Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fashion Designs International, Inc. George Gonzalez, PhD, Assistant Professor Accounting University of Lethbridge-Calgary Campus Calgary, Alberta, Canada INTRODUCTION Balancing quantitative and qualitative factors can

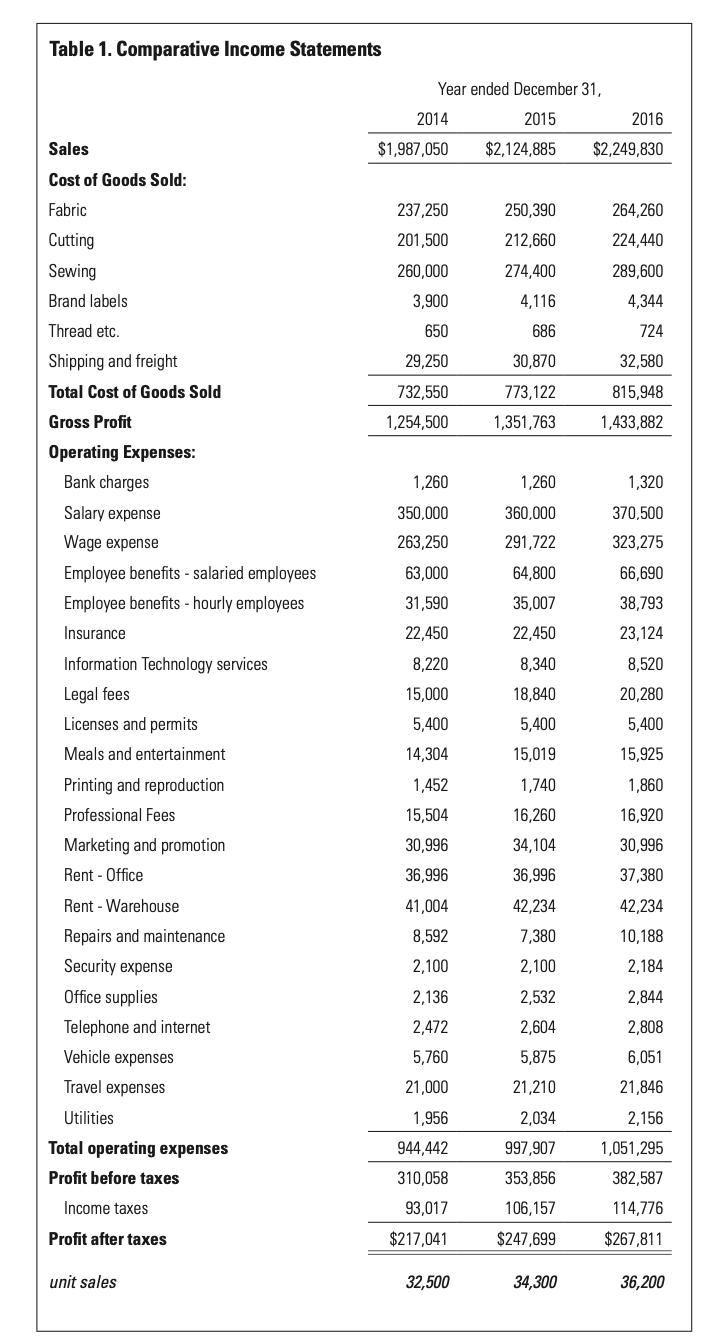

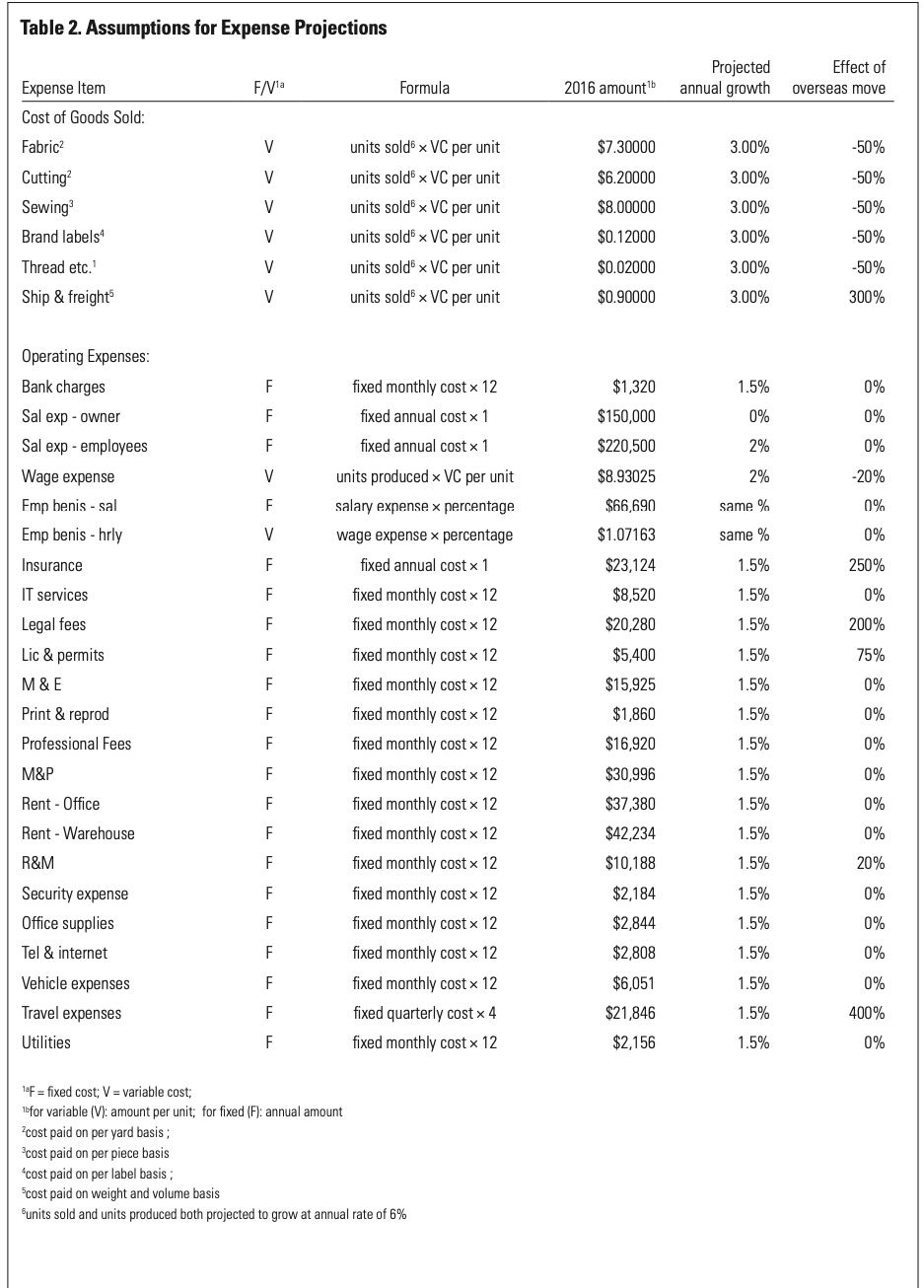

Fashion Designs International, Inc. George Gonzalez, PhD, Assistant Professor Accounting University of Lethbridge-Calgary Campus Calgary, Alberta, Canada INTRODUCTION "Balancing quantitative and qualitative factors can be quite a challenge," Charles Riley thought to himself. Riley is the CFO of Fashion Designs International, Inc. (FDI), a small women's apparel business. The CEO and sole shareholder of FDI, Alina Rossi, had asked Riley for suggestions about how to increase the company's profits to the level that matched her financial goals. Riley knew, however, that there were qualitative factors of importance to Rossi that posed challenges. FDI, based in Greensboro, North Carolina, manufactures and distributes women's apparel to retailers worldwide under the brand name RossiDesigns. Headed by Rossi, an Italian- educated, award-winning fashion designer with a high work ethic and a perfectionist streak, the company's products are considered of excellent quality by consumers and retailers. The designs, fabric, and processes used in production all contribute to this high level of quality. Since its inception in 2001, the company has grown steadily to annual sales of US$2.25 million in 2016 (see Table 1). ALINA ROSSI, FASHION DESIGNER Alina Rossi studied fashion design in Italy and, upon completing her studies, moved back to the United States where her family had emigrated when she was 10 years old. Rossi was a highly creative designer who almost certainly could have done well by selling her designs to large international fashion companies but chose instead to start her own company. Rossi started her fashion business in 2001 by selling women's apparel to small U.S.-based boutique shops. Her designs-particularly popular with women in their 20s, 30s, and 40s sold quickly, and her business grew accordingly. After several years, her market expanded to include Canada, Mexico, and a few countries in Europe. Rossi tends to be a perfectionist both with her designs and in her insistence on high production quality. This manifests itself in her close supervision of production processes, to a point of near-obsession with ensuring the high apparel standards that she demands. APPAREL PRODUCTION The production of FDI's products is composed of three major phases: (1) manufacturing the fabric to be used for apparel pieces, (2) cutting the fabric according to the particular