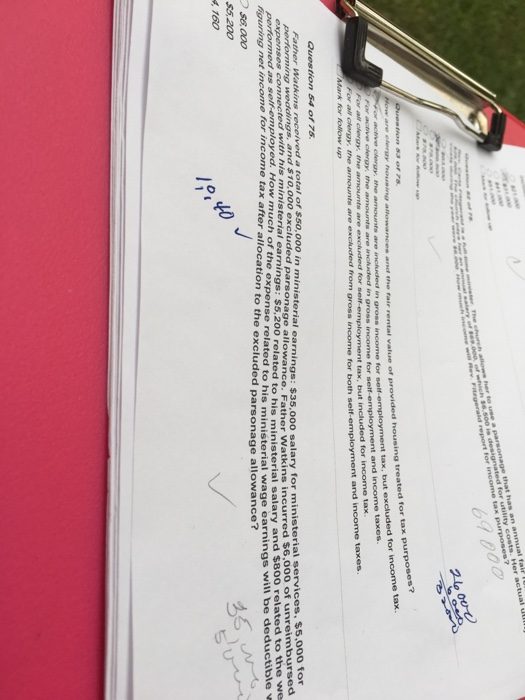

father watkins received a total of $50000 in ministral earnings $35000 salary for ministral services $5000 for performing weddings $10000 excluded pasonage allowance father watkins incurred $6000 of unreenbursed expenses connected with his monittral earnings $5200 related to his ministral salary and $800 related to the weddings performed as self employed how much of the expense related to his ministral wage earnings will be dedutable when figuring net income for income tax after allocation to the excluded parsonage allowance

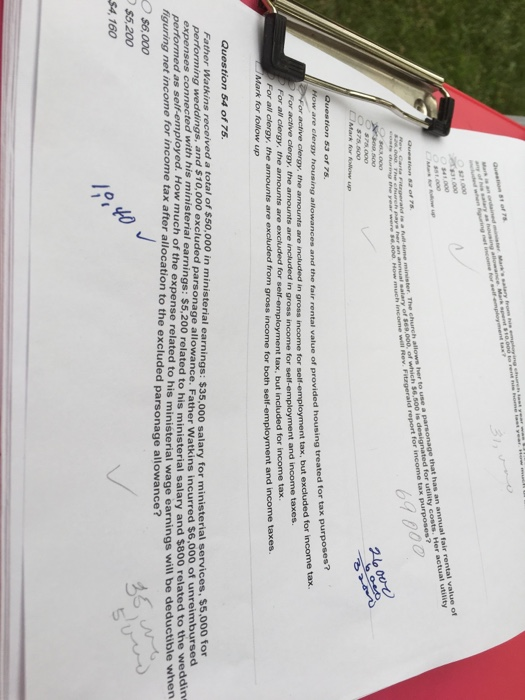

has an annual fair et ses.ooo, of which eme w Rev Fitegerald report for income tax purposes? anage tha .500 is de u er The ebueh alows ber to snea pare nated for utisity cots. Her actual i 69 000 Ouestion 83 of P8 Mow are elergy housing atowances and the fair rental value of provided housing treated for tax purposes? RFer acve clergy the amouAnts are inchded in gross income for self-employment and income taxes. Fer all egy the amounts are excluded for selfemployment tax, but included for income tax. Fer alf cergy, the amounts are exchudded from gross income for both self-employment and income taxes Fer actve cengy e amounts are incrded in gross income for self-employment tax, but excluded for income tax Mark for folow up Question 54 of 75 Father Waatkins received a total of $50,000 in ministerial earnings: $35.o00 salary for ministerial services, $5,000 for performing weddings, and $10,000 excluded parsonage allowance. Father Watkins incurred $6,000 of unreimbursed expenses connected with his ministerial earnings: $5,200 related to his ministerial salary and $800 related to the we performed as self-employed. How much of the expense related to his ministerial wage earnings will be deductible figuring et income for income tax after allocation to the excluded parsonage allowance? S6,000 $5.200 160 No e e est ye Mark s eelery rm oe mp et elast er Question 81 of P seent t allowance Mark an ondained en wan hou any of hese wen aring net i me for seif empoyent ex 1.000 Ta000 se1000 ast000 minister The church allows her to use a parsonage that has an anmual fair rental value of ngual salary or costs. Her actual utility e cheh par se.cod Howmuch income will Rev. Fitzgerald report for income tax purposes? 69 000 Questioa 42 af rs Rev Carta Fitegerad a f- 000, of which $6,500 is designated for utilits darng theyeas s3000 $75,000 O $7550o CMark for foow up Questionn 53 of 78 How are clergy houreing allowances and the fair rental value of provided housing treated for tax purposes? Fer active cleray, the amounts are included in gross income for self-employment tax, but excluded for income tax. For active clergy, the amounts are included in gross income for self-employment and income taxes. For all clergy, the amounts are excluded for self-employment tax, but included for income tax. For all clegy, the amounts are excluded from gross income for both self-employment and income taxes. Mark for follow up Question 54 of 75 Father Watkins received a total of $50,000 in ministerial earnings: $35,000 salary for ministerial services, $5,000 for performing weddings, and ST0,00 excluded parsonage allowance. Father Watkins incurred $6,000 of unreimbursed expenses connected with his ministerial earnings: $5,200 related to his ministerial salary and $800 related to the weddin- performed as self-employed. How much of the expense related to his ministerial wage earnings will be deductible when figuring net income for income tax after allocation to the excluded parsonage allowance? $6,000 $5.200 $4, 160