Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Feast Ltd. (Feast) owns various famous restaurants across South Africa including Cuppa Chat, Wholesome and Delight. Each of these three famous restaurants of Feast currently

