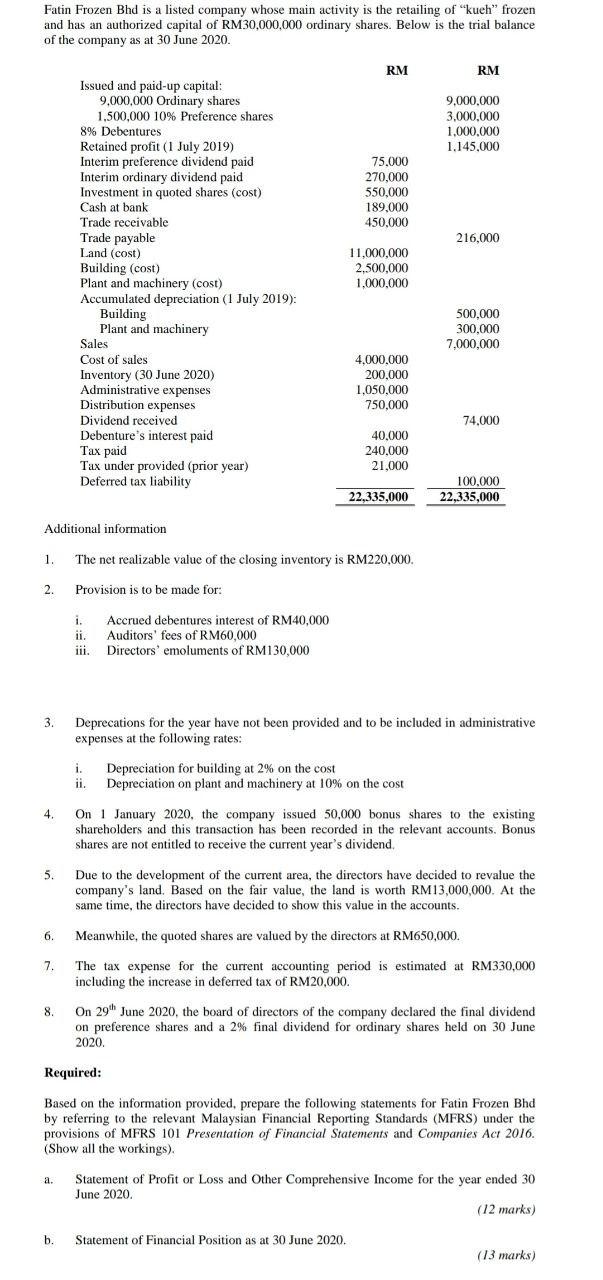

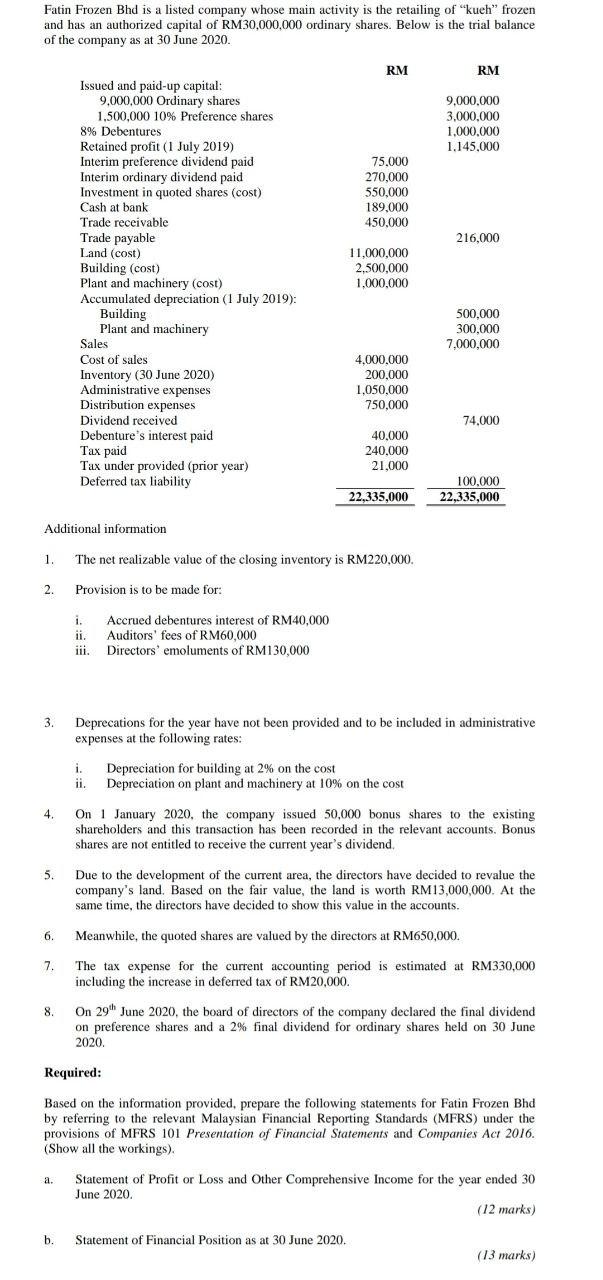

Fatin Frozen Bhd is a listed company whose main activity is the retailing of "kueh frozen and has an authorized capital of RM30,000,000 ordinary shares. Below is the trial balance of the company as at 30 June 2020. RM RM 9.000.000 3.000.000 1.000.000 1.145.000 75,000 270,000 550,000 189,000 450,000 216,000 Issued and paid-up capital: 9,000,000 Ordinary shares 1,500,000 10% Preference shares 8% Debentures Retained profit (1 July 2019) Interim preference dividend paid Interim ordinary dividend paid Investment in quoted shares (cost) Cash at bank Trade receivable Trade payable Land (cost) Building (cost) Plant and machinery (cost) Accumulated depreciation (1 July 2019): Building Plant and machinery Sales Cost of sales Inventory (30 June 2020) Administrative expenses Distribution expenses Dividend received Debenture's interest paid Tax paid Tax under provided (prior year) Deferred tax liability 11,000,000 2,500,000 1,000,000 500,000 300,000 7,000,000 4.000.000 200,000 1,050,000 750.000 74,000 40.000 240,000 21,000 22,335,000 100,000 22.335,000 Additional information 1. The net realizable value of the closing inventory is RM220.000. 2. Provision is to be made for: i. Accrued debentures interest of RM40,000 ii. Auditors' fees of RM60,000 iii. Directors' emoluments of RM130,000 3. Deprecations for the year have not been provided and to be included in administrative expenses at the following rates: i. ii. Depreciation for building at 2% on the cost Depreciation on plant and machinery at 10% on the cost 4. On 1 January 2020, the company issued 50,000 bonus shares to the existing shareholders and this transaction has been recorded in the relevant accounts. Bonus shares are not entitled to receive the current year's dividend, 5. Due to the development of the current area, the directors have decided to revalue the company's land. Based on the fair value, the land is worth RM13,000,000. At the same time, the directors have decided to show this value in the accounts. 6. Meanwhile, the quoted shares are valued by the directors at RM650,000. 7. The tax expense for the current accounting period is estimated at RM330,000 including the increase in deferred tax of RM20,000. 8. On 29th June 2020, the board of directors of the company declared the final dividend on preference shares and a 2% final dividend for ordinary shares held on 30 June 2020, Required: Based on the information provided, prepare the following statements for Fatin Frozen Bhd by referring to the relevant Malaysian Financial Reporting Standards (MFRS) under the provisions of MFRS 101 Presentation of Financial Statements and Companies Act 2016. (Show all the workings). a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020, (12 marks) b. Statement of Financial