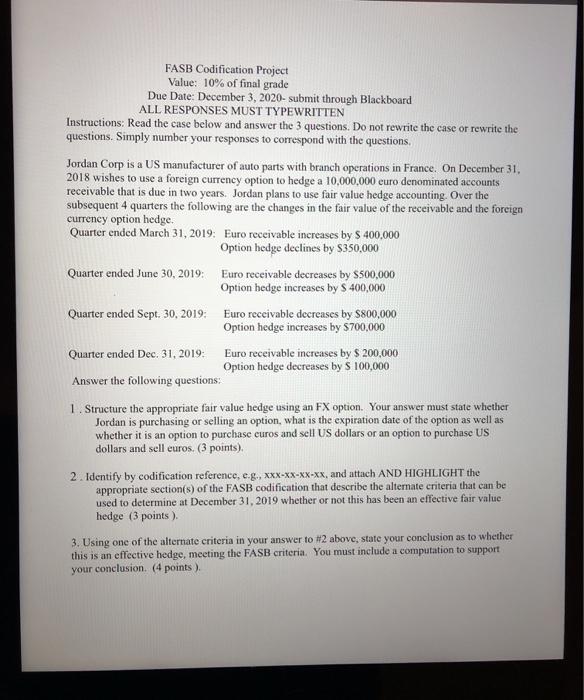

FASB Codification Project Value: 10% of final grade Due Date: December 3, 2020-submit through Blackboard ALL RESPONSES MUST TYPEWRITTEN Instructions: Read the case below and answer the 3 questions. Do not rewrite the case or rewrite the questions. Simply number your responses to correspond with the questions Jordan Corp is a US manufacturer of auto parts with branch operations in France. On December 31, 2018 wishes to use a foreign currency option to hedge a 10,000,000 euro denominated accounts receivable that is due in two years. Jordan plans to use fair value hedge accounting. Over the subsequent 4 quarters the following are the changes in the fair value of the receivable and the foreign currency option hedge Quarter ended March 31, 2019: Euro receivable increases by $ 400,000 Option hedge declines by S350,000 Quarter ended June 30, 2019: Euro receivable decreases by S500,000 Option hedge increases by $ 400,000 Quarter ended Sept. 30, 2019: Euro receivable decreases by $800,000 Option hedge increases by $700,000 Quarter ended Dec. 31, 2019: Euro receivable increases by $ 200,000 Option hedge decreases by S 100,000 Answer the following questions: 1. Structure the appropriate fair value hedge using an FX option. Your answer must state whether Jordan is purchasing or selling an option, what is the expiration date of the option as well as whether it is an option to purchase euros and sell US dollars or an option to purchase US dollars and sell euros. (3 points) 2. Identify by codification reference, e.g., XXX-XX-XX-XX, and attach AND HIGHLIGHT the appropriate section(s) of the FASB codification that describe the alternate criteria that can be used to determine at December 31, 2019 whether or not this has been an effective fair value hedge (3 points) 3. Using one of the alternate criteria in your answer to #2 above, state your conclusion as to whether this is an effective hedge, meeting the FASB criteria. You must include a computation to support your conclusion (4 points). FASB Codification Project Value: 10% of final grade Due Date: December 3, 2020-submit through Blackboard ALL RESPONSES MUST TYPEWRITTEN Instructions: Read the case below and answer the 3 questions. Do not rewrite the case or rewrite the questions. Simply number your responses to correspond with the questions Jordan Corp is a US manufacturer of auto parts with branch operations in France. On December 31, 2018 wishes to use a foreign currency option to hedge a 10,000,000 euro denominated accounts receivable that is due in two years. Jordan plans to use fair value hedge accounting. Over the subsequent 4 quarters the following are the changes in the fair value of the receivable and the foreign currency option hedge Quarter ended March 31, 2019: Euro receivable increases by $ 400,000 Option hedge declines by S350,000 Quarter ended June 30, 2019: Euro receivable decreases by S500,000 Option hedge increases by $ 400,000 Quarter ended Sept. 30, 2019: Euro receivable decreases by $800,000 Option hedge increases by $700,000 Quarter ended Dec. 31, 2019: Euro receivable increases by $ 200,000 Option hedge decreases by S 100,000 Answer the following questions: 1. Structure the appropriate fair value hedge using an FX option. Your answer must state whether Jordan is purchasing or selling an option, what is the expiration date of the option as well as whether it is an option to purchase euros and sell US dollars or an option to purchase US dollars and sell euros. (3 points) 2. Identify by codification reference, e.g., XXX-XX-XX-XX, and attach AND HIGHLIGHT the appropriate section(s) of the FASB codification that describe the alternate criteria that can be used to determine at December 31, 2019 whether or not this has been an effective fair value hedge (3 points) 3. Using one of the alternate criteria in your answer to #2 above, state your conclusion as to whether this is an effective hedge, meeting the FASB criteria. You must include a computation to support your conclusion (4 points)