Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fast plezzzzzz Alla Finance LLC is based in the U.S. with two subsidiaries, one located in the UK, and other in Norway. The US dollar

fast plezzzzzz

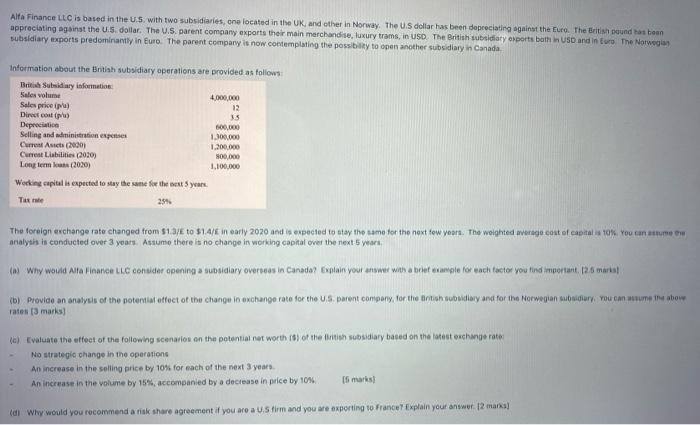

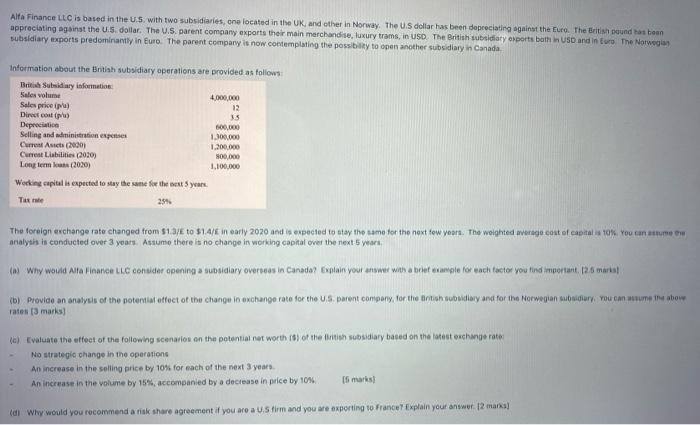

Alla Finance LLC is based in the U.S. with two subsidiaries, one located in the UK, and other in Norway. The US dollar has been depreciating against the ture. The British poundsban appreciating against the US dollar. The U.S. parent company exports their main merchandise, luxury trams, in USD The British subsidiary exports both in USD and in tura The Norwegian subsidiary texports predominantly in Euro. The parent company is now contemplating the possibility to open another subsidiary in Canada Information about the British subsidiary operations are provided as follows: British Subsidiary information Sales volume 4,000,000 Soles price 12 Direct con (p) 15 Depreciation 600,000 Selling and administration expertiser 1.300.000 Curres Asics (2001 1.200.000 Current Liabilities (2020) 800.000 Long term (2020 1.100.000 Working capital is expected to stay the same the years Title 259 The foreign exchange rate changed from 51.3/4 to $14/6 in early 2020 and is expected to stay the same for the next few years. The weighted average cost of capital is toe. You can one analysis is conducted over 3 years. Assume there is no change in working capital over the next 5 years ww why would Alta Marcello conuder opening a subsidiary overveas in Canada? Explain your answer with a brutale Vorach factor you tind mortart. 12. mars b) Provide an analysis of the potential atteet of the change in exchange rate for the U.S.parent company for the subsidiary and for the Norwegian ubadlary, you can see the show rates [3 marks) (6) Evaluate the effect of the following scenarios on the potential net worth (6) of the British subsidiary based on the latest exchange rate No strategia change in the operations An increase in the selling price by 10% for each of the next 3 years An increase in the volume by 15% accompanied by a decrease in price by 10% [1 marks (di Wlw would you recommend a risk share agreement if you are a US firm and you are exporting to France? Explain your answer 12 marks] Alla Finance LLC is based in the U.S. with two subsidiaries, one located in the UK, and other in Norway. The US dollar has been depreciating against the ture. The British poundsban appreciating against the US dollar. The U.S. parent company exports their main merchandise, luxury trams, in USD The British subsidiary exports both in USD and in tura The Norwegian subsidiary texports predominantly in Euro. The parent company is now contemplating the possibility to open another subsidiary in Canada Information about the British subsidiary operations are provided as follows: British Subsidiary information Sales volume 4,000,000 Soles price 12 Direct con (p) 15 Depreciation 600,000 Selling and administration expertiser 1.300.000 Curres Asics (2001 1.200.000 Current Liabilities (2020) 800.000 Long term (2020 1.100.000 Working capital is expected to stay the same the years Title 259 The foreign exchange rate changed from 51.3/4 to $14/6 in early 2020 and is expected to stay the same for the next few years. The weighted average cost of capital is toe. You can one analysis is conducted over 3 years. Assume there is no change in working capital over the next 5 years ww why would Alta Marcello conuder opening a subsidiary overveas in Canada? Explain your answer with a brutale Vorach factor you tind mortart. 12. mars b) Provide an analysis of the potential atteet of the change in exchange rate for the U.S.parent company for the subsidiary and for the Norwegian ubadlary, you can see the show rates [3 marks) (6) Evaluate the effect of the following scenarios on the potential net worth (6) of the British subsidiary based on the latest exchange rate No strategia change in the operations An increase in the selling price by 10% for each of the next 3 years An increase in the volume by 15% accompanied by a decrease in price by 10% [1 marks (di Wlw would you recommend a risk share agreement if you are a US firm and you are exporting to France? Explain your answer 12 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started