Position as at 30 June 2020. (13 marks) Fatin Frozen Bhd is a listed company whose main activity is the retailing of "kueh frozen and has an authorized capital of RM30,000,000 ordinary shares. Below is the trial balance of the company as at 30 June 2020. RM RM 9.000.000 3.000.000 1.000.000 1.145.000 75,000 270,000 550,000 189,000 450,000 216,000 Issued and paid-up capital: 9,000,000 Ordinary shares 1,500,000 10% Preference shares 8% Debentures Retained profit (1 July 2019) Interim preference dividend paid Interim ordinary dividend paid Investment in quoted shares (cost) Cash at bank Trade receivable Trade payable Land (cost) Building (cost) Plant and machinery (cost) Accumulated depreciation (1 July 2019): Building Plant and machinery Sales Cost of sales Inventory (30 June 2020) Administrative expenses Distribution expenses Dividend received Debenture's interest paid Tax paid Tax under provided (prior year) Deferred tax liability 11,000,000 2,500,000 1,000,000 500,000 300,000 7,000,000 4.000.000 200,000 1,050,000 750.000 74,000 40.000 240,000 21,000 22,335,000 100,000 22.335,000 Additional information 1. The net realizable value of the closing inventory is RM220.000. 2. Provision is to be made for: i. Accrued debentures interest of RM40,000 ii. Auditors' fees of RM60,000 iii. Directors' emoluments of RM130,000 3. Deprecations for the year have not been provided and to be included in administrative expenses at the following rates: i. ii. Depreciation for building at 2% on the cost Depreciation on plant and machinery at 10% on the cost 4. On 1 January 2020, the company issued 50,000 bonus shares to the existing shareholders and this transaction has been recorded in the relevant accounts. Bonus shares are not entitled to receive the current year's dividend, 5. Due to the development of the current area, the directors have decided to revalue the company's land. Based on the fair value, the land is worth RM13,000,000. At the same time, the directors have decided to show this value in the accounts. 6. Meanwhile, the quoted shares are valued by the directors at RM650,000. 7. The tax expense for the current accounting period is estimated at RM330,000 including the increase in deferred tax of RM20,000. 8. On 29th June 2020, the board of directors of the company declared the final dividend on preference shares and a 2% final dividend for ordinary shares held on 30 June 2020, Required: Based on the information provided, prepare the following statements for Fatin Frozen Bhd by referring to the relevant Malaysian Financial Reporting Standards (MFRS) under the provisions of MFRS 101 Presentation of Financial Statements and Companies Act 2016. (Show all the workings). a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020, (12 marks) b. Statement of Financial Position as at 30 June 2020. (13 marks)