Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fashion plc has a main office building purchased for 1,200,000 two years ago, and currently used for the business operations. On 31 March 2020,

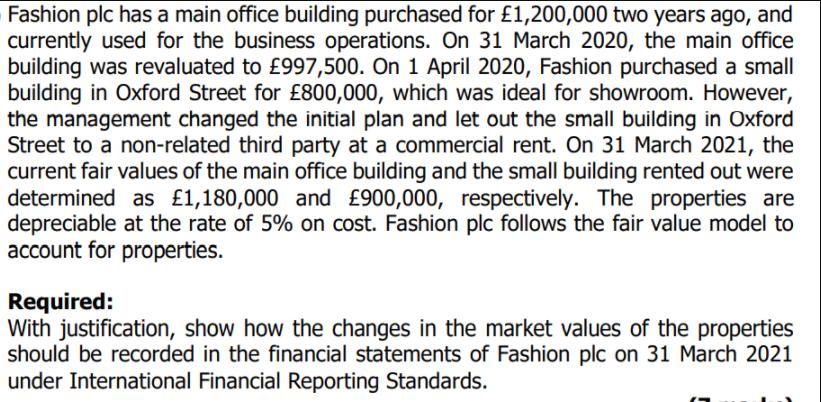

Fashion plc has a main office building purchased for 1,200,000 two years ago, and currently used for the business operations. On 31 March 2020, the main office building was revaluated to 997,500. On 1 April 2020, Fashion purchased a small building in Oxford Street for 800,000, which was ideal for showroom. However, the management changed the initial plan and let out the small building in Oxford Street to a non-related third party at a commercial rent. On 31 March 2021, the current fair values of the main office building and the small building rented out were determined as 1,180,000 and 900,000, respectively. The properties are depreciable at the rate of 5% on cost. Fashion plc follows the fair value model to account for properties. Required: With justification, show how the changes in the market values of the properties should be recorded in the financial statements of Fashion plc on 31 March 2021 under International Financial Reporting Standards.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The IFRS requires that the changes in the market values of the properties should be recorded in the financial statements of Fashion plc on 31 March 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started