Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Farnsworth Sporting Inc., produces two different models of bows. The manufacturing process for both models involves two main stages--the handle production and the limb production.

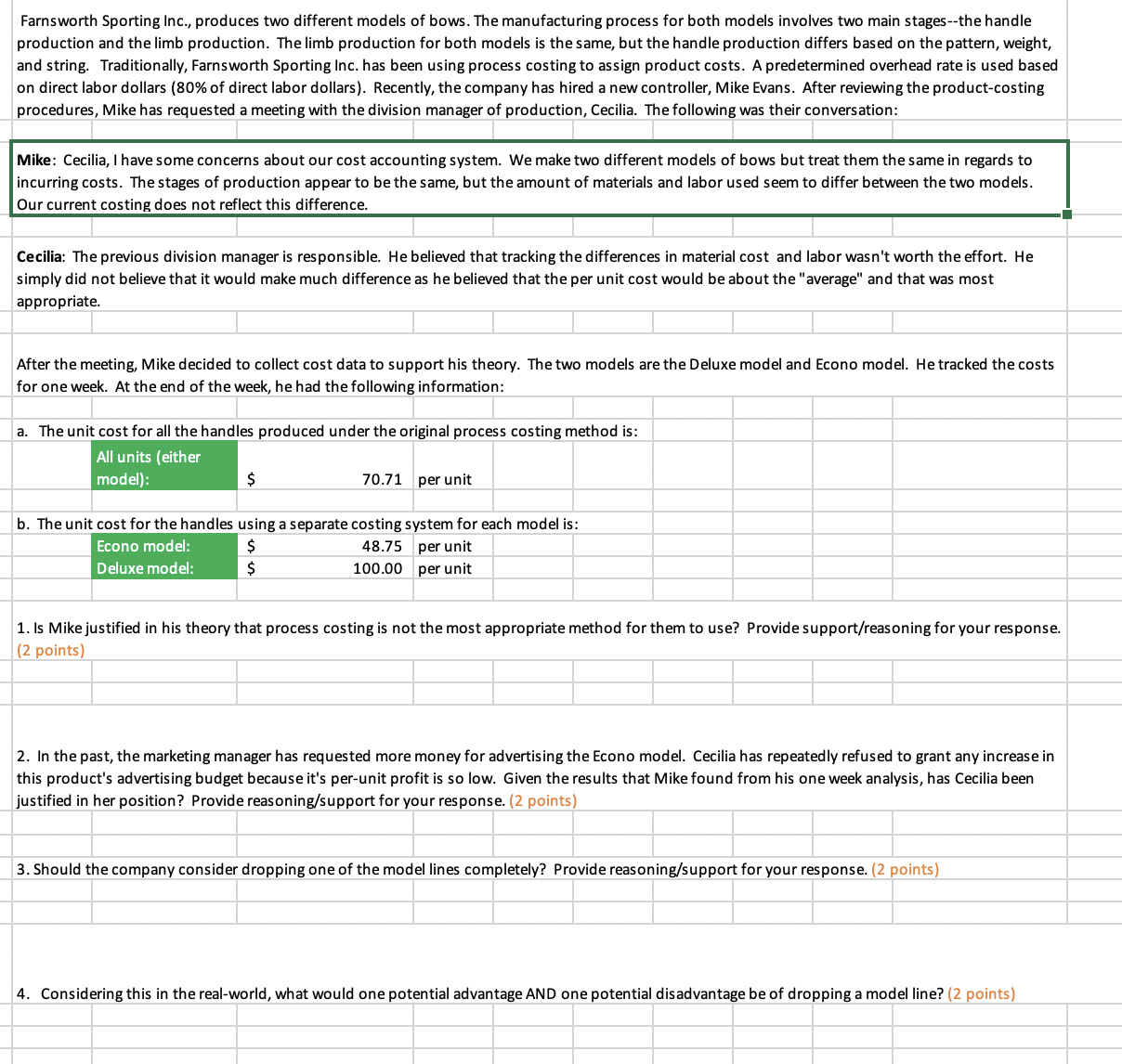

Farnsworth Sporting Inc., produces two different models of bows. The manufacturing process for both models involves two main stages--the handle production and the limb production. The limb production for both models is the same, but the handle production differs based on the pattern, weight, and string. Traditionally, Farnsworth Sporting Inc. has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars ( 80% of direct labor dollars). Recently, the company has hired a new controller, Mike Evans. After reviewing the product-costing procedures, Mike has requested a meeting with the division manager of production, Cecilia. The following was their conversation: Mike: Cecilia, I have some concerns about our cost accounting system. We make two different models of bows but treat them the same in regards to incurring costs. The stages of production appear to be the same, but the amount of materials and labor used seem to differ between the two models. Our current costing does not reflect this difference. Cecilia: The previous division manager is responsible. He believed that tracking the differences in material cost and labor wasn't worth the effort. He simply did not believe that it would make much difference as he believed that the per unit cost would be about the "average" and that was most appropriate. After the meeting, Mike decided to collect cost data to support his theory. The two models are the Deluxe model and Econo model. He tracked the costs for one week. At the end of the week, he had the following information: a. The unit cost for all the handles produced under the original process costing method is: All units (either model): $ 70.71 per unit b. The unit cost for the handles using a separate costing system for each model is: Econo model: Deluxe model: \begin{tabular}{|l|r|l|l|l|l|} \hline$ & 48.75 & per unit & & \\ \hline$ & 100.00 & per unit & & \\ & & & & \\ \hline \end{tabular} 1. Is Mike justified in his theory that process costing is not the most appropriate method for them to use? Provide support/reasoning for your response. ( 2 points) 2. In the past, the marketing manager has requested more money for advertising the Econo model. Cecilia has repeatedly refused to grant any increase in this product's advertising budget because it's per-unit profit is so low. Given the results that Mike found from his one week analysis, has Cecilia been justified in her position? Provide reasoning/support for your response. ( 2 points) 3. Should the company consider dropping one of the model lines completely? Provide reasoning/support for your response. (2 points) 4. Considering this in the real-world, what would one potential advantage AND one potential disadvantage be of dropping a model line? ( 2 points)

