Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fareh is not married and supports her 12 year old child who lives with her. Fareh works as an employee with gross salaries and

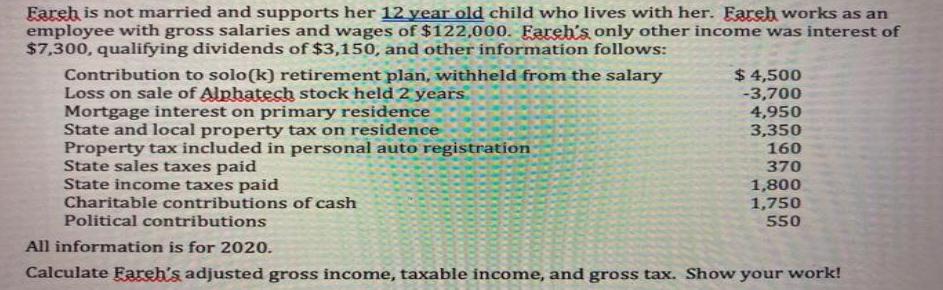

Fareh is not married and supports her 12 year old child who lives with her. Fareh works as an employee with gross salaries and wages of $122,000. Fareh's only other income was interest of $7,300, qualifying dividends of $3,150, and other information follows: Contribution to solo(k) retirement plan, withheld from the salary Loss on sale of Alphatech stock held 2 years. Mortgage interest on primary residence State and local property tax on residence Property tax included in personal auto registration State sales taxes paid State income taxes paid Charitable contributions of cash Political contributions $ 4,500 -3,700 4,950 3,350 160 370 1,800 1,750 550 All information is for 2020. Calculate Fareh's adjusted gross income, taxable income, and gross tax. Show your work!

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Farehs adjusted gross income taxable income and gross tax Computation of Taxable inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started