Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fast n fresh food company operates and services snack vending machines located in restaurants, gas stations and factories in four southwestern states the machines are

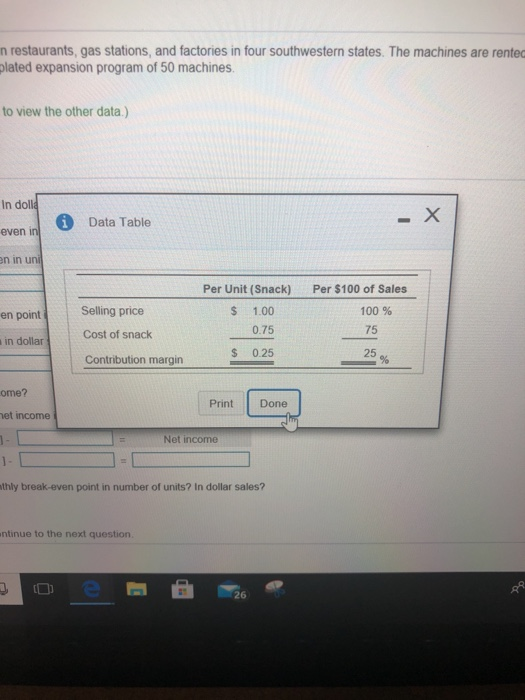

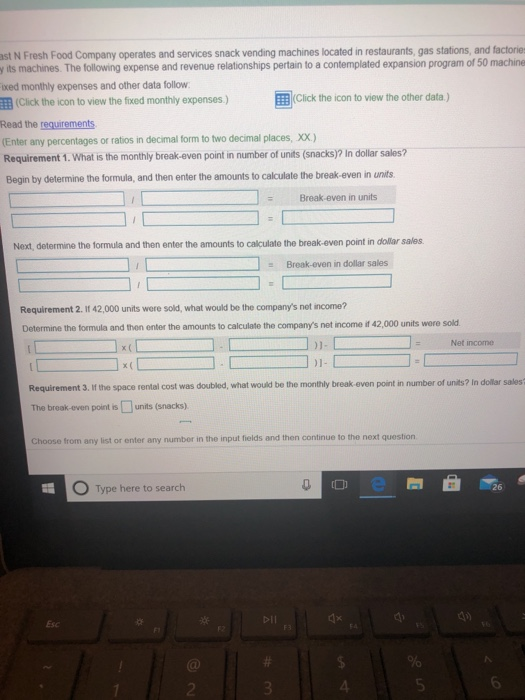

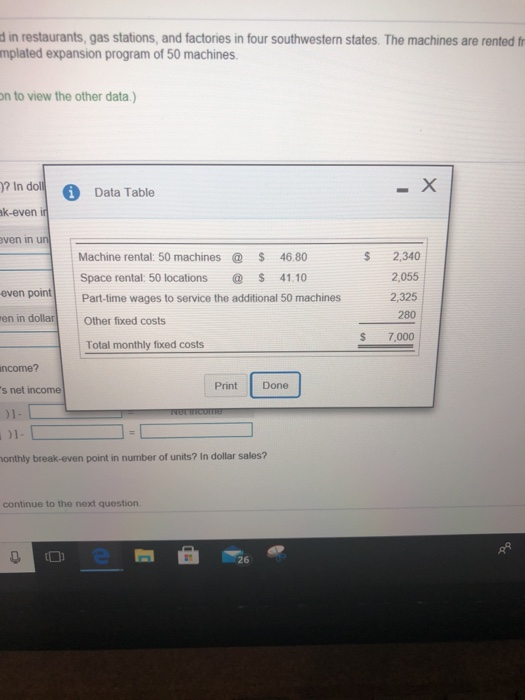

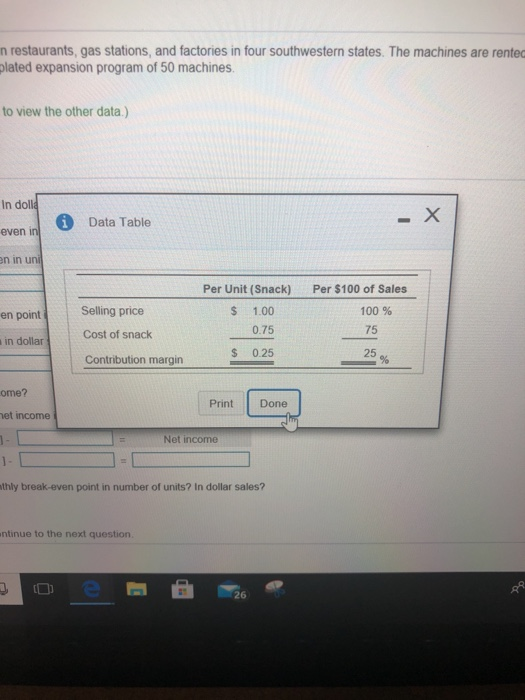

fast n fresh food company operates and services snack vending machines located in restaurants, gas stations and factories in four southwestern states the machines are rented from the manufacturer. in addition fast n fresh must rent the space occupied by its machines. the following expense and revenue relationships pertain to a contemplated expansion program of 50

