Answered step by step

Verified Expert Solution

Question

1 Approved Answer

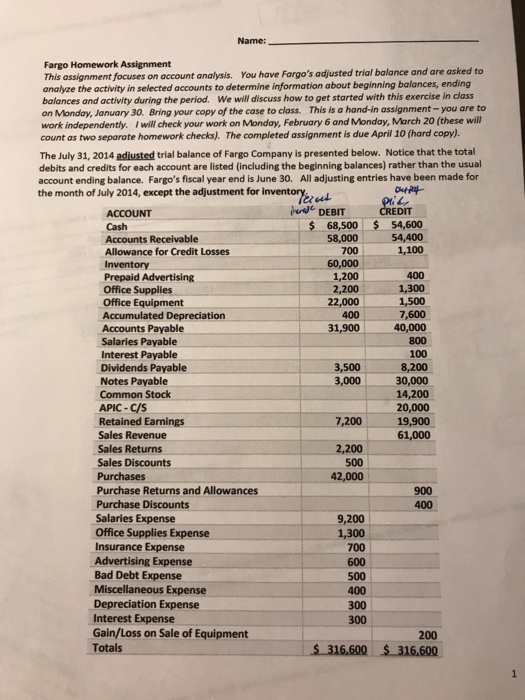

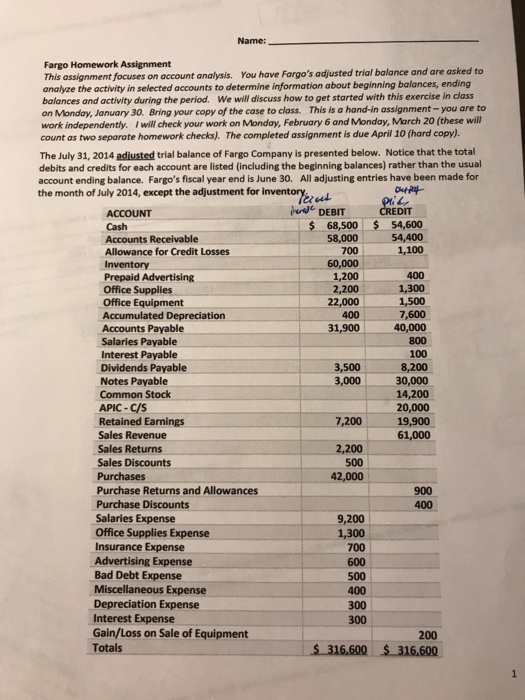

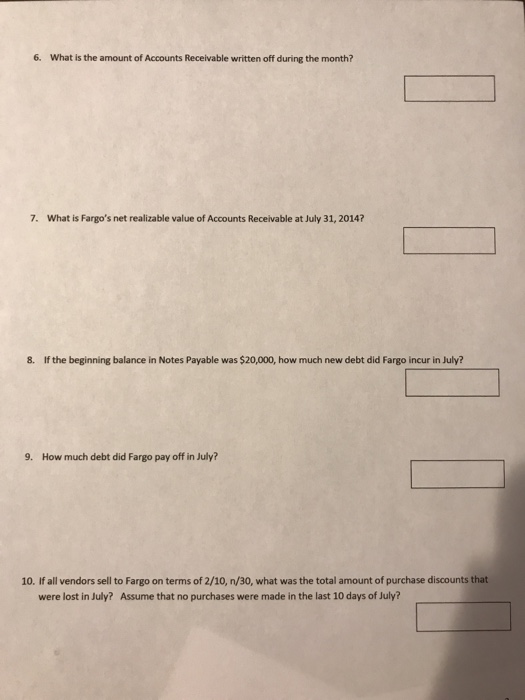

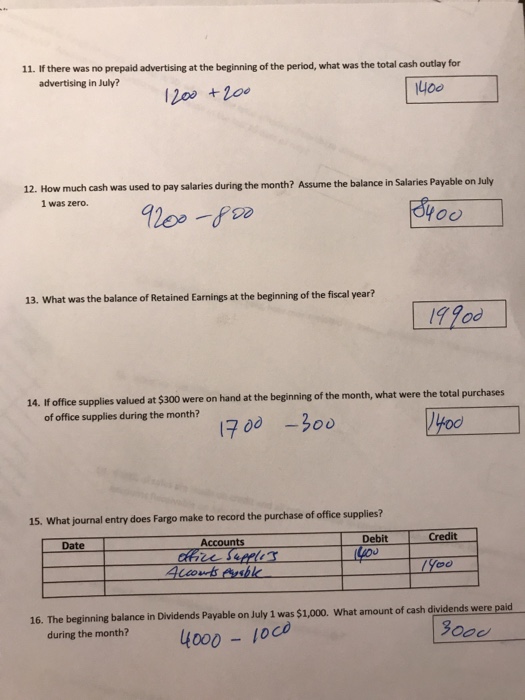

