Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FEASIBLITY 1. Briefly explain, how the learnings from feasibility studies affect the procurement of projects. (10 Points) 2. Explain any two types of feasibility analysis.

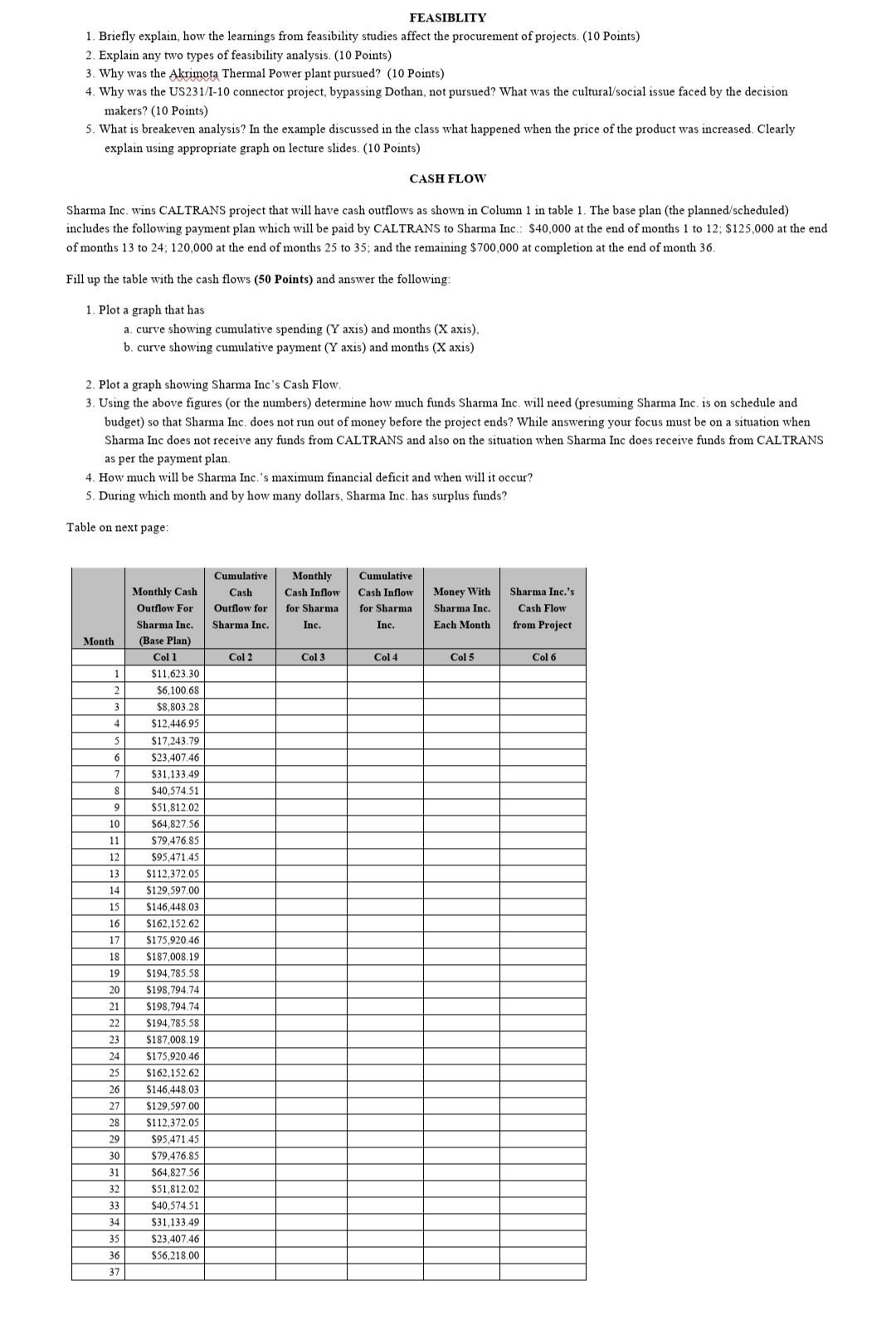

FEASIBLITY 1. Briefly explain, how the learnings from feasibility studies affect the procurement of projects. (10 Points) 2. Explain any two types of feasibility analysis. (10 Points) 3. Why was the Akrimota Thermal Power plant pursued? (10 Points) 4. Why was the US231/1-10 connector project, bypassing Dothan, not pursued? What was the cultural/social issue faced by the decision makers? (10 Points) 5. What is breakeven analysis? In the example discussed in the class what happened when the price of the product was increased. Clearly explain using appropriate graph on lecture slides. (10 Points) CASH FLOW Sharma Inc. wins CALTRANS project that will have cash outflows as shown in Column 1 in table 1. The base plan (the planned/scheduled) includes the following payment plan which will be paid by CALTRANS to Sharma Inc.: $40,000 at the end of months 1 to 12: S125,000 at the end of months 13 to 24; 120,000 at the end of months 25 to 35; and the remaining $ 700,000 at completion at the end of month 36. Fill up the table with the cash flows (50 Points) and answer the following: 1. Plot a graph that has a. curve showing cumulative spending (Y axis) and months (X axis), b. curve showing cumulative payment (Y axis) and months (X axis) 2. Plot a graph showing Sharma Inc's 3. Using the above figures (or the numbers) determine how much funds Sharma Inc. will need (presuming Sharma Inc. is on schedule and budget) so that Sharma Inc, does not run out of money before the project ends? While answering your focus must be on a situation when Sharma Inc does not receive any funds from CALTRANS and also on the situation when Sharma Inc does receive funds from CALTRANS as per the payment plan 4. How much will be Sharma Inc.'s maximum financial deficit and when will it occur? 5. During which month and by how many dollars, Sharma Inc. has surplus funds? Table on next page: Cumulative Cash Outflow for Sharma Inc. Monthly Cash Inflow for Sharma Inc. Cumulative Cash Inflow for Sharma Money With Sharma Inc. Each Month Sharma Inc.'s Cash Flow from Project Inc. Month Col2 Col 3 Col 4 Col 5 Col 6 1 2 3 4 S 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Monthly Cash Outflow For Sharma Inc. (Base Plan) Col 1 $11,623.30 $6,100.68 $8,803.28 $12,446.95 $17,243.79 $23,407.46 $31,133.49 $40,574.51 $51,812.02 $64.827.56 $79,476.85 $95,471.45 $112,372.05 $129,597,00 $146,448,03 $162,152.62 $175,920.46 $187.008.19 $194,785.58 $198,794.74 $198.794.74 $194,785.58 $187.008.19 $175,920.46 $162,152.62 $146,448,03 $129,597.00 $112.372.05 $95,471.45 $79.476.85 $64,827.56 $51,812.02 $40,574.51 $31,133.49 $23,407,46 $56,218.00 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 FEASIBLITY 1. Briefly explain, how the learnings from feasibility studies affect the procurement of projects. (10 Points) 2. Explain any two types of feasibility analysis. (10 Points) 3. Why was the Akrimota Thermal Power plant pursued? (10 Points) 4. Why was the US231/1-10 connector project, bypassing Dothan, not pursued? What was the cultural/social issue faced by the decision makers? (10 Points) 5. What is breakeven analysis? In the example discussed in the class what happened when the price of the product was increased. Clearly explain using appropriate graph on lecture slides. (10 Points) CASH FLOW Sharma Inc. wins CALTRANS project that will have cash outflows as shown in Column 1 in table 1. The base plan (the planned/scheduled) includes the following payment plan which will be paid by CALTRANS to Sharma Inc.: $40,000 at the end of months 1 to 12: S125,000 at the end of months 13 to 24; 120,000 at the end of months 25 to 35; and the remaining $ 700,000 at completion at the end of month 36. Fill up the table with the cash flows (50 Points) and answer the following: 1. Plot a graph that has a. curve showing cumulative spending (Y axis) and months (X axis), b. curve showing cumulative payment (Y axis) and months (X axis) 2. Plot a graph showing Sharma Inc's 3. Using the above figures (or the numbers) determine how much funds Sharma Inc. will need (presuming Sharma Inc. is on schedule and budget) so that Sharma Inc, does not run out of money before the project ends? While answering your focus must be on a situation when Sharma Inc does not receive any funds from CALTRANS and also on the situation when Sharma Inc does receive funds from CALTRANS as per the payment plan 4. How much will be Sharma Inc.'s maximum financial deficit and when will it occur? 5. During which month and by how many dollars, Sharma Inc. has surplus funds? Table on next page: Cumulative Cash Outflow for Sharma Inc. Monthly Cash Inflow for Sharma Inc. Cumulative Cash Inflow for Sharma Money With Sharma Inc. Each Month Sharma Inc.'s Cash Flow from Project Inc. Month Col2 Col 3 Col 4 Col 5 Col 6 1 2 3 4 S 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Monthly Cash Outflow For Sharma Inc. (Base Plan) Col 1 $11,623.30 $6,100.68 $8,803.28 $12,446.95 $17,243.79 $23,407.46 $31,133.49 $40,574.51 $51,812.02 $64.827.56 $79,476.85 $95,471.45 $112,372.05 $129,597,00 $146,448,03 $162,152.62 $175,920.46 $187.008.19 $194,785.58 $198,794.74 $198.794.74 $194,785.58 $187.008.19 $175,920.46 $162,152.62 $146,448,03 $129,597.00 $112.372.05 $95,471.45 $79.476.85 $64,827.56 $51,812.02 $40,574.51 $31,133.49 $23,407,46 $56,218.00 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started