Answered step by step

Verified Expert Solution

Question

1 Approved Answer

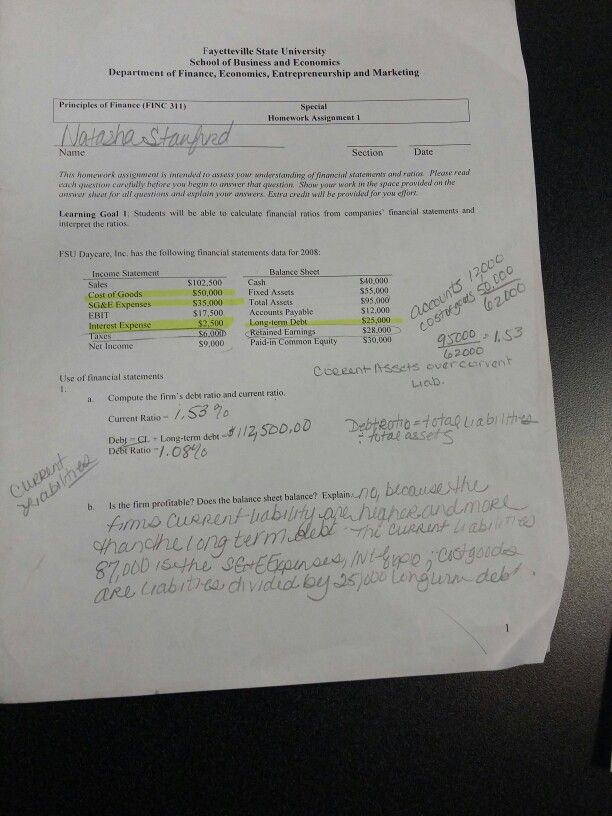

Fayetteville State University School of Business and Economics Department of Finance, Economies, Entrepreneurship and Marketing Principles of Finance (FINC 311) Special Homework Assignment 1 Name

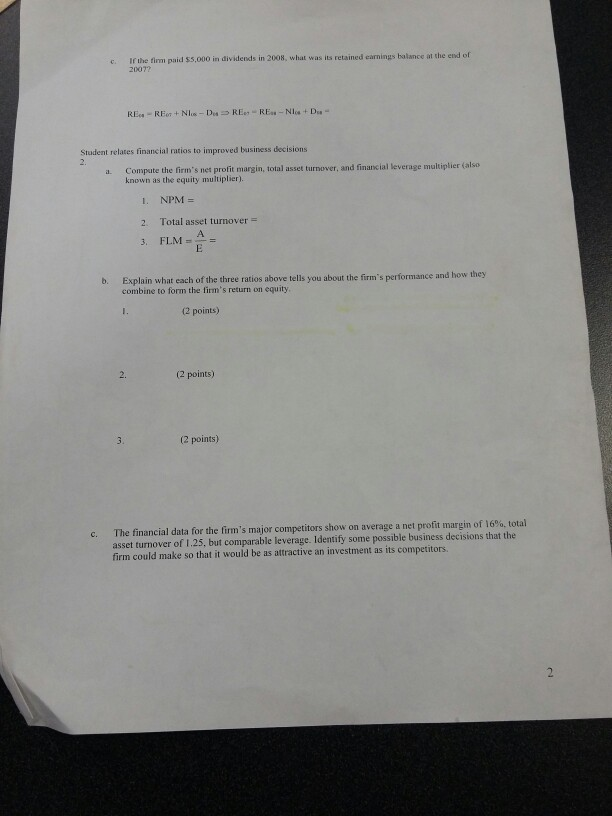

Fayetteville State University School of Business and Economics Department of Finance, Economies, Entrepreneurship and Marketing Principles of Finance (FINC 311) Special Homework Assignment 1 Name Section each question carefully hefore you begin to answer thar qwesrion. Show your work in the space pravided an the answer sheer for ali qwestions and explain your onswers. Extra credir wil be provided for you effort Learning Goal I: Sudents will be able to calculate financial ratios from companies financial satements and interpret the ratios FSU Daycare, Inc, has the following financial statemems data for 2008 Income Statement Sales Cost of Goods SG&E Expenses EBIT Interest Expense Balance Shoe coo 2t00 Talim50.000 Fainm C0,0000o IS3 540,000 $55,000 /2000 $35.000 $17,500 Fixed Assets Total Assets Accounts Payable $12,000 $2,500 Long-term Debt$25,000 Retained Earnings Paid-in Common Equity Net Incoms 59.00 92700 o 2000 Use of financial statements Compute the firm's debt ratio and current ratio Liab. a. Current Ratio De C. , Long-term dend//2SDD,OD Debi Ratio-/.08't6 Debtecto totaquab) : rh. :fotar assets b. Is the firm profitable? Doesthe balance sheet balance? Espai hanchelong tern ake,Uabitreas dwidd.busspi (ndum delef If the finm 20072 paid $5,000 in dividends in 2008, what was its retained earnings balance at the end of c. Student relates financial ratios to improved business decisions Compate the firm's net profit margin, total asset turnover, and financial leverage multiplier (also known as the equity multiplier) a. 1. NPM 2. Total asset turnover Explain what each of the three ratios above tells you about the firm's performance and combine to form the firm's return on equity b. how they (2 points) 2. (2 points) 3. (2 points) c. The financial data for the firm's major competitors show on average a net profit margin of 16% total asset turnover of 1.25, but comparable leverage. Identify some possible business decisions that the firm could make so that it would be as attractive an investment as its competitors. irthe firm paid SS,000 in dividends 2007 i, 2008, "h. w., remed"w, halas, a thr aid of c Student relates financial ratios to improved busianess decisions a Compute the firm's net profit margin, total asset tuarmover, and flieancial leverage multiplier (ahe known as the eqaity multiplie) L NPM- 2. Total asset turnover - b. Explain what each of the three ratios above tells you combine to form the firm's return on equity about the firm's performance and how they (2 points) (2 points) (2 points) 6% lotal The financial data for the firm's major competitors show on average a net profit margin of I c. asset turnover of 1.25, but comparable leverage. Identify some possible business decisions that the firm could make so that it would be as attractive an investment as its competitors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started