apparel piece's design, and (3) sewing the cut fabric into apparel wear. FDI's women's outfits are made from high-quality fabric, which Rossi specifies to the fabric manufacturer, a company based in Toronto, Ontario, Canada. Large rolls of fabric manufactured for FDI are shipped to FDI's warehouse in Greensboro, where they are stored until ready to be used in production runs. At such time, fabric is sent to the cutting shop where the fabric is cut into large pieces of specific size and shape, as specified by Rossi's design. Finished cut pieces are then delivered to the sewing shop. In the sewing process, cut pieces are sewn as prescribed by Rossi into final products, which is then transported to FDI's warehouse until ready for shipment to retailers (for instance, FDI's main customers). The cutting brand name.' The Rossi Designs label is sewn into each piece that FDI produces. FDI PROFITABILITY FDI's profitability is attributable to a lean company structure and Rossi's talents and work ethic. The company, however, has not achieved the level of profitability that Rossi desires. While her goal is an annual net cash payout from the company of US$600,000, currently the net cash paid or available to her (for instance, combined salary and net profit) is only about two-thirds that amount. RILEY'S RESEARCH AND PREPARATION As mentioned previously, all of FDI's production activities are in North America: The fabric is produced in Canada, and the cutting and sewing are done in the United States. Riley believes that the quickest and surest way for FDI to increase its profitability is by moving manufacturing activities overseas to a low-cost country where labor and other production costs would be significantly reduced. Based on his prior research, Riley has estimated how the company's costs would change if all manufacturing was moved overseas (see Table 2). He has prepared a schedule of revenue and expense growth rates that allow him to project future net profits under either scenario- for instance, keeping manufacturing in North America or moving it overseas (see Table 2, "Projected Annual Growth" column). Riley determined the cost behavior of each item of expense based on cost drivers and used this information to arrive at formulas for projecting each expense item (see Table 2, "Formula" column). Riley believes that it is in the company's best interest to move production overseas and that this course of action is the best way to reach Rossi's goals for the company. He recognizes, however, that a big challenge in convincing Rossi of this is her strong desire for close supervision of all production processes. Riley knows that Rossi is a perfectionist, and he believes that other related aspects of Rossi's