Answered step by step

Verified Expert Solution

Question

1 Approved Answer

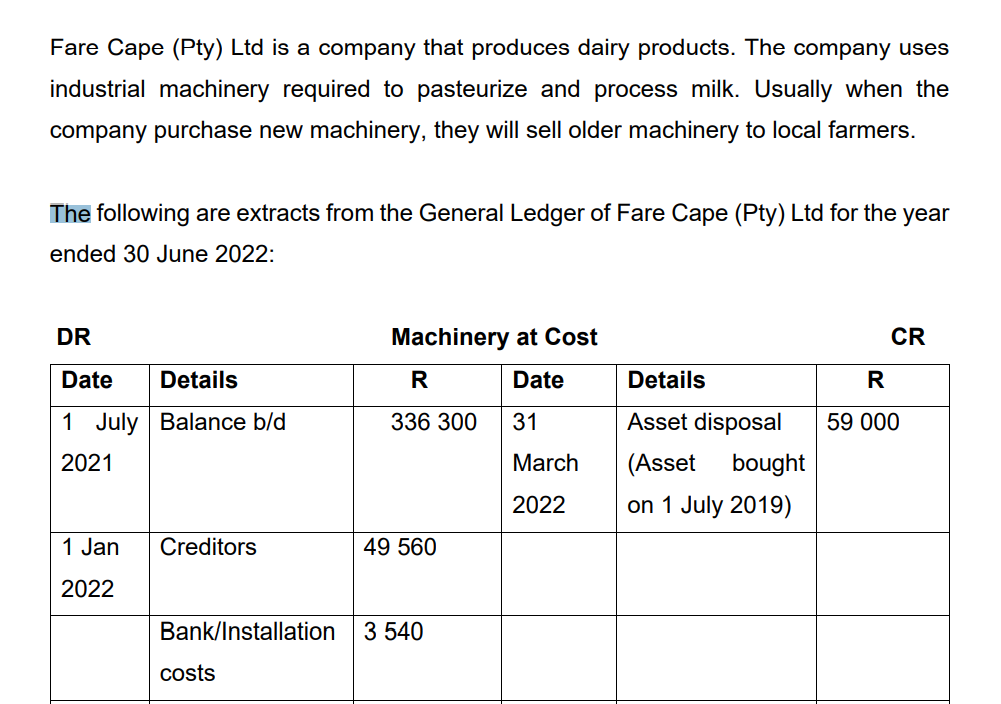

Fare Cape (Pty) Ltd is a company that produces dairy products. The company uses industrial machinery required to pasteurize and process milk. Usually when the

