Fast Feet is a new specialty running shoe store in Lumberton, NC. Fast Feet started off with a very good first year, as it made a profit. 2022 is not looking as good, however, as increased supply prices and utilities have driven up the COGS and a decrease in store traffic has sales numbers down considerably from 2021. Fast Feet does not have much of a seasonal swing, and with the store being new, there is no long-term data by which forecasting can be done.

However, sales are currently averaging $142,867.08 per month through May 31, 2022. In that same time, the COGS has been $171,212.42. Obviously, Fast Feet cannot continue this same course the rest of the year. You have been contracted at a cost of $10,000 (administrative costs) to provide an analysis of what Fast Feet should do. The owner has asked that you provide these scenarios

- Project the Income Statement, Balance Sheet, and Statement of Cash Flows for 2022

- Project the Income Statement, Balance Sheet, and Statement of Cash Flows for 2022, should Fast Feet take on a marketing campaign that should increase sales, from the first five-month average for 2022, by 21%. The campaign will cost Fast Feet $3,000 spread out over the last seven months of the year

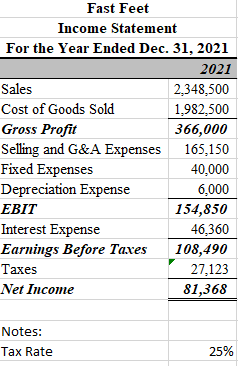

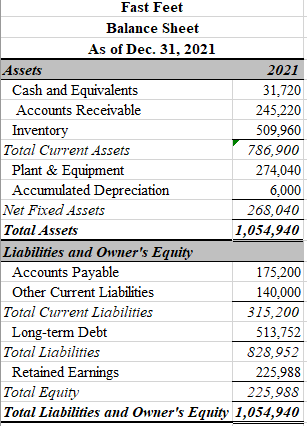

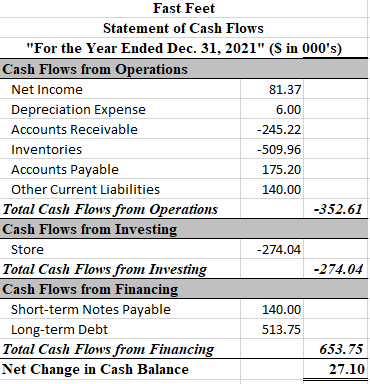

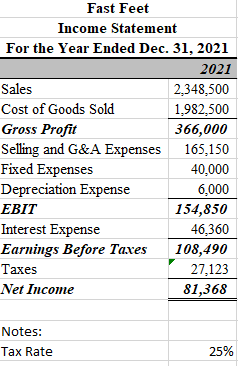

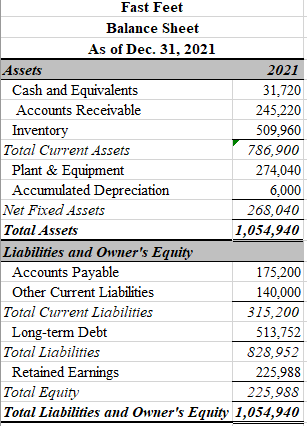

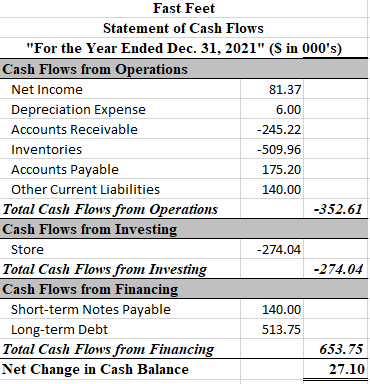

Fast Feet Income Statement For the Year Ended Dec. 31, 2021 2021 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Interest Expense Earnings Before Taxes Taxes Net Income Notes: Tax Rate 2,348,500 1,982,500 366,000 165,150 40,000 6,000 154,850 46,360 108,490 27,123 81,368 25% Fast Feet Balance Sheet As of Dec. 31, 2021 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Net Fixed Assets Total Assets 2021 31,720 245,220 509,960 786,900 274,040 6,000 268,040 1,054,940 Liabilities and Owner's Equity Accounts Payable Other Current Liabilities Total Current Liabilities Long-term Debt Total Liabilities Retained Earnings Total Equity 225,988 Total Liabilities and Owner's Equity 1,054,940 175,200 140,000 315,200 513,752 828,952 225,988 Fast Feet Statement of Cash Flows "For the Year Ended Dec. 31, 2021" (S in 000's) Cash Flows from Operations Net Income Depreciation Expense Accounts Receivable Inventories Accounts Payable Other Current Liabilities Total Cash Flows from Operations Cash Flows from Investing Store Total Cash Flows from Investing Cash Flows from Financing Short-term Notes Payable Long-term Debt Total Cash Flows from Financing Net Change in Cash Balance 81.37 6.00 -245.22 -509.96 175.20 140.00 -274.04 140.00 513.75 -352.61 -274.04 653.75 27.10 Fast Feet Income Statement For the Year Ended Dec. 31, 2021 2021 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Interest Expense Earnings Before Taxes Taxes Net Income Notes: Tax Rate 2,348,500 1,982,500 366,000 165,150 40,000 6,000 154,850 46,360 108,490 27,123 81,368 25% Fast Feet Balance Sheet As of Dec. 31, 2021 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Net Fixed Assets Total Assets 2021 31,720 245,220 509,960 786,900 274,040 6,000 268,040 1,054,940 Liabilities and Owner's Equity Accounts Payable Other Current Liabilities Total Current Liabilities Long-term Debt Total Liabilities Retained Earnings Total Equity 225,988 Total Liabilities and Owner's Equity 1,054,940 175,200 140,000 315,200 513,752 828,952 225,988 Fast Feet Statement of Cash Flows "For the Year Ended Dec. 31, 2021" (S in 000's) Cash Flows from Operations Net Income Depreciation Expense Accounts Receivable Inventories Accounts Payable Other Current Liabilities Total Cash Flows from Operations Cash Flows from Investing Store Total Cash Flows from Investing Cash Flows from Financing Short-term Notes Payable Long-term Debt Total Cash Flows from Financing Net Change in Cash Balance 81.37 6.00 -245.22 -509.96 175.20 140.00 -274.04 140.00 513.75 -352.61 -274.04 653.75 27.10