Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FAO(2021): ACCOUNTANCY ILA QUESTION 3 (20 MARKS) (30 MINUTES) Fragrantico Ltd is a company trading in imported perfumes through its twenty outlets across South Africa.

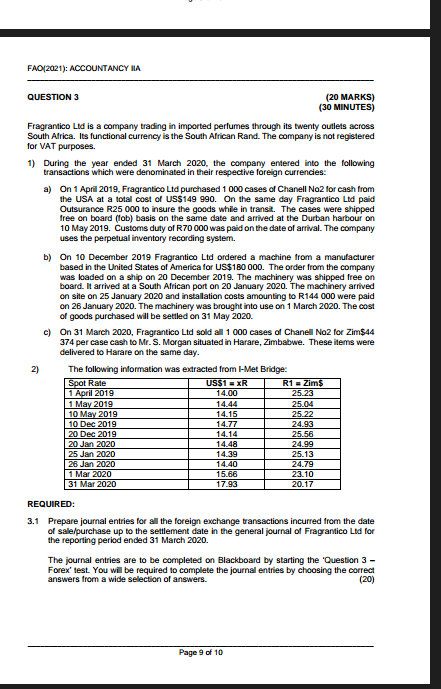

FAO(2021): ACCOUNTANCY ILA QUESTION 3 (20 MARKS) (30 MINUTES) Fragrantico Ltd is a company trading in imported perfumes through its twenty outlets across South Africa. Its functional currency is the South African Rand. The company is not registered for VAT purposes. 1) During the year ended 31 March 2020, the company entered into the following transactions which were denominated in their respective foreign currencies: a) On 1 April 2019, Fragrantico Ltd purchased 1 000 cases of Chanell No2 for cash from the USA at a total cost of US$149 990. On the same day Fragrantico Led paid Outsurance R25 000 to insure the goods while in transit. The cases were shipped free on board (ob) basis on the same date and arrived at the Durban harbour on 10 May 2019. Customs duty of R70 000 was paid on the date of arrival. The company uses the perpetual inventory recording system. b) On 10 December 2019 Fragrantico Ltd ordered a machine from a manufacturer based in the United States of America for US$180 000. The order from the company was loaded on a ship on 20 December 2019. The machinery was shipped free on board. It arrived at a South African port on 20 January 2020. The machinery arrived on site on 25 January 2020 and installation costs amounting to R144 000 were paid on 26 January 2020. The machinery was brought into use on 1 March 2020. The cost of goods purchased will be settled on 31 May 2020. c) On 31 March 2020, Fragrantico Ltd sold a 1 000 cases of Chanel No2 for Zim$44 374 per case cash to Mr. S. Morgan situated in Harare, Zimbabwe. These items were delivered to Harare on the same day. 2) The following information was extracted from l-Met Bridge: Spot Rate US$1 = XR R1 = Zims 1 April 2019 14.00 25.23 1 May 2019 14.44 25.04 10 May 2019 14.15 25.22 10 Dec 2019 14.77 24.93 20 Dec 2019 14.14 25.56 20 Jan 2020 14.48 24.99 25 Jan 2020 14.39 25.13 26 Jan 2020 14.40 24.79 1 Mar 2020 15.66 23.10 31 Mar 2020 17.93 20.17 REQUIRED: 3.1 Prepare journal entries for all the foreign exchange transactions incurred from the date of sale/purchase up to the settlement date in the general journal of Fragrantico Lid for the reporting period ended 31 March 2020. The journal entries are to be completed on Blackboard by starting the Question 3 - Forex' test. You will be required to complete the journal entries by choosing the correct answers from a wide selection of answers. (20) Page 9 of 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started