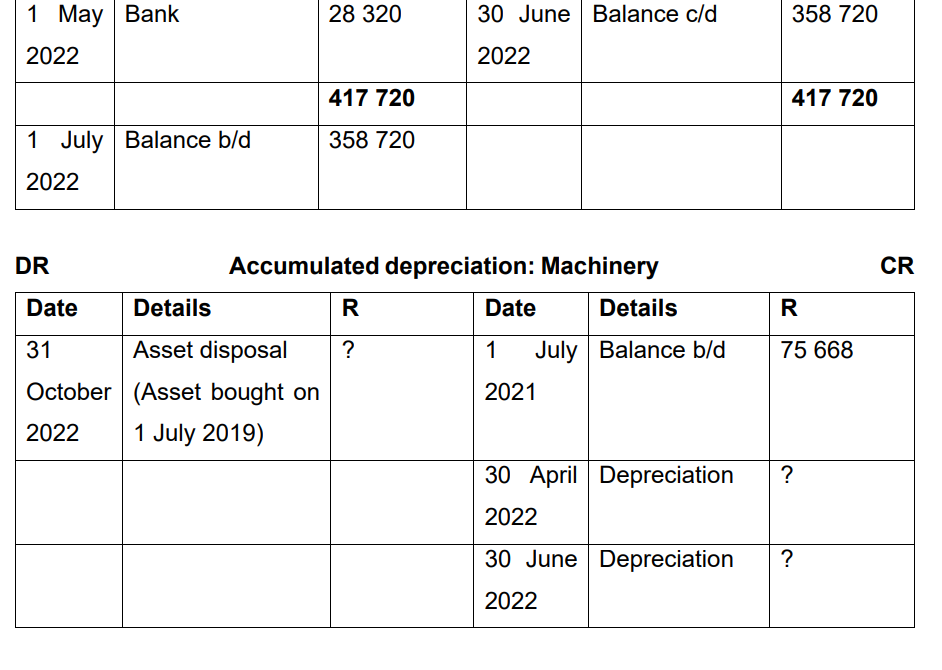

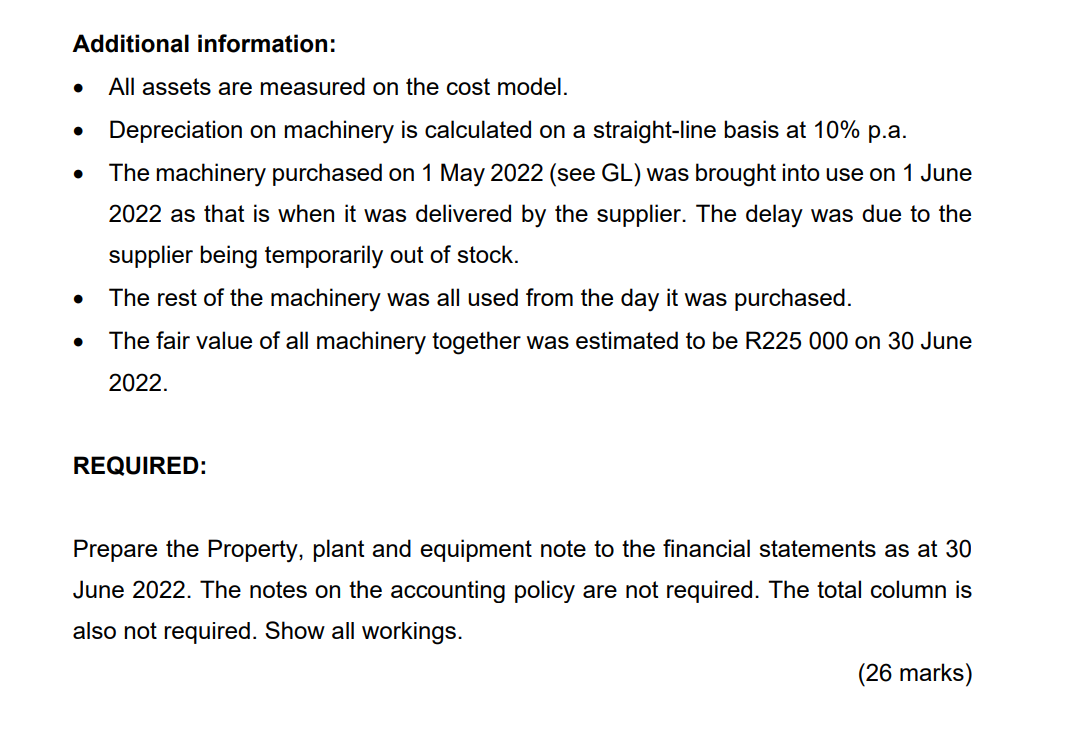

Fare Cape (Pty) Ltd is a company that produces dairy products. The company uses industrial machinery required to pasteurize and process milk. Usually when the company purchase new machinery, they will sell older machinery to local farmers. The following are extracts from the General Ledger of Fare Cape (Pty) Ltd for the year ended 30 June 2022: Accumulated depreciation: Machinery Additional information: - All assets are measured on the cost model. - Depreciation on machinery is calculated on a straight-line basis at 10% p.a. - The machinery purchased on 1 May 2022 (see GL) was brought into use on 1 June 2022 as that is when it was delivered by the supplier. The delay was due to the supplier being temporarily out of stock. - The rest of the machinery was all used from the day it was purchased. - The fair value of all machinery together was estimated to be R225 000 on 30 June 2022. REQUIRED: Prepare the Property, plant and equipment note to the financial statements as at 30 June 2022. The notes on the accounting policy are not required. The total column is also not required. Show all workings. (26 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started