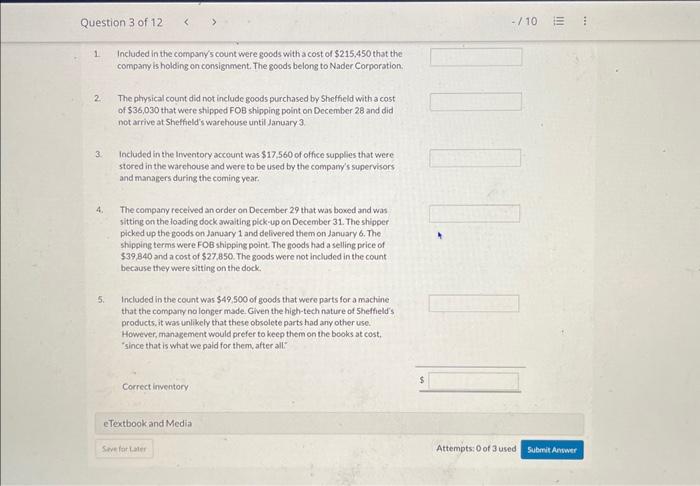

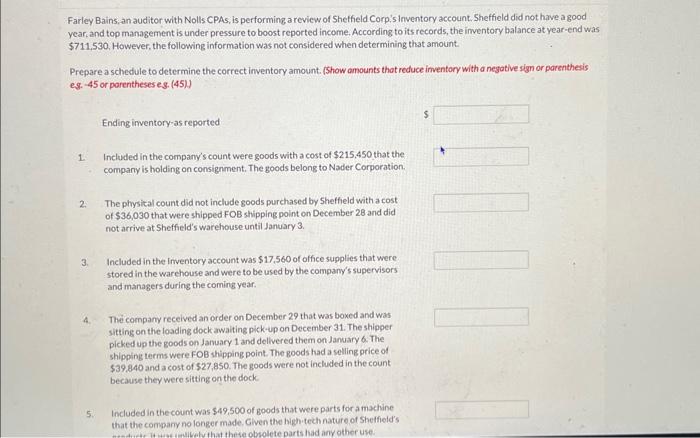

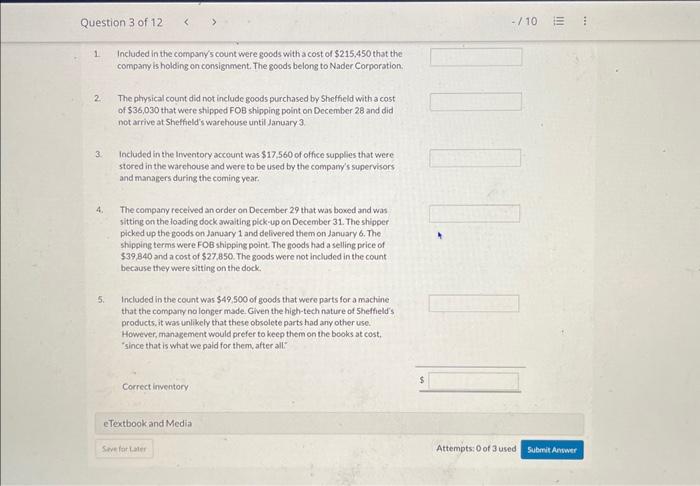

Farley Bains, an auditor with Nolls CPAS, is performing a review of Sheffield Corp's Inventory account. Sheffield did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-end was $711,530. However, the following information was not considered when determining that amount. Prepare a schedule to determine the correct inventory amount. (Show amounts that reduce inventory with a negative sign or parenthesis eg.-45 or parentheses e.g. (45).) 1. 2. 3. 4. 5. Ending inventory-as reported Included in the company's count were goods with a cost of $215,450 that the company is holding on consignment. The goods belong to Nader Corporation. The physical count did not include goods purchased by Sheffield with a cost of $36,030 that were shipped FOB shipping point on December 28 and did not arrive at Sheffield's warehouse until January 3. Included in the Inventory account was $17,560 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year. The company received an order on December 29 that was boxed and was sitting on the loading dock awaiting pick-up on December 31. The shipper picked up the goods on January 1 and delivered them on January 6. The shipping terms were FOB shipping point. The goods had a selling price of $39,840 and a cost of $27,850. The goods were not included in the count because they were sitting on the dock. Included in the count was $49,500 of goods that were parts for a machine that the company no longer made. Given the high-tech nature of Sheffield's products, it was unlikely that these obsolete parts had any other use. However, management would prefer to keep them on the books at cost, "since that is what we paid for them, after all." $ 111