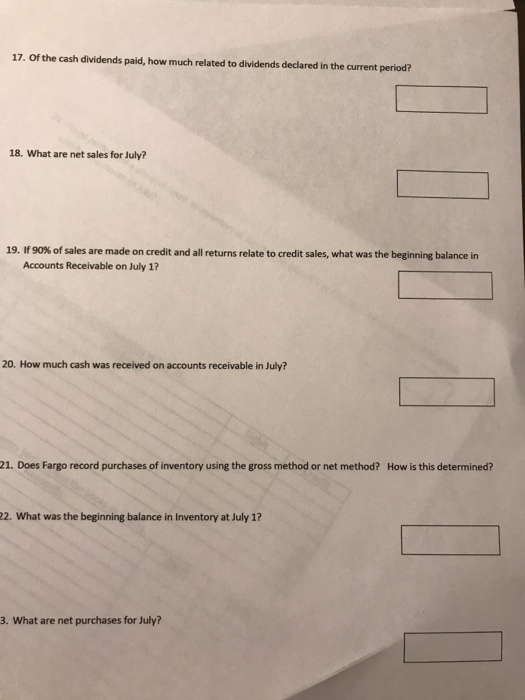

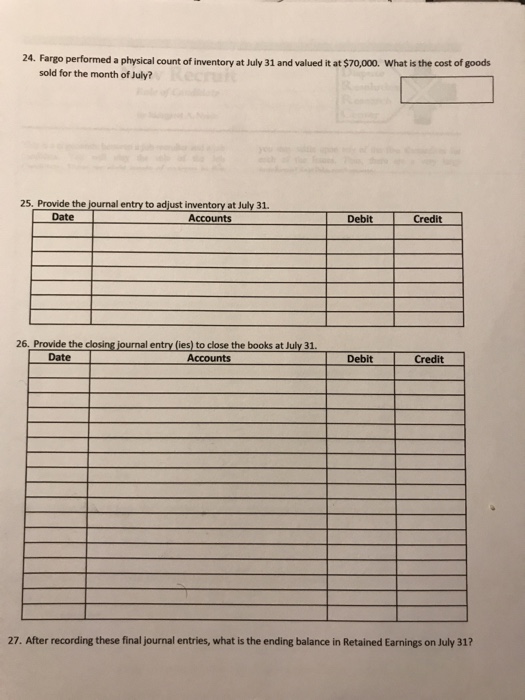

Fargo accounting Name: Fargo Homework Assignment adjusted trial balance and are asked to This assignment focuses on account analysis. You have Fargo's analyze the activity