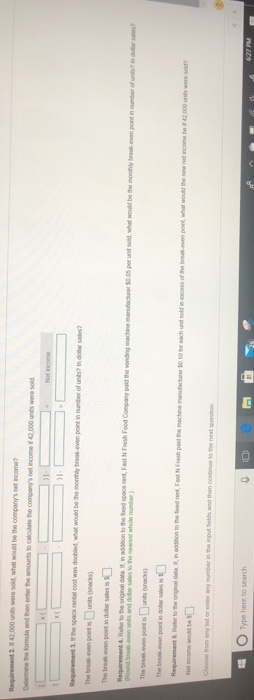

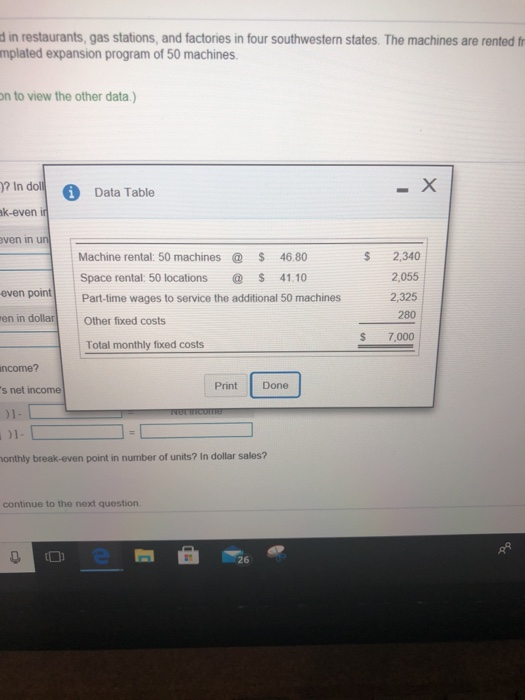

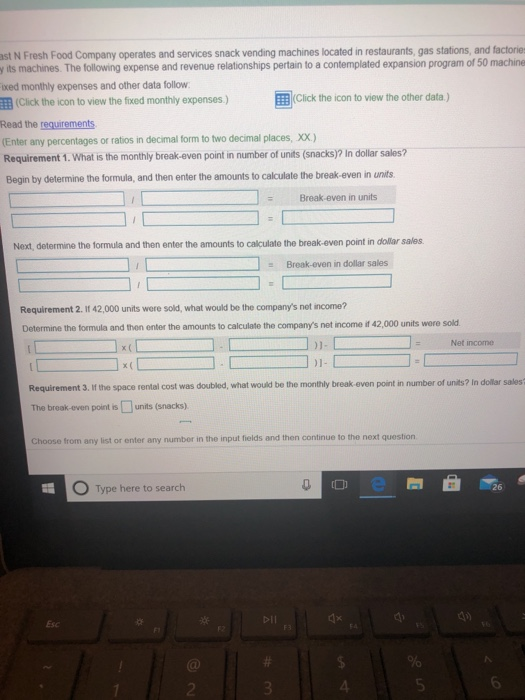

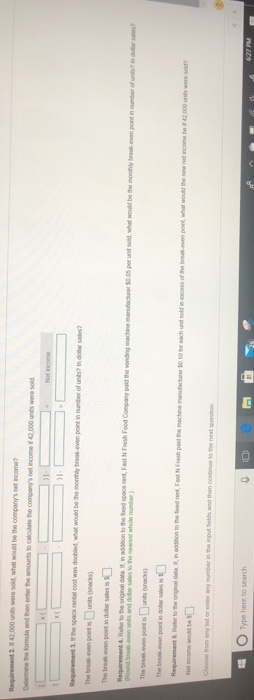

a in restaurants, gas stations, and factories in four southwestern states. The machines are rented fr mplated expansion program of 50 machines. on to view the other data.) ? In doll 0 Data Table - X ak-even id even in un $ 2,340 2,055 $ 41.10 even point Machine rental: 50 machines @ $ 46.80 Space rental: 50 locations Part-time wages to service the additional 50 machines Other fixed costs Total monthly fixed costs 2,325 280 ren in dollar $ 7,000 income? Print Done 's net income NUMOT monthly break-even point in number of units? In dollar sales? continue to the next question n restaurants, gas stations, and factories in four southwestern states. The machines are rente plated expansion program of 50 machines. to view the other data.) In dolla Data Table - even in en in uni Per Unit (Snack) $ Selling price en point Per $100 of Sales 100 % 75 1.00 0.75 Cost of snack in dollar $ 0.25 Contribution margin 25 % ome? Print Done net income 3- Net income thly break-even point in number of units? In dollar sales? ntinue to the next question 26 ast N Fresh Food Company operates and services snack vending machines located in restaurants, gas stations, and factories its machines. The following expense and revenue relationships pertain to a contemplated expansion program of 50 machine Fixed monthly expenses and other data follow (Click the icon to view the fixed monthly expenses.) (Click the icon to view the other data) Read the requirements (Enter any percentages or ratios in decimal form to two decimal places, XX) Requirement 1. What is the monthly