Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $50,000 and Jimm contributes $150,000 as their capital contributions. They decide

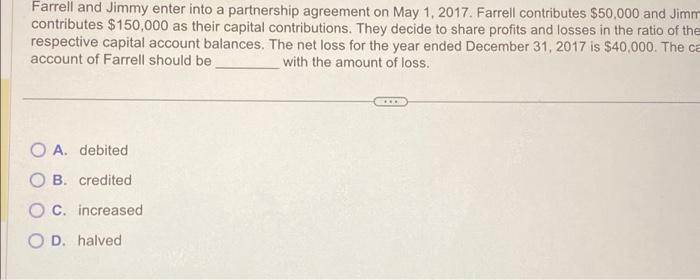

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $50,000 and Jimm contributes $150,000 as their capital contributions. They decide to share profits and losses in the ratio of the respective capital account balances. The net loss for the year ended December 31, 2017 is $40,000. The ca account of Farrell should be with the amount of loss. O A. debited OB. credited OC. increased O D. halved

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started