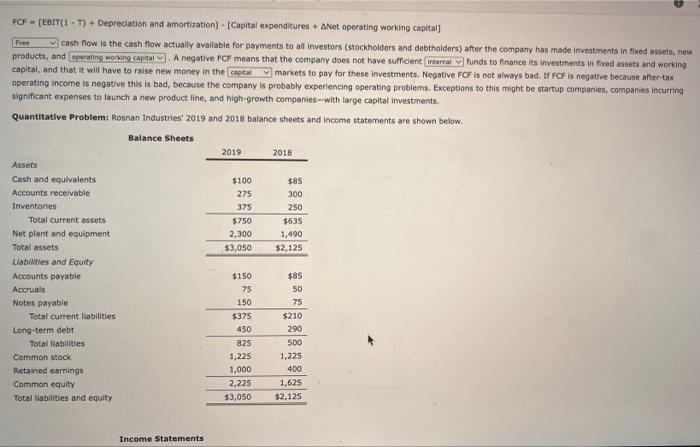

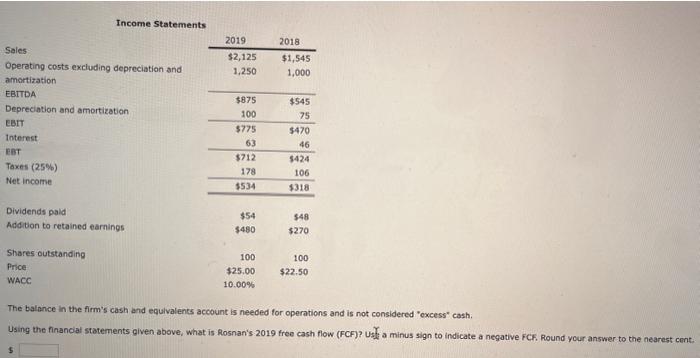

FCF=[ EBIT (1T)+ Depreciation and amortization] - [Capital expenditures + Avet operating working capital] cash fiow is the cash flow actually available for payments to all investors (stockholders and debtholders) after the company has made investments in fixed assets, new Preducts, and A negative FCF means that the company does not have ruficient funds to finance its investments in fixed assets and working capital, and that it will have to raise new money in the markets to pay for these investments. Negative FCF is not always bad. If FOF is negative because after-tax operating income is negative this is bad, because the company is probably experiencing operating problems, Exceptions to this might be startup companies, companies incurring significant expenses to launch a new product line, and bigh-growth companies-with large capital investenents. Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below: Income statements Income Statements The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash. Using the financial statements given above, what is fosnan's 2019 free cash flow (FCF)? Ust, a minus sign to indicate a negative FCF. Round your answer to the nearest cent. 5 FCF=[ EBIT (1T)+ Depreciation and amortization] - [Capital expenditures + Avet operating working capital] cash fiow is the cash flow actually available for payments to all investors (stockholders and debtholders) after the company has made investments in fixed assets, new Preducts, and A negative FCF means that the company does not have ruficient funds to finance its investments in fixed assets and working capital, and that it will have to raise new money in the markets to pay for these investments. Negative FCF is not always bad. If FOF is negative because after-tax operating income is negative this is bad, because the company is probably experiencing operating problems, Exceptions to this might be startup companies, companies incurring significant expenses to launch a new product line, and bigh-growth companies-with large capital investenents. Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below: Income statements Income Statements The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash. Using the financial statements given above, what is fosnan's 2019 free cash flow (FCF)? Ust, a minus sign to indicate a negative FCF. Round your answer to the nearest cent. 5