Farley Baims, an auditor with Nolls CPAs, is performing a review ot Sheffield Corp's inventory account, Sheffeld did not have a good year and top management is under pressure to boost reported income. According to its records the inwentory bylance at veariend was \$711.530. However, the followine information was not considered when determinine that amount. Prepare a schedule to determine the correct inventory amount. (Show amounts that reduce inventory with a negutive sign or parenthests es. 45 or porentheses es (45) Ending inventory as reported 1. Included in the company's count were goods with a cost of $215,450 that the company is holding on consignment. The goods belong to Nader Corporation. 2. The ptrrsical count did not include goods purchused by Sheffield with a cost of $36.030 that were shipped FOB shipping point on December 28 and did not arrive at Shietfield swarehouse untit January? 3. Included in the Inventocy account was $17.560 of otfice supplies that were stored in the warehouse and were to be used by the comparrys supervisors arid managers duiling the coming year. 4. The companr received an order on December 29 that was boked and was sitting on the losding dock awa ting pick.up on December 31 . The shipper picked up the goodi on fanuary 1 and deflivered them on Jinuary 8 . The thipping terms were FOB shipping point. The goods had a selling prike of $39.840 and a cost of $27.850. The roods were not included in the count becwise they were sitting on the dock. 5. Included in the count was 549,500 of goods that were parts for a machine that the comparv no longer made. Given the high-tech nature of Shethelds Howerer, management wodd prefer to keep them on the books t cost. 'since that is what we paid for them after all: Farley Bains, an auditor with Nolls CPAs, is performing a review of Sheffield Corp's Inventory account. Sheffield did not have a good year, and top management is under pressure to boost reported income. According to its records, the imventory balance at year-end was $711,530. However, the following information was not considered when determining that amount. Prepare a schedule to determine the correct inventory amount. (Show amounts that reduce inventory with a nejative sign or parenthesis es. -45 or parentheses es. (45).) Ending imventory-as reported 1. Included in the company's count were goods with a cost of $215,450 that the company is holding on consignment. The goods belong to Nader Corporation. 2. The physital count did not include goods purchased by Sheffeld with a cost of $36,030 that were shipped FOB shipping point on December 28 and did not arrive at Shefficld's warehouse unti January 3. 3. Included in the Imventory account was $17,560 of office supplies that were stored in the warchouse and were to be used by the company's supervisors and managers during the coming year. 4. The company received an order on December 29 that was boxed and was sitting on the loading dock awaiting pick-up on December 31. The shipger pickef up the goods on fanuary 1 and dellvered them on January 6 . The shipping terms were FOB shipping point. The goods had a selling price of $39,840 and a cost of $27,850. The goods were not included in the count because they were sitting on the dock 5. Included in the count was $49,500 of goods that were parts for a machine that the compary no longer made. Given the high-tech nature of Sheffield's 1 Included in the company/s count were goods with a cost of $215,450 that the compary is holding on consignment. The goods belong to Nader Corporstion. 2. The physical count did not include goods purchased by Shefficid with a cost of $36,030 that were shipped FOB shipping point on December 28 and did not arrive at Shefficld's warehouse until January. 3 3. Included in the Irventory account was $17,560 of office supplies that were stored in the warehouse and were to be used by the compary's supervisors and manalgers during the coming year. 4. The company received an order on December 29 that was boxed and was sitting on the loading dock awaiting plck-up on December 31 . The shipper picked up the goods on January 1 and delivered them on January 6 . The shipping terms were FOB shipping point. The goods had a selling price of $39,840 and a cost of $27,850. The goods were not included in the count because they were sitting on the dock. 5. Included in the count was $49,500 of goods that were parts for a machine that the compary no longer made. Given the high-tech nature of Sheffield's products, it was unlikely that these obsolete parts had any other use. However, management would prefer to keep them on the books at cost. "since that is what we paid for them after all