Answered step by step

Verified Expert Solution

Question

1 Approved Answer

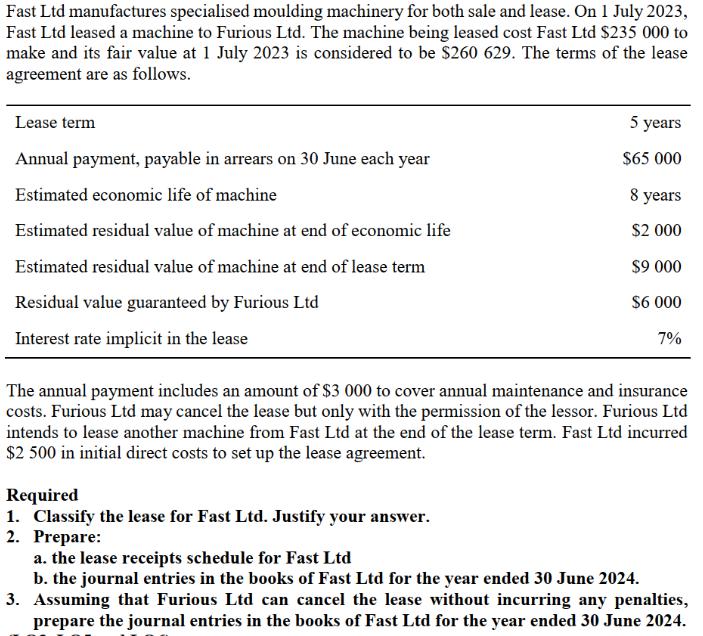

Fast Ltd manufactures specialised moulding machinery for both sale and lease. On 1 July 2023, Fast Ltd leased a machine to Furious Ltd. The

Fast Ltd manufactures specialised moulding machinery for both sale and lease. On 1 July 2023, Fast Ltd leased a machine to Furious Ltd. The machine being leased cost Fast Ltd $235 000 to make and its fair value at 1 July 2023 is considered to be $260 629. The terms of the lease agreement are as follows. Lease term Annual payment, payable in arrears on 30 June each year Estimated economic life of machine Estimated residual value of machine at end of economic life Estimated residual value of machine at end of lease term Residual value guaranteed by Furious Ltd Interest rate implicit in the lease 5 years $65 000 8 years $2000 $9.000 $6.000 7% The annual payment includes an amount of $3 000 to cover annual maintenance and insurance costs. Furious Ltd may cancel the lease but only with the permission of the lessor. Furious Ltd intends to lease another machine from Fast Ltd at the end of the lease term. Fast Ltd incurred $2 500 in initial direct costs to set up the lease agreement. Required 1. Classify the lease for Fast Ltd. Justify your answer. 2. Prepare: a. the lease receipts schedule for Fast Ltd b. the journal entries in the books of Fast Ltd for the year ended 30 June 2024. 3. Assuming that Furious Ltd can cancel the lease without incurring any penalties, prepare the journal entries in the books of Fast Ltd for the year ended 30 June 2024.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Classification of the Lease Based on the lease terms and criteria for lease classification the lea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started