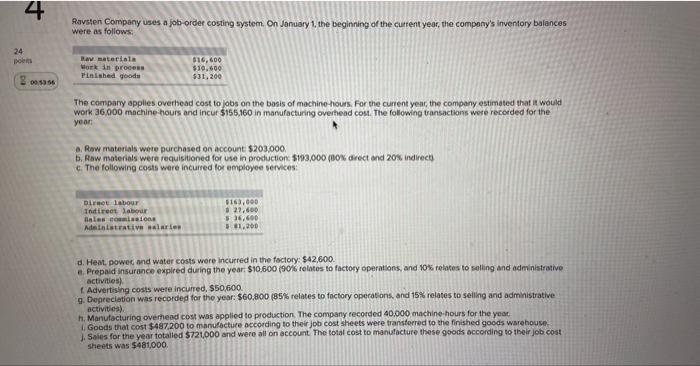

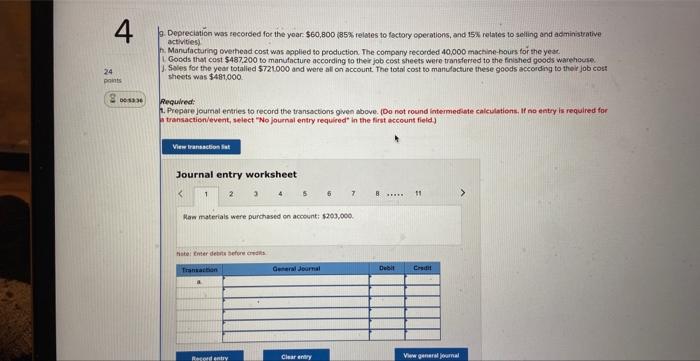

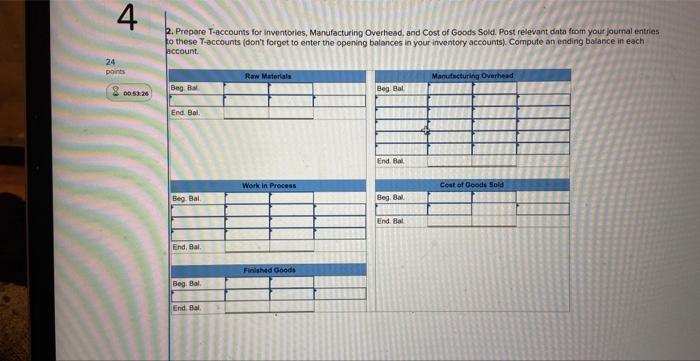

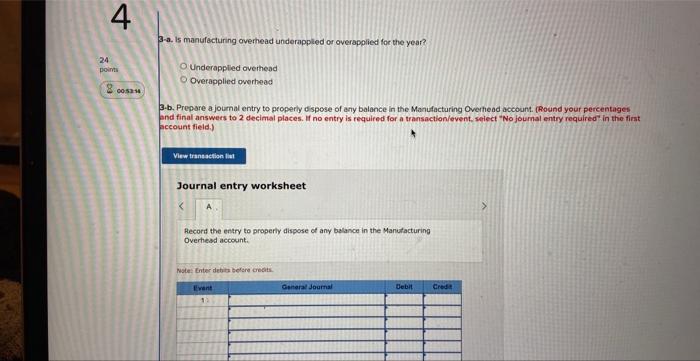

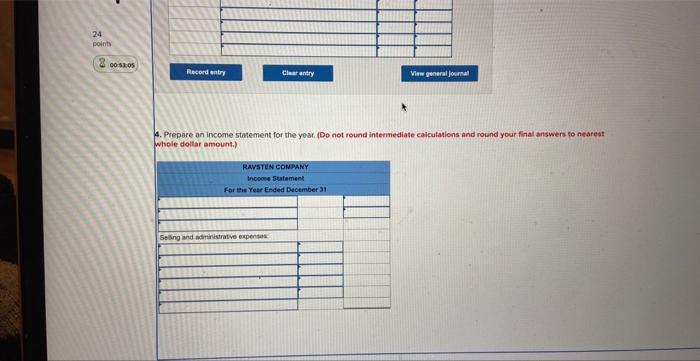

favsten Company uses a job-order costing system, On January 1, the beginning of the curtent year, the compony's inventory balances were as follows: The company applies overhead cost to jobs on the basis of machine hours. For the current year, the company estimated that is would work 36,000 machine-hours and incur $155,160 in manufacturing overhead cost. The following transactians were recorded for the year: a. Row materials were purchased on account $203,000 b. Raw materials were requisitioned for use in productions $103,000 (800s drect and 205 indirect) c. The following costs were incurred for employee services: d. Heat, powec, and water costs were incurred in the factory: $42,600. E. Frepaid insurance expired during the year. $10.600 igosi telotes to factory operations, and ros relates to seling and administrative activities) L. Advertising costs were incurred, $50,600 9. Degreciation was recorded for the year: $60.800 (85\% relates to foctory opecabions, and 15% relates to selling and administrative activities) h. Manufacturing overnead cost was applied to production. The company recorded 40.000 machine-hours for the yaar. 1. Goods that cost $487,200 to manufacture accoeding to their job cost sheets were transtorrod to the finished goods warehouse. j. Saies for the year totalied $721,000 and were all on accoint. The total cost to manulacture these 900d5 according to their job cost sheets was $481,000. 9. Depreciation was zecorded for the yoar $60,800 85% relates to fectory cperations, and 15% retales to sciling and adminiskrative activities) h. Manufactaring owerhead cost was applied to production. The compary recorded 40,000 machine-hours for the yeac 1. Goeds thst cast $487,200 to manulacture according to their job cest sheets were transferred to the finished goods warehoure. J. Soles for the year totalied $721000 and were all on account. The total cost to martulacture these goeds according to the ju job cost sheets was $481,000. Requireat: t. Prepare joumal entries to record the transactions given above. (Do not round intermedlate caiculations, If no entry is required for Wtransacticndevent, select "No joumal entry required" in the first account field) 2. Prepare T-accounts for inwontories, Manufacturing Oyerhead, and Cost of Goods Sold. Post relevant data from yout journal entries to these T-accounts (don't forget to enter the opening balances in your invontory accounts) Compute an ending balance in each. account. 3-a. Is manufacturing ovemead underappled or overapplied for the year? Underappled overhead Overapplied owerheed 3.b. Prepare a joumal entry to properly dispose of anty balance in the Manufacturing Overthead account. (Round your percentages and final answers to 2 decimal places. If no entry is required for a transaction/event. seiect "No joumal entry required? in the first account field.) Journal entry worksheet Record the entry to properly dispose of any belance in the Manufacturing Overhesd account. Mule: Enter debirs tefere creats. 