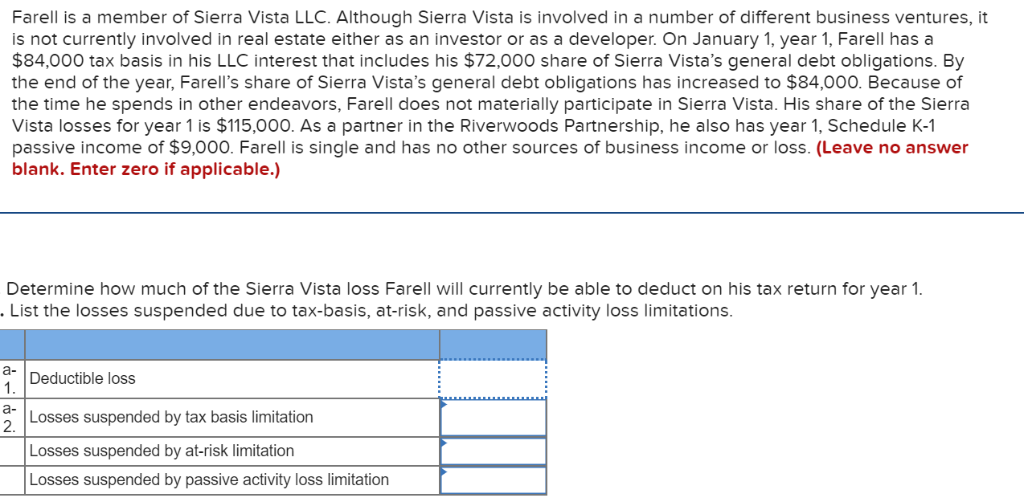

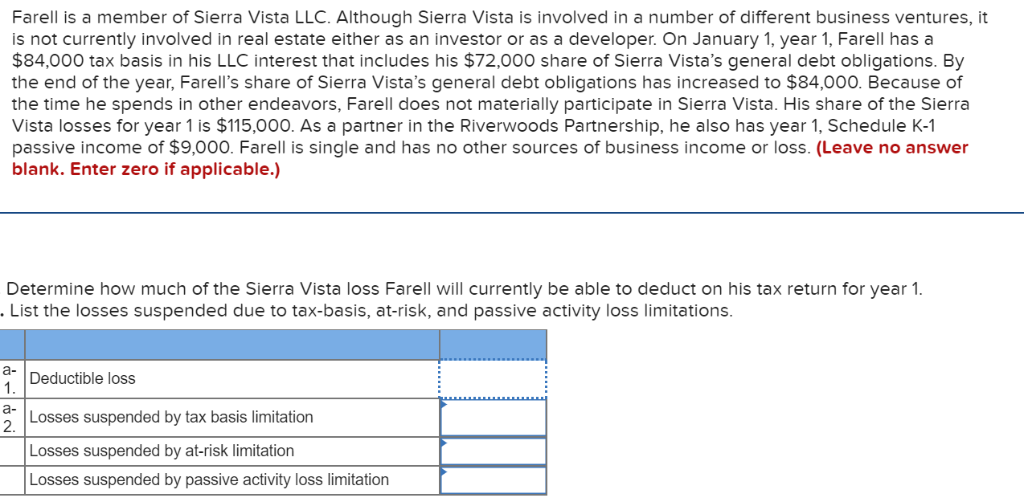

Farell is a member of Sierra Vista LLC. Although Sierra Vista is involved in a number of different business ventures, it is not currently involved in real estate either as an investor or as a developer. On January 1, year 1, Farell has a $84,000 tax basis in his LLC interest that includes his $72,000 share of Sierra Vista's general debt obligations. By the end of the year, Farell's share of Sierra Vista's general debt obligations has increased to $84,000. Because of the time he spends in other endeavors, Farell does not materially participate in Sierra Vista. His share of the Sierra Vista losses for year 1 is $115,000. As a partner in the Riverwoods Partnership, he also has year 1, Schedule K-1 passive income of $9,000. Farell is single and has no other sources of business income or loss. (Leave no answer blank. Enter zero if applicable.) Determine how much of the Sierra Vista loss Farell will currently be able to deduct on his tax return for year 1. . List the losses suspended due to tax-basis, at-risk, and passive activity loss limitations. Deductible loss Losses suspended by tax basis limitation Losses suspended by at-risk limitation Losses suspended by passive activity loss limitation Farell is a member of Sierra Vista LLC. Although Sierra Vista is involved in a number of different business ventures, it is not currently involved in real estate either as an investor or as a developer. On January 1, year 1, Farell has a $84,000 tax basis in his LLC interest that includes his $72,000 share of Sierra Vista's general debt obligations. By the end of the year, Farell's share of Sierra Vista's general debt obligations has increased to $84,000. Because of the time he spends in other endeavors, Farell does not materially participate in Sierra Vista. His share of the Sierra Vista losses for year 1 is $115,000. As a partner in the Riverwoods Partnership, he also has year 1, Schedule K-1 passive income of $9,000. Farell is single and has no other sources of business income or loss. (Leave no answer blank. Enter zero if applicable.) Determine how much of the Sierra Vista loss Farell will currently be able to deduct on his tax return for year 1. . List the losses suspended due to tax-basis, at-risk, and passive activity loss limitations. Deductible loss Losses suspended by tax basis limitation Losses suspended by at-risk limitation Losses suspended by passive activity loss limitation