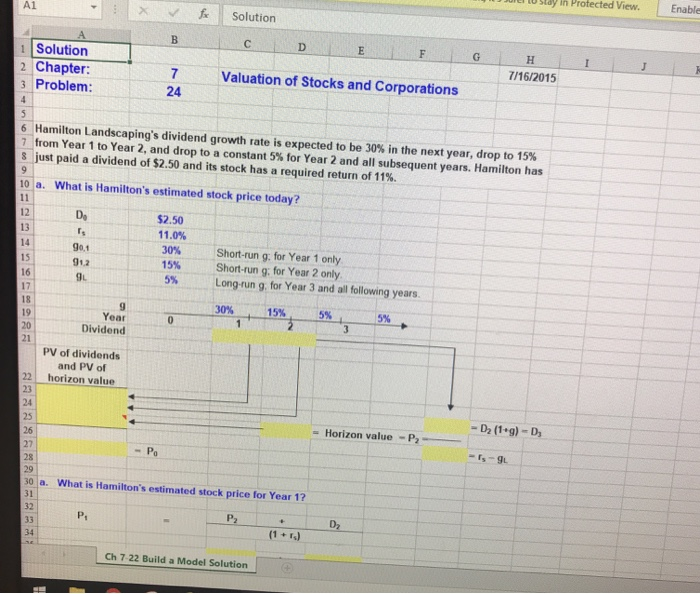

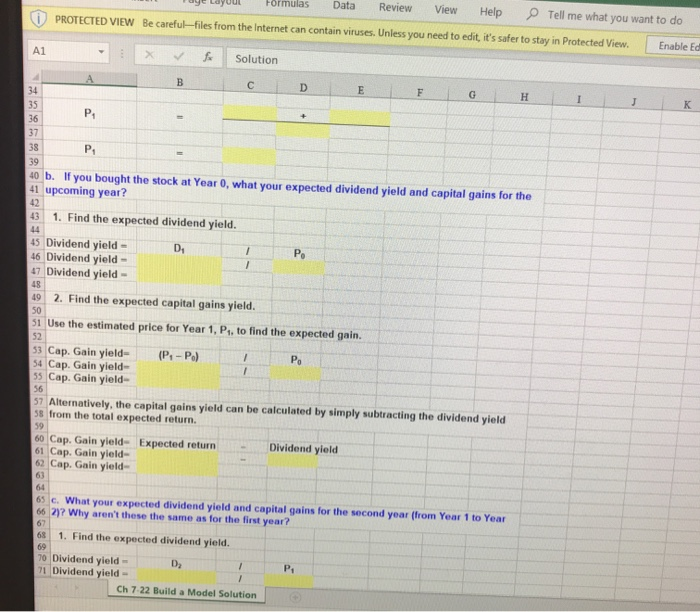

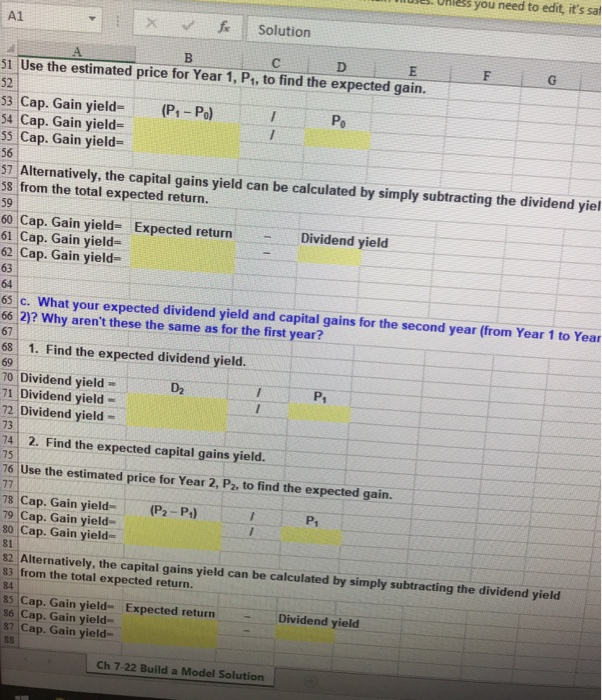

fe Solution CDEFGH 7/16/2015 Valuation of Stocks and Corporations 1 Solution 2 Chapter: 3 Problem: 7 24 6 Hamilton Landscaping's dividend growth rate is expected to be 30% in the next year, drop to 15% 7 from Year 1 to Year 2, and drop to a constant 5% for Year 2 and all subsequent years. Hamilton has just paid a dividend of $2.50 and its stock has a required return of 11%. 10 a. What is Hamilton's estimated stock price today? $2.50 11.0% 30% 154 5% Short-run g: for Year 1 only Short-run g: for Year 2 only Long-run g, for Year 3 and all following years Year Dividend PV of dividends and PV of horizon value 22 -D2 (1.) -D = Horizon value -P- -19 30 a. What is Hamilton's estimated stock price for Year 1? Ch 7-22 Build a Model Solution we cayout Formulas Data Review View Help Tell me what you want to do PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Ed Solution 40 b. If you bought the stock at Year 0, what your expected dividend yield and capital gains for the 41 upcoming year? 43 1. Find the expected dividend yield. 45 Dividend yield - 46 Dividend yield- 47 Dividend yield- 19 2. Find the expected capital gains yield. 51 Use the estimated price for Year 1, Pt. to find the expected gain. 53 Cap. Gain yield (P.-P.) 54 Cap. Gain yield- 55 Cap. Gain yield- 56 57 Alternatively, the capital gains yield can be calculated by simply subtracting the dividend yield 58 from the total expected return. Dividend yield 60 Cap. Gain yield- Expected return 61 Cap. Gain yield- 62 Cap. Gain yield- 64 65 c. What your expected dividend yield and capital gains for the second year (from Year 1 to Year 66 2)? Why aren't these the same as for the first year? 68 1. Find the expected dividend yield. 70 Dividend yield- D 71 Dividend yield- Ch 7-22 Build a Model Solution m e . Unles you need to edit, it's sal fx Solution D 51 Use the estimated price for Year 1, P4, to find the expected gain. 52 53 Cap. Gain yield (P1-P) 54 Cap. Gain yield 55 Cap. Gain yield- 56 57 Alternatively, the capital gains yield can be calculated by simply subtracting the dividend yiel 58 from the total expected return. 59 60 Cap. Gain yield= Expected return 61 Cap. Gain yield- 62 Cap. Gain yield- Dividend yield 63 64 65 c. What your expected dividend yield and capital gains for the second year (from Year 1 to Year 66 2)? Why aren't these the same as for the first year? 67 68 1. Find the expected dividend yield. 70 Dividend yield = 71 Dividend yield - 72 Dividend yield - 74 2. Find the expected capital gains yield. 75 76 Use the estimated price for Year 2, P. to find the expected gain. 77 78 Cap. Gain yield- 79 Cap. Gain yield- 80 Cap. Gain yield- (P2P) 81 82 Alternatively, the capital gains yield can be calculated by simply subtracting the dividend yield 83 from the total expected return. 84 85 Cap. Gain yield- Expected return 86 Cap. Gain yield- 87 Cap. Gain yield- - Dividend yield 88 Ch 7-22 Build a Model Solution