Farnsworth Sporting Inc., produces two different models of bows. The manufacturing process for both models involves two main stages--the handle production and the limb production. The limb production for both models is the same, but the handle production differs based on the pattern, weight, and string. Traditionally, Farnsworth Sporting Inc. has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars ( 80% of direct labor dollars). Recently, the company has hired a new controller, Mike Evans. After reviewing the product-costing procedures, Mike has requested a meeting with the division manager of production, Cecilia. The following was their conversation: Mike: Cecilia, I have some concerns about our cost accounting system. We make two different models of bows but treat them the same in regards to incurring costs. The stages of production appear to be the same, but the amount of materials and labor used seem to differ between the two models. Our current costing does not reflect this difference. Cecilia: The previous division manager is responsible. He believed that tracking the differences in material cost and labor wasn't worth the effort. He simply did not believe that it would make much difference as he believed that the per unit cost would be about the "average" and that was most appropriate. After the meeting, Mike decided to collect cost data to support his theory. The two models are the Deluxe model and Econo model. He tracked the costs for one week. At the end of the week, he had the following information: a. The unit cost for all the handles produced under the original process costing method is: All units (either model): $ 70.71 per unit b. The unit cost for the handles using a separate costing system for each model is: Econo model: Deluxe model: \begin{tabular}{|l|r|l|l|l|l|} \hline$ & 48.75 & per unit & & \\ \hline$ & 100.00 & per unit & & \\ & & & & \\ \hline \end{tabular} 1. Is Mike justified in his theory that process costing is not the most appropriate method for them to use? Provide support/reasoning for your response. ( 2 points) 2. In the past, the marketing manager has requested more money for advertising the Econo model. Cecilia has repeatedly refused to grant any increase in this product's advertising budget because it's per-unit profit is so low. Given the results that Mike found from his one week analysis, has Cecilia been justified in her position? Provide reasoning/support for your response. ( 2 points) 3. Should the company consider dropping one of the model lines completely? Provide reasoning/support for your response. (2 points) 4. Considering this in the real-world, what would one potential advantage AND one potential disadvantage be of dropping a model line? ( 2 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started