4. Prepare an income statement for the year, (Do not round inteemediate calculations and round your final answers to neareat whole dollar amount.) favsten Company uses a job-order costing system, On January 1, the beginning of the curtent year, the compony's inventory balances were as follows: The company applies overhead cost to jobs on the basis of machine hours. For the current year, the company estimated that is would work 36,000 machine-hours and incur $155,160 in manufacturing overhead cost. The following transactians were recorded for the year: a. Row materials were purchased on account $203,000 b. Raw materials were requisitioned for use in productions $103,000 (800s drect and 205 indirect) c. The following costs were incurred for employee services: d. Heat, powec, and water costs were incurred in the factory: $42,600. E. Frepaid insurance expired during the year. $10.600 igosi telotes to factory operations, and ros relates to seling and administrative activities) L. Advertising costs were incurred, $50,600 9. Degreciation was recorded for the year: $60.800 (85\% relates to foctory opecabions, and 15% relates to selling and administrative activities) h. Manufacturing overnead cost was applied to production. The company recorded 40.000 machine-hours for the yaar. 1. Goods that cost $487,200 to manufacture accoeding to their job cost sheets were transtorrod to the finished goods warehouse. j. Saies for the year totalied $721,000 and were all on accoint. The total cost to manulacture these 900d5 according to their job cost sheets was $481,000. 9. Depreciation was zecorded for the yoar $60,800 85% relates to fectory cperations, and 15% retales to sciling and adminiskrative activities) h. Manufactaring owerhead cost was applied to production. The compary recorded 40,000 machine-hours for the yeac 1. Goeds thst cast $487,200 to manulacture according to their job cest sheets were transferred to the finished goods warehoure. J. Soles for the year totalied $721000 and were all on account. The total cost to martulacture these goeds according to the ju job cost sheets was $481,000. Requireat: t. Prepare joumal entries to record the transactions given above. (Do not round intermedlate caiculations, If no entry is required for Wtransacticndevent, select "No joumal entry required" in the first account field) 2. Prepare T-accounts for inwontories, Manufacturing Oyerhead, and Cost of Goods Sold. Post relevant data from yout journal entries to these T-accounts (don't forget to enter the opening balances in your invontory accounts) Compute an ending balance in each. account. 3-a. Is manufacturing ovemead underappled or overapplied for the year? Underappled overhead Overapplied owerheed 3.b. Prepare a joumal entry to properly dispose of anty balance in the Manufacturing Overthead account. (Round your percentages and final answers to 2 decimal places. If no entry is required for a transaction/event. seiect "No joumal entry required? in the first account field.) Journal entry worksheet Record the entry to properly dispose of any belance in the Manufacturing Overhesd account. Mule: Enter debirs tefere creats. 4. Prepare an income statement for the year, (Do not round inteemediate calculations and round your final answers to neareat whole dollar amount.)