Answered step by step

Verified Expert Solution

Question

1 Approved Answer

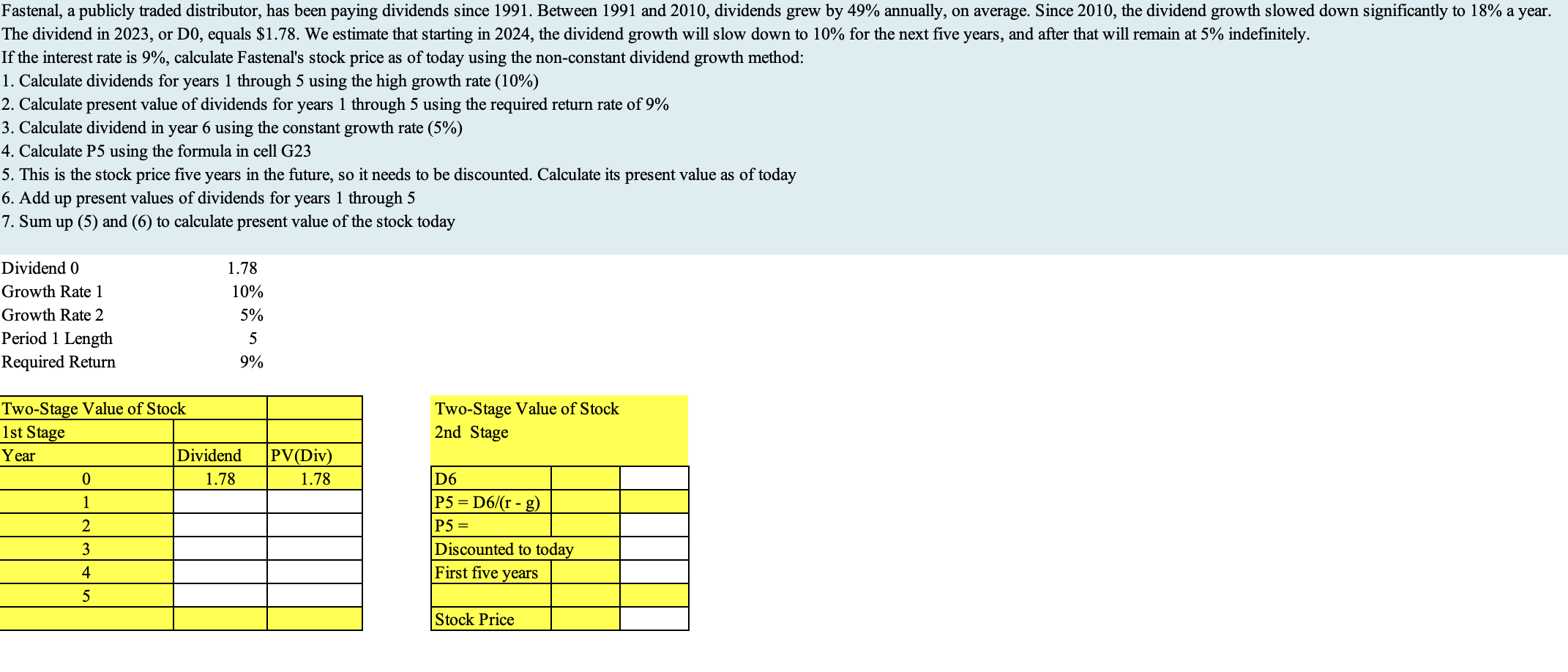

Fastenal, a publicly traded distributor, has been paying dividends since 1 9 9 1 . Between 1 9 9 1 and 2 0 1 0

Fastenal, a publicly traded distributor, has been paying dividends since Between and dividends grew by annually, on average. Since the dividend growth slowed down significantly to a year.

The dividend in or D equals $ We estimate that starting in the dividend growth will slow down to for the next five years, and after that will remain at indefinitely.

If the interest rate is calculate Fastenal's stock price as of today using the nonconstant dividend growth method:

Calculate dividends for years through using the high growth rate

Calculate present value of dividends for years through using the required return rate of

Calculate dividend in year using the constant growth rate

Calculate P using the formula in cell G

This is the stock price five years in the future, so it needs to be discounted. Calculate its present value as of today

Add up present values of dividends for years through

Sum up and to calculate present value of the stock today

TwoStage Value of Stock

nd Stage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started