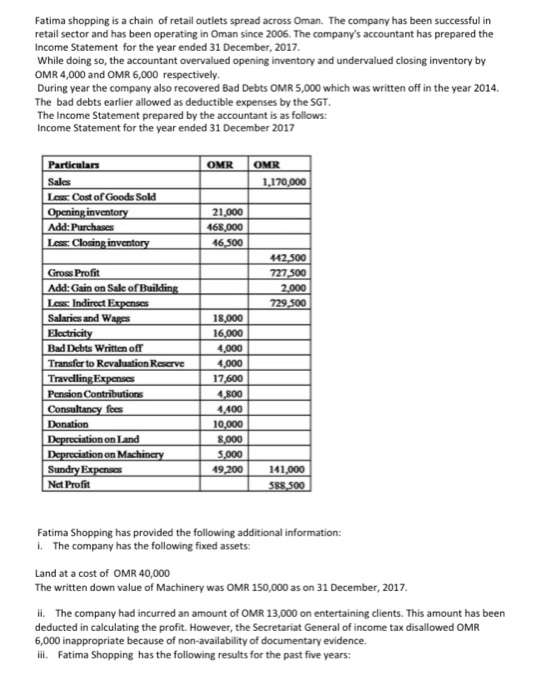

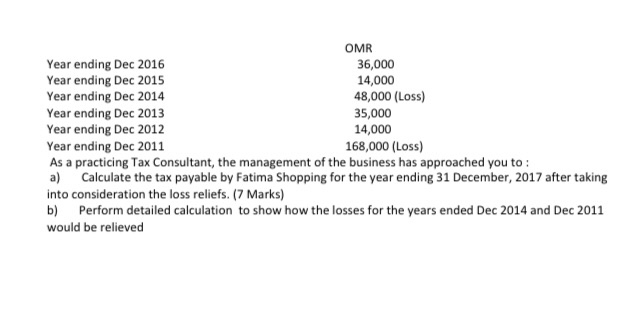

Fatima shopping is a chain of retail outlets spread across Oman. The company has been successful in retail sector and has been operating in Oman since 2006. The company's accountant has prepared the Income Statement for the year ended 31 December, 2017 While doing so, the accountant overvalued opening inventory and undervalued closing inventory by OMR 4,000 and OMR 6,000 respectively. During year the company also recovered Bad Debts OMR 5,000 which was written off in the year 2014. The bad debts earlier allowed as deductible expenses by the SGT. The Income Statement prepared by the accountant is as follows: Income Statement for the year ended 31 December 2017 OMR OMR 1,170,000 Particulars Sales Less: Cost of Goods Sold Opening inventory Add: Purchases Less: Closing inventory 21,000 468,000 46.500 442,500 727.500 2,000 729.500 Gross Profit Add:Gain on Sale of Building Less: Indirect Expenses Salaries and Wages Electricity Bad Debts Written off Transfer to Revaluation Reserve TravellingExpenses Pension Contributions Consultancy focs Donation Depreciation on Land Depreciation on Machinery Sundry Expenses Net Profit 18,000 16,000 4,000 4,000 17,600 4,800 4.400 10,000 8,000 5.000 49,200 141,000 588,500 Fatima Shopping has provided the following additional information: 1. The company has the following fixed assets: Land at a cost of OMR 40,000 The written down value of Machinery was OMR 150,000 as on 31 December, 2017 ii. The company had incurred an amount of OMR 13,000 on entertaining clients. This amount has been deducted in calculating the profit. However, the Secretariat General of income tax disallowed OMR 6,000 inappropriate because of non-availability of documentary evidence. ili. Fatima Shopping has the following results for the past five years: OMR Year ending Dec 2016 36,000 Year ending Dec 2015 14,000 Year ending Dec 2014 48,000 (Loss) Year ending Dec 2013 35,000 Year ending Dec 2012 14,000 Year ending Dec 2011 168,000 (Loss) As a practicing Tax Consultant, the management of the business has approached you to : a) Calculate the tax payable by Fatima Shopping for the year ending 31 December, 2017 after taking into consideration the loss reliefs. (7 Marks) b) Perform detailed calculation to show how the losses for the years ended Dec 2014 and Dec 2011 would be relieved