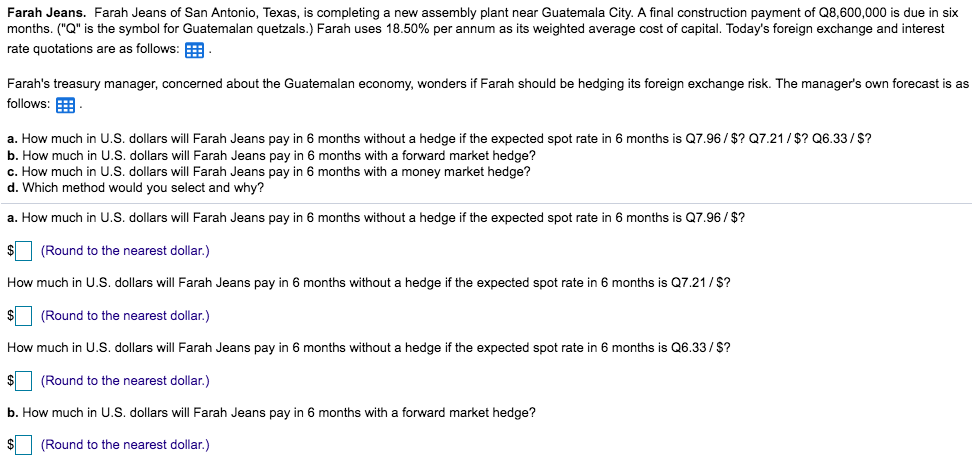

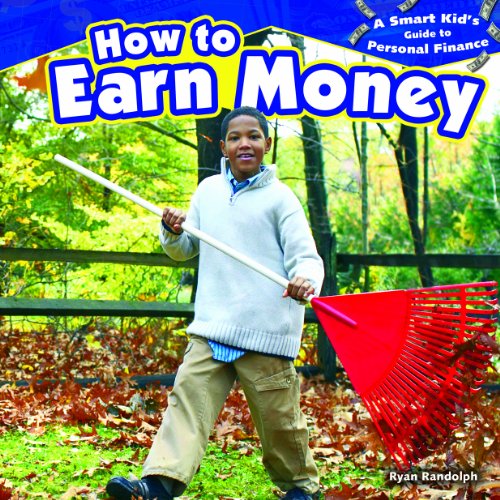

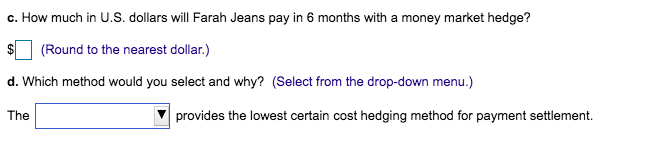

Farah Jeans. Farah Jeans of San Antonio, Texas, is completing a new assembly plant near Guatemala City. A final construction payment of Q8,600,000 is due in six months. Q is the symbol or Guatemalan quetzals. Farah uses 18.50% per annum as its weighted average cost of capital. Today's reign exchange and interest rate quotations are as follows: EEB Farah's treasury manager, concerned about the Guatemalan economy, wonders if Farah should be hedging its foreign exchange risk. The manager's own forecast is as follows: EEB a. How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.96/$? Q7.21/$? Q6.33/S? b. How much in U.S. dollars will Farah Jeans pay in 6 months with a forward market hedge? c. How much in U.S. dollars will Farah Jeans pay in 6 months with a money market hedge? d. Which method would you select and why? a. How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.96/$? $Round to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.21/S? SRound to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q6.33/S? $Round to the nearest dollar.) b. How much in U.S. dollars will Farah Jeans pay in 6 months with a forward market hedge? $Round to the nearest dollar.) c. How much in U.S. dollars will Farah Jeans pay in 6 months with a money market hedge'? (Round to the nearest dollar.) d. Which method would you select and why? (Select from the drop-down menu.) The Vprovides the lowest certain cost hedging method for payment settlement. Farah Jeans. Farah Jeans of San Antonio, Texas, is completing a new assembly plant near Guatemala City. A final construction payment of Q8,600,000 is due in six months. Q is the symbol or Guatemalan quetzals. Farah uses 18.50% per annum as its weighted average cost of capital. Today's reign exchange and interest rate quotations are as follows: EEB Farah's treasury manager, concerned about the Guatemalan economy, wonders if Farah should be hedging its foreign exchange risk. The manager's own forecast is as follows: EEB a. How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.96/$? Q7.21/$? Q6.33/S? b. How much in U.S. dollars will Farah Jeans pay in 6 months with a forward market hedge? c. How much in U.S. dollars will Farah Jeans pay in 6 months with a money market hedge? d. Which method would you select and why? a. How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.96/$? $Round to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q7.21/S? SRound to the nearest dollar.) How much in U.S. dollars will Farah Jeans pay in 6 months without a hedge if the expected spot rate in 6 months is Q6.33/S? $Round to the nearest dollar.) b. How much in U.S. dollars will Farah Jeans pay in 6 months with a forward market hedge? $Round to the nearest dollar.) c. How much in U.S. dollars will Farah Jeans pay in 6 months with a money market hedge'? (Round to the nearest dollar.) d. Which method would you select and why? (Select from the drop-down menu.) The Vprovides the lowest certain cost hedging method for payment settlement