Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fast plaese A company's balance sheets show a total of $30 million long-term debt with a coupon rate of 9 percent that matures in 20

fast plaese

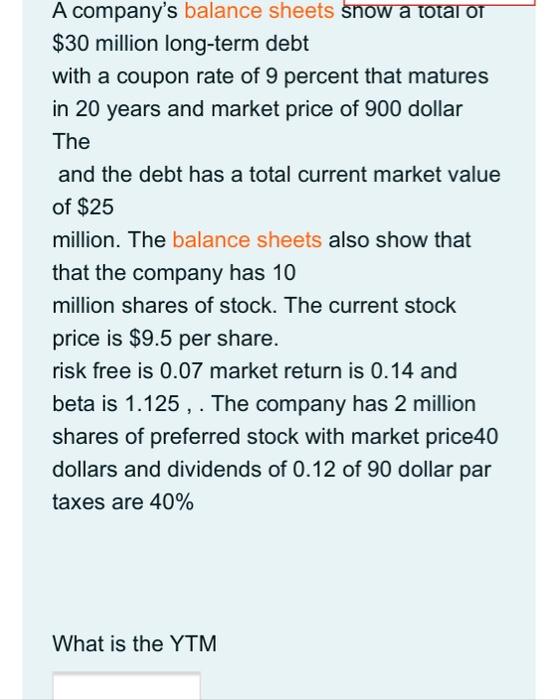

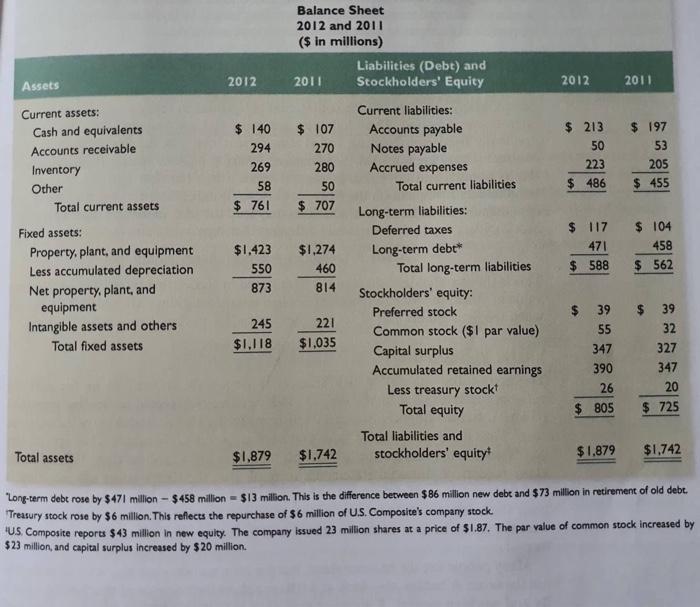

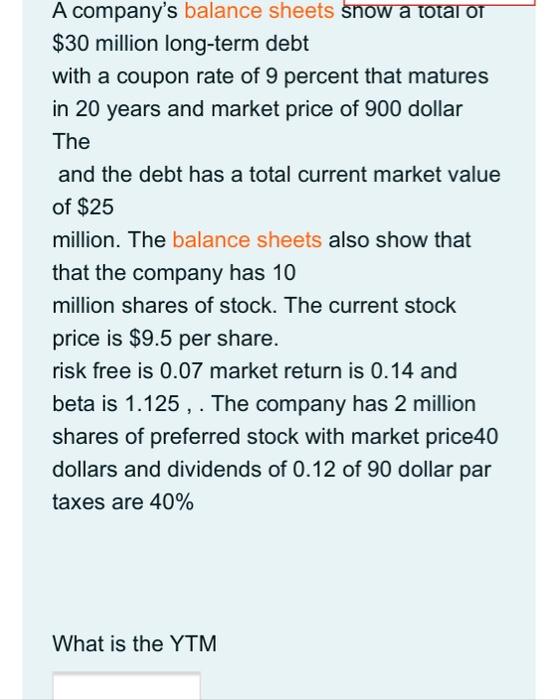

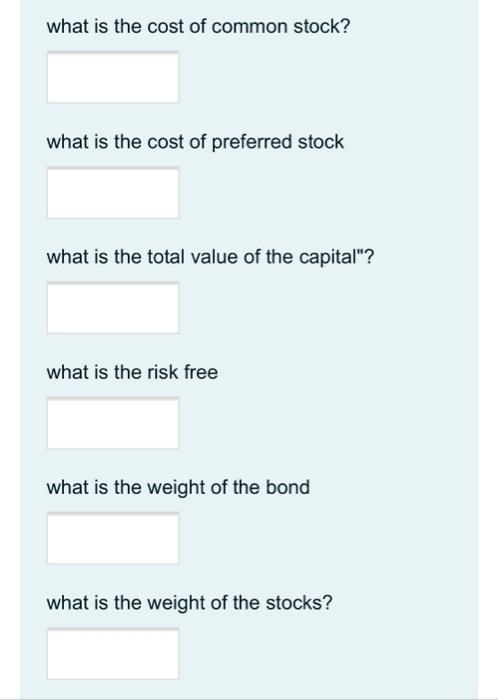

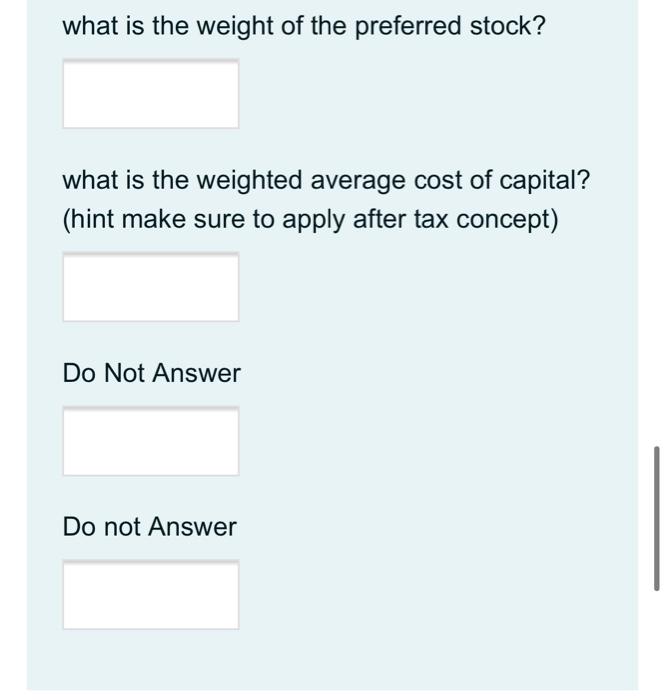

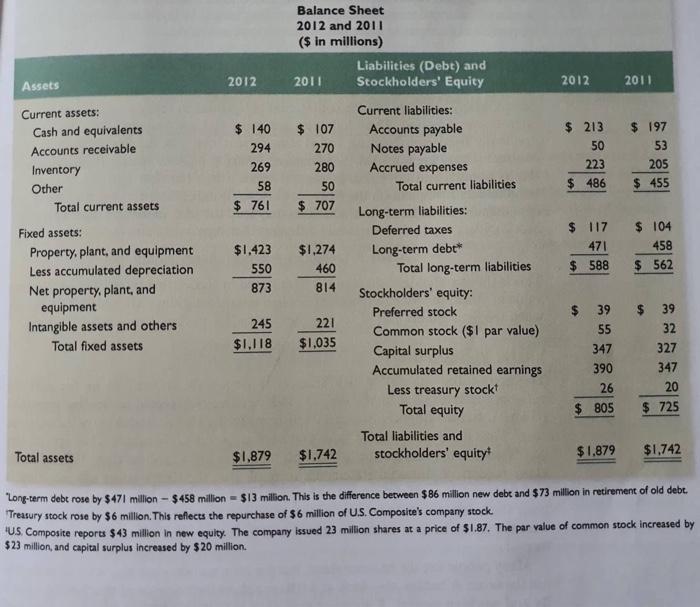

A company's balance sheets show a total of $30 million long-term debt with a coupon rate of 9 percent that matures in 20 years and market price of 900 dollar The and the debt has a total current market value of $25 million. The balance sheets also show that that the company has 10 million shares of stock. The current stock price is $9.5 per share. risk free is 0.07 market return is 0.14 and beta is 1.125 , . The company has 2 million shares of preferred stock with market price40 dollars and dividends of 0.12 of 90 dollar par taxes are 40% What is the YTM what is the cost of common stock? what is the cost of preferred stock what is the total value of the capital"? what is the risk free what is the weight of the bond what is the weight of the stocks? what is the weight of the preferred stock? what is the weighted average cost of capital? (hint make sure to apply after tax concept) Do Not Answer Do not Answer Balance Sheet 2012 and 2011 ($ in millions) Liabilities (Debt) and 2011 Stockholders' Equity Assets 2012 2012 2011 Current assets: Cash and equivalents Accounts receivable Inventory Other Total current assets $ 140 294 269 58 $ 761 $ 107 270 280 50 $ 707 $ 213 50 223 $ 486 $ 197 53 205 $ 455 $1,423 550 873 Fixed assets: Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Intangible assets and others Total fixed assets $ 117 471 $ 588 $1,274 460 814 $ 104 458 $ 562 Current liabilities: Accounts payable Notes payable Accrued expenses Total current liabilities Long-term liabilities: Deferred taxes Long-term debt* Total long-term liabilities Stockholders' equity: Preferred stock Common stock ($1 par value) Capital surplus Accumulated retained earnings Less treasury stockt Total equity Total liabilities and stockholders' equity $ 245 $1.118 221 $1.035 $ 39 55 347 390 26 $ 805 39 32 327 347 20 $ 725 Total assets $1.879 $1.742 $1.879 $1,742 long-term debt rose by $471 million - $458 million - $13 milion. This is the difference between $86 million new debt and $73 million in retirement of old debt. Treasury stock rose by $6 million. This reflects the repurchase of $6 million of U.S. Composite's company stock Us Composite reports $43 million in new equity. The company issued 23 million shares at a price of $1.87. The par value of common stock increased by $23 million, and capital surplus increased by $ 20 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started