break-even point in number of units (snacks)? In dollar sales? Begin by determine the formula, and then enter the amounts to calculate the break-even in units. Break-even in units Next, determine the formula and then enter the amounts to calculate the break-even point in dollar sales = Break-even in dollar sales Requirement 2. If 42,000 units were sold, what would be the company's net income? Determine the formula and then enter the amounts to calculate the company's net income if 42,000 units were sold Net income x Requirement 3. If the space rental cost was doubled, what would be the monthly break even point in number of units? In dollar sales The break-even point is units (snacks) Choose from any list or enter any number in the input fields and then continue to the next question 0 Type here to search 26 DIL Esc F3 % 5 2 3 Requirement 2.8 42.000 unts were sold, what would be the company's net income? 1 Requirements the space rental cost wes debid, what would be the monthly break even point in number of uns? in dolla? The brukervenport units wacks). The book or post in dollar se Round von uns and color sales to the whole number Requirement. Refer to the originaldate nation is the feed spacerent, Fast Fresh Food Company paid the vending machine manufacturer 0.05 per un sold what would be the montre pontinuerunt?in do? usadas The break-even point in dotare Requirements. Roer to the original inition to the front, Fast Freshpand the machine and 0.10 for each sold in excess of the seven put what would the now at com.000 unts were Choose from any store any number is the mound then continue to the next to Type here to search 627 PM solve requirments 1-5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started