personality represent potential hurdles to an overseas move. Fashion design is, at its essence, an artistic skill. focus on her financial goal, convincing her that achieving those goals will require tradeoffs in production supervision, and convincing her that the tradeoffs will be well worth it. ASSIGNMENT QUESTIONS 1. Based on the information presented in Tables 1 and 2, calculate the number of unit sales required to (a) break even and (b) reach the target profit that achieves Rossi's profitability goal. 2. Using Riley's projected growth rates (Table 2), prepare a pro forma income statement for the year 2017. 3. Based on your answer to Question 2, what would be the net cash paid or available to the owner? 4. Assuming FDI continues all production in North America, and using Riley's projected growth rates (Table 2), how long would it take to achieve Rossi's profitability goal? 5. Assuming that FDI decides to move all manufacturing overseas, and using Riley's expected changes in costs from this move and projected growth rates (Table 2), prepare a pro forma income statement for the year 2017. 6. Based on your answer to Question 5, what would be the net cash paid or available to the owner? 7. Assuming that FDI decides to move its production overseas, and using Riley's expected changes in costs from such a change in manufacturing and projected growth rates (Table 2), how long would it take to achieve Rossi's profitability goal? 8. What do you think FDI should do with its production: continue in North America or move it overseas? Discuss the quantitative, qualitative, and ethical factors, if any, that come into play with this decision. Table 1. Comparative Income Statements Sales Year ended December 31, 2014 $1,987,050 2015 $2,124,885 2016 $2,249,830 Cost of Goods Sold: Fabric 237,250 250,390 264,260 Cutting 201,500 212,660 224,440 Sewing 260,000 274,400 289,600 Brand labels 3,900 4,116 4,344 Thread etc. 650 686 724 Shipping and freight 29,250 30,870 32,580 Total Cost of Goods Sold 732,550 773,122 815,948 Gross Profit 1,254,500 1,351,763 1,433,882 Operating Expenses: Bank charges 1,260 1,260 1,320 Salary expense 350,000 360,000 370,500 Wage expense 263,250 291,722 323,275 Employee benefits - salaried employees 63,000 64,800 66,690 Employee benefits - hourly employees 31,590 35,007 38,793 Insurance 22,450 22,450 23,124 Information Technology services 8,220 8,340 8,520 Legal fees 15,000 18,840 20,280 Licenses and permits 5,400 5,400 5,400 Meals and entertainment 14,304 15,019 15,925 Printing and reproduction 1,452 1,740 1,860 Professional Fees 15,504 16,260 16,920 Marketing and promotion 30,996 34,104 30,996 Rent - Office 36,996 36,996 37,380 Rent - Warehouse 41,004 42,234 42,234 Repairs and maintenance 8,592 