Fargo accounting

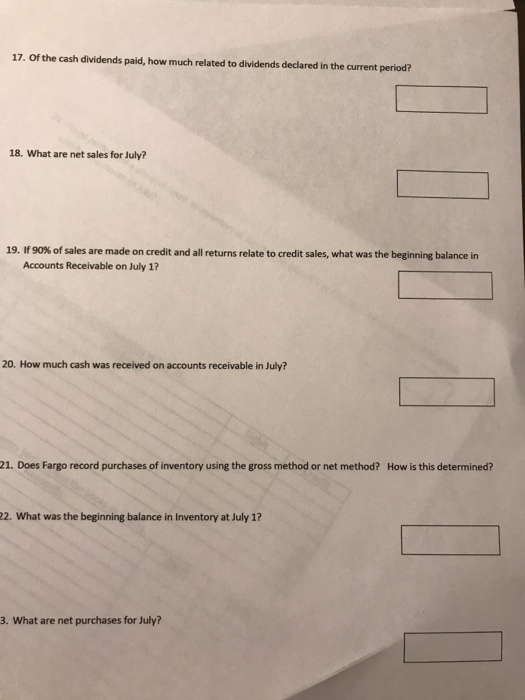

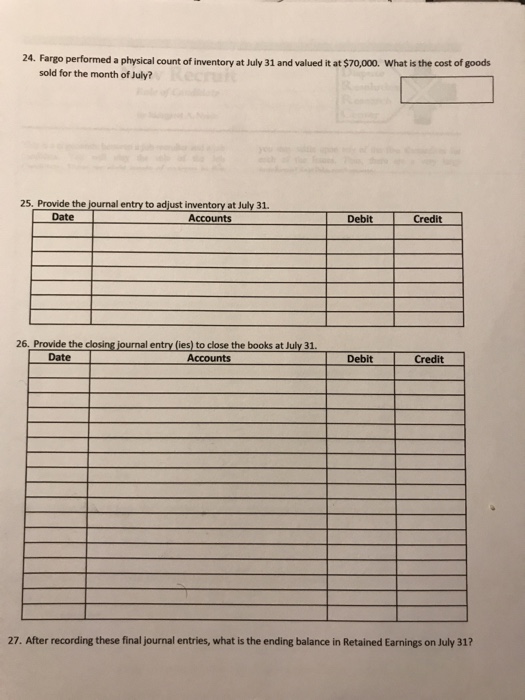

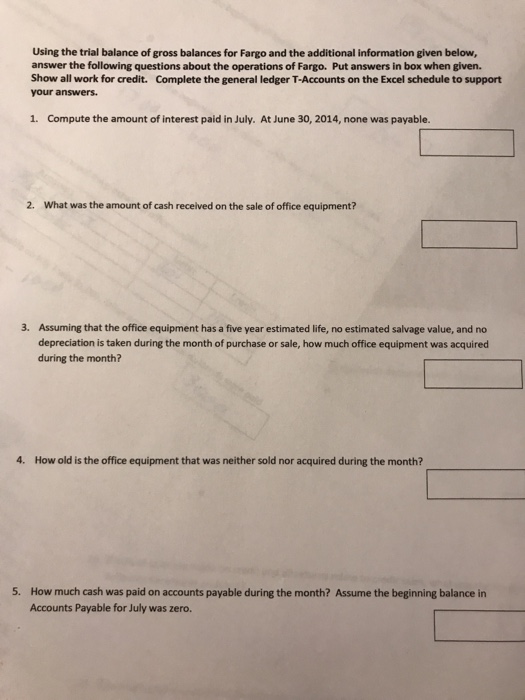

Name: Fargo Homework Assignment adjusted trial balance and are asked to This assignment focuses on account analysis. You have Fargo's analyze the activity in selected accounts to determine information about beginning balances, ending balances and activity during the period. We willdiscuss how to get started with this exercise on Monday, January 30. Bring your copy of the case to class. This is a hand-in assignment-you are to work independently. Iwill check your work on Monday, February and Monday, March 20 (these will count as two separate homework checks) The completed assignment is due April 10 (hard copy). The July 31, 2014 adiusted trial balance of Fargo Company is presented below. Notice that the total debits and credits for each account are listed (including the beginning balances) rather than the usual account ending balance. Fargo's fiscal year end is June 30. All adjusting entries have been made for the month of July 2014, except the adjustment for inventory, DEBIT ACCOUNT 68,500 54,600 Cash 54,400 Accounts Receivable 1,100 Allowance for Credit Losses 60,000 Inventory 1,200 2,200 1,300 22,000 1500 Prepaid Advertising Office Supplies Office Equipment 7,600 Accumulated Depreciation 31,900 40,000 Accounts Payable Salaries Payable Interest Payable 100 Dividends Payable 3,500 8,200 3,000 30,000 Notes Payable Common Stock 14,200 APIC CIS 20,000 Retained Earnings 7,200 19,900 Sales Revenue 61,000 Sales Returns Sales Discounts 500 Purchases 42,000 Purchase Returns and Allowances Purchase Discounts Salaries Expense 9,200 office supplies Expense 1,300 Insurance Expense Advertising Expense Bad Debt Expense 5000 Miscellaneous Expense Depreciation Expense Interest Expense 300 Gain/Loss on Sale of Equipment 200 Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started