Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Faste -6 } 1: 2 B BI U fx fx E F A A __ G HIH & General Conditional Formatting Insert Format as

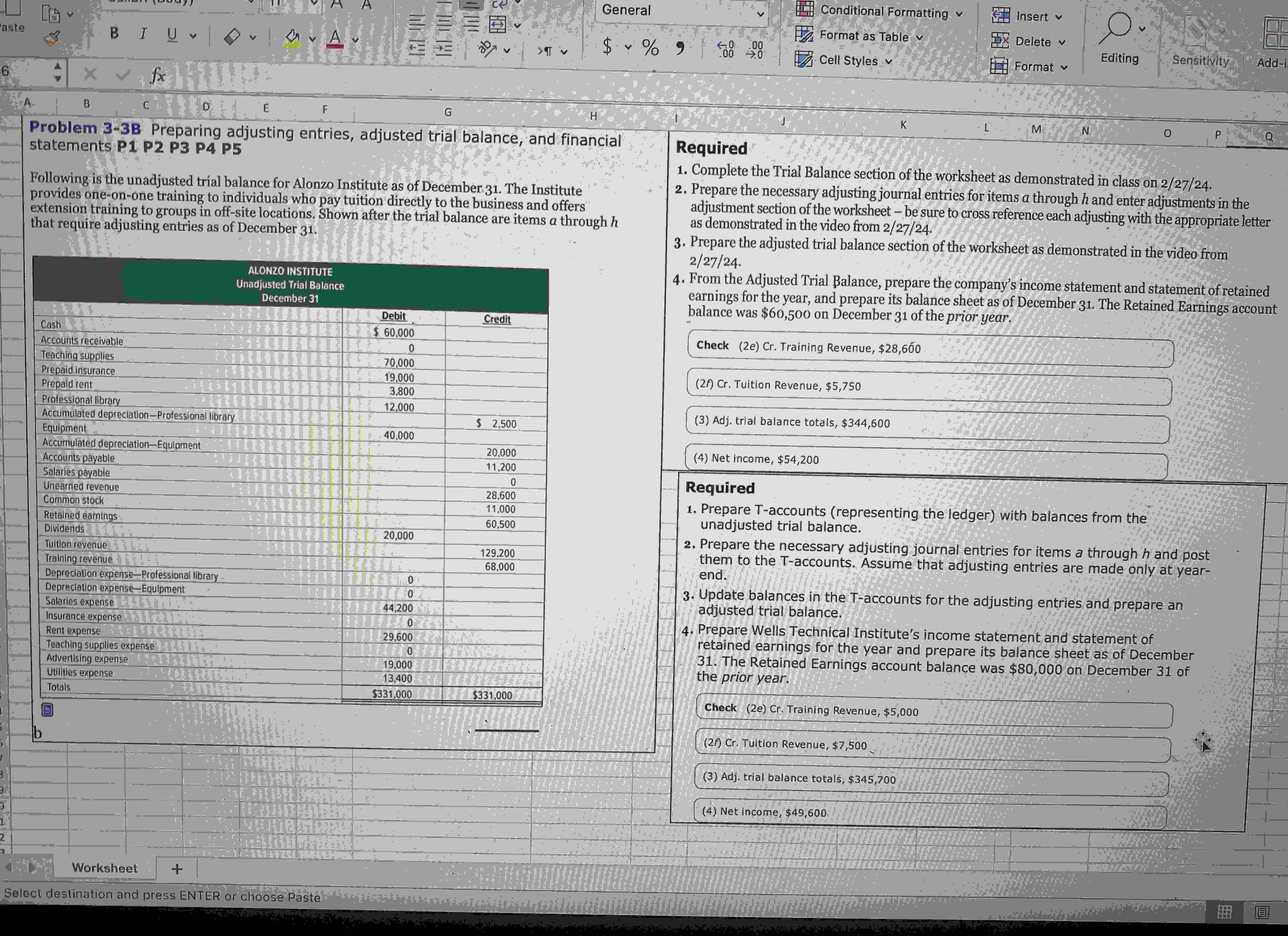

Faste -6 } 1: 2 B BI U fx fx E F A A __ G HIH & General Conditional Formatting Insert Format as Table $ % 9 0.00 .00 0 Cell Styles Delete Format Editing Sensitivity Add-i Problem 3-3B Preparing adjusting entries, adjusted trial balance, and financial statements P1 P2 P3 P4 P5 Following is the unadjusted trial balance for Alonzo Institute as of December 31. The Institute provides one-on-one training to individuals who pay tuition directly to the business and offers extension training to groups in off-site locations. Shown after the trial balance are items a through h that require adjusting entries as of December 31. Cash Accounts receivable Teaching supplies ALONZO INSTITUTE Unadjusted Trial Balance December 31 Credit Debit $ 60,000 0 70,000 Prepaid insurance 19,000 Prepaid rent 3,800 Professional library 12,000 Accumulated depreciation-Professional library. |+2| $ 2,500 Equipment 40,000 Accumulated depreciation-Equipment Accounts payable Salaries payable Unearned revenue Common stock Retained earnings 20,000 11,200 0 28,600 11,000 60,500 Dividends 20,000 Tuition revenueEF 129,200 Training revenue 69068 68,000 Depreciation expense-Professional library PETIMO 0 Depreciation expense-Equipment FO Salaries expense 159TORAN $44,200 Insurance expense lifelin 0 Rent expense 29,600 Teaching supplies expense 45H Advertising expense 51+1369369 19.000 13,400 $331,000 $331,000 Utilities expense Totals " 1 Required K - M N 0 P 1. Complete the Trial Balance section of the worksheet as demonstrated in class on 2/27/24. 2. Prepare the necessary adjusting journal entries for items a through h and enter adjustments in the adjustment section of the worksheet - be sure to cross reference each adjusting with the appropriate letter as demonstrated in the video from 2/27/24. 3. Prepare the adjusted trial balance section of the worksheet as demonstrated in the video from 2/27/24. 4. From the Adjusted Trial Balance, prepare the company's income statement and statement of retained earnings for the year, and prepare its balance sheet as of December 31. The Retained Earnings account balance was $60,500 on December 31 of the prior year. Check (2e) Cr. Training Revenue, $28,600 (2) Cr. Tuition Revenue, $5,750 (3) Adj. trial balance totals, $344,600 (4) Net income, $54,200 Required 1. Prepare T-accounts (representing the ledger) with balances from the unadjusted trial balance. L 2. Prepare the necessary adjusting journal entries for items a through h and post them to the T-accounts. Assume that adjusting entries are made only at year- end. 3. Update balances in the T-accounts for the adjusting entries and prepare an adjusted trial balance. 4. Prepare Wells Technical Institute's income statement and statement of retained earnings for the year and prepare its balance sheet as of December 31. The Retained Earnings account balance was $80,000 on December 31 of the prior year. Check (2e) Cr. Training Revenue, $5,000 (2) Cr. Tuition Revenue, $7,500 (3) Adj. trial balance totals, $345,700 (4) Net income, $49,600 L Worksheet + $1487845) Select destination and press ENTER or choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started