Answered step by step

Verified Expert Solution

Question

1 Approved Answer

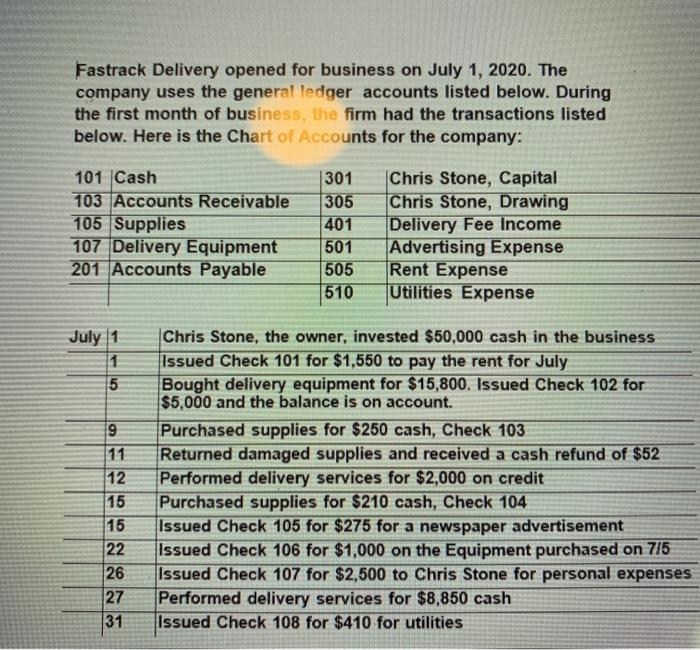

Fastrack Delivery opened for business on July 1, 2020. The company uses the general ledger accounts listed below. During the first month of business,

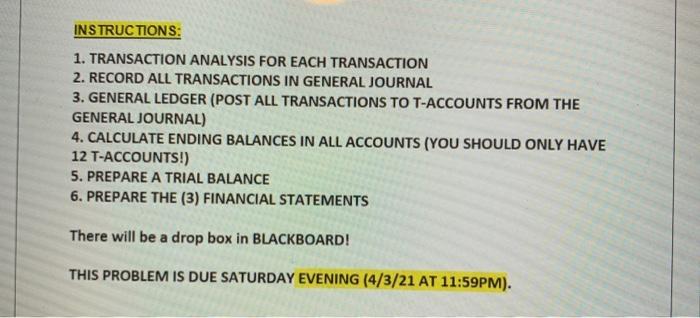

Fastrack Delivery opened for business on July 1, 2020. The company uses the general ledger accounts listed below. During the first month of business, the firm had the transactions listed below. Here is the Chart of Accounts for the company: 101 Cash 301 103 Accounts Receivable 305 105 Supplies 401 107 Delivery Equipment 501 201 Accounts Payable 505 510 July 1 1 5 19 11 12 15 15 22 26 27 31 Chris Stone, Capital Chris Stone, Drawing Delivery Fee Income Advertising Expense Rent Expense Utilities Expense Chris Stone, the owner, invested $50,000 cash in the business Issued Check 101 for $1,550 to pay the rent for July Bought delivery equipment for $15,800. Issued Check 102 for $5,000 and the balance is on account. Purchased supplies for $250 cash, Check 103 Returned damaged supplies and received a cash refund of $52 Performed delivery services for $2,000 on credit Purchased supplies for $210 cash, Check 104 Issued Check 105 for $275 for a newspaper advertisement Issued Check 106 for $1,000 on the Equipment purchased on 7/5 Issued Check 107 for $2,500 to Chris Stone for personal expenses Performed delivery services for $8,850 cash Issued Check 108 for $410 for utilities INSTRUCTIONS: 1. TRANSACTION ANALYSIS FOR EACH TRANSACTION 2. RECORD ALL TRANSACTIONS IN GENERAL JOURNAL 3. GENERAL LEDGER (POST ALL TRANSACTIONS TO T-ACCOUNTS FROM THE GENERAL JOURNAL) 4. CALCULATE ENDING BALANCES IN ALL ACCOUNTS (YOU SHOULD ONLY HAVE 12 T-ACCOUNTS!) 5. PREPARE A TRIAL BALANCE 6. PREPARE THE (3) FINANCIAL STATEMENTS There will be a drop box in BLACKBOARD! THIS PROBLEM IS DUE SATURDAY EVENING (4/3/21 AT 11:59PM).

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Transaction Analysis a July 1 Chris Stone the owner invested 50000 cash in the business Transaction Cash 101 Capital 301 b July 5 Bought delivery equipment for 15800 Issued Check 102 for 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started