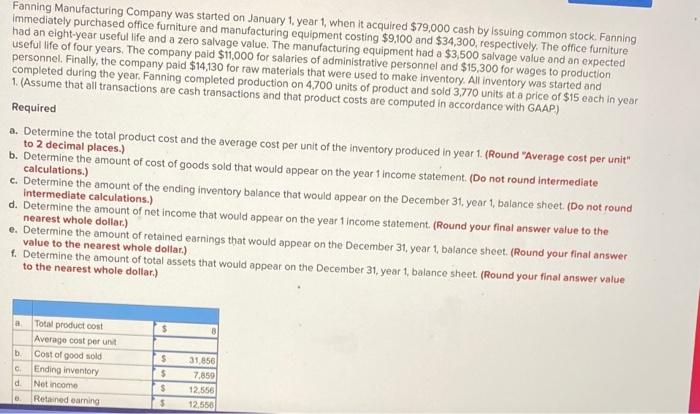

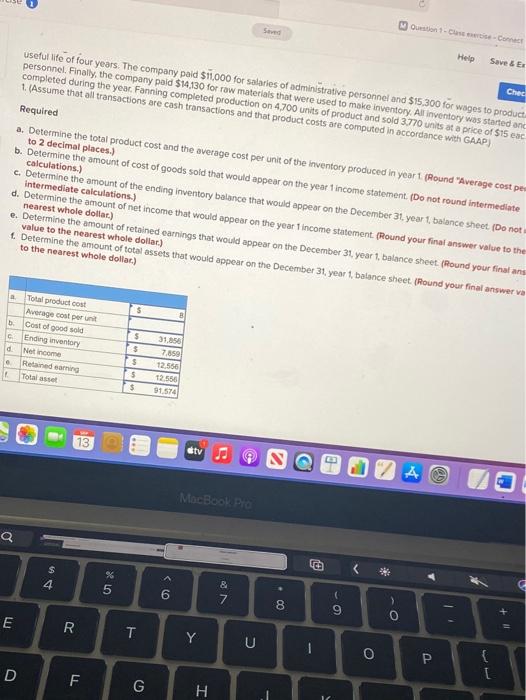

Fanning Manufacturing Company was started on January 1, year 1, when it acquired $79,000 cash by Issuing common stock. Fanning Immediately purchased office furniture and manufacturing equipment costing $9,100 and $34,300, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $3,500 salvage value and an expected useful life of four years. The company paid $11,000 for salaries of administrative personnel and $15,300 for wages to production personnel. Finally, the company paid $14,130 for raw materials that were used to make inventory. All inventory was started and completed during the year. Fanning completed production on 4,700 units of product and sold 3,770 units at a price of $15 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP) Required a. Determine the total product cost and the average cost per unit of the inventory produced in year 1. (Round "Average cost per unit" to 2 decimal places.) b. Determine the amount of cost of goods sold that would appear on the year 1 income statement. (Do not round intermediate calculations.) c. Determine the amount of the ending inventory balance that would appear on the December 31. year 1, balance sheet. (Do not round d. Determine the amount of net income that would appear on the year 1 income statement. (Round your final answer value to the nearest whole dollar.) e. Determine the amount of retained earnings that would appear on the December 31, year 1, balance sheet (Round your final answer value to the nearest whole dollar.) t. Determine the amount of total assets that would appear on the December 31, year 1, balance sheet. (Round your final answer value to the nearest whole dollar.) $ b. Total product cost Average cost per unit Cost of good sold Ending inventory Net income Retained earning d $ $ $ $ 31.856 7.850 12.556 12.556 Seved Ouestion - Connect Help Save & Ex Chec useful life of four years. The company paid $11,000 for salaries of administrative personnel and $15.300 for wages to product personnel. Finally, the company paid $14.130 for raw materials that were used to make inventory, All Inventory was started and completed during the year. Fanning completed production on 4,700 units of product and sold 3770 units at a price of $15 eac 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP) Required a. Determine the total product cost and the average cost per unit of the Inventory produced in year 1 (Round "Average cost per to 2 decimal places b. Determine the amount of cost of goods sold that would appear on the year income statement. (Do not round intermediate calculations.) c. Determine the amount of the ending inventory balance that would appear on the December 31, year 1, balance sheet (Do not intermediate calculations.) d. Determine the amount of net income that would appear on the year 1 income statement. (Round your final answer value to the e. Determine the amount of retained earnings that would appear on the December 31. year 1, balance sheet (Round your final ans 1. Determine the amount of total assets that would appear on the December 31, year 1, balance sheet (Round your final answer va to the nearest whole dollar) $ Total product cost Average cost perunt Cost of good sold Ending inventory Not income Retained earning Total asset d S $ $ 5 $ 31.056 7.850 12.550 12.550 91 574 13 tv VA MacBook Pro Q A 4 5 6 & 7 8 9 E 0 W + 20 T Y U 0 { [ D F G