7,380 10,188 Security expense 2,100 2,100 2,184 Office supplies 2,136 2,532 2,844 Telephone and internet 2,472 2,604 2,808 Vehicle expenses 5,760 5,875 6,051 Travel expenses 21,000 21,210 21,846 Utilities 1,956 2,034 2,156 Total operating expenses 944,442 997,907 1,051,295 Profit before taxes 310,058 353,856 382,587 Income taxes 93,017 106,157 114,776 Profit after taxes $217,041 $247,699 $267,811 unit sales 32,500 34,300 36,200 Table 2. Assumptions for Expense Projections Projected Effect of Expense Item F/V1a Formula 2016 amountb annual growth overseas move Cost of Goods Sold: Fabric V units sold x VC per unit $7.30000 3.00% -50% Cutting V units sold VC per unit $6.20000 3.00% -50% Sewing V units sold VC per unit $8.00000 3.00% -50% Brand labels V units sold VC per unit $0.12000 3.00% -50% Thread etc." V units sold x VC per unit $0.02000 3.00% -50% Ship & freight V units sold x VC per unit $0.90000 3.00% 300% Operating Expenses Bank charges F fixed monthly cost 12 $1,320 1.5% 0% Sal exp - owner F fixed annual cost 1 $150,000 0% 0% Sal exp employees F fixed annual cost 1 $220,500 2% 0% Wage expense V units produced VC per unit $8.93025 2% -20% Emp benis - sal F salary expense x percentage $66,690 same % 0% Emp benis-hrly V wage expense x percentage $1.07163 same % 0% Insurance F fixed annual cost 1 $23,124 1.5% 250% IT services F fixed monthly cost x 12 $8,520 1.5% 0% Legal fees F fixed monthly cost x 12 $20,280 1.5% 200% Lic & permits F fixed monthly cost 12 $5,400 1.5% 75% M & E F fixed monthly cost 12 $15,925 1.5% 0% Print & reprod F fixed monthly cost 12 $1,860 1.5% 0% Professional Fees F fixed monthly cost 12 $16,920 1.5% 0% M&P F fixed monthly cost 12 $30,996 1.5% 0% Rent - Office F fixed monthly cost 12 $37,380 1.5% 0% Rent - Warehouse F fixed monthly cost 12 $42,234 1.5% 0% R&M F fixed monthly cost 12 $10,188 1.5% 20% Security expense F fixed monthly cost 12 $2,184 1.5% 0% Office supplies F fixed monthly cost 12 $2,844 1.5% 0% Tel & internet F fixed monthly cost 12 $2,808 1.5% 0% Vehicle expenses F fixed monthly cost 12 $6,051 1.5% 0% Travel expenses F fixed quarterly cost 4 $21,846 1.5% 400% Utilities F fixed monthly cost 12 $2,156 1.5% 0% F = fixed cost; V = variable cost; 1bfor variable (V): amount per unit; for fixed (F): annual amount cost paid on per yard basis; cost paid on per piece basis *cost paid on per label basis; Scost paid on weight and volume basis bunits sold and units produced both projected to grow at annual rate of 6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The overall objective of financial planning in a business is generally to ensure the longterm financial health and stability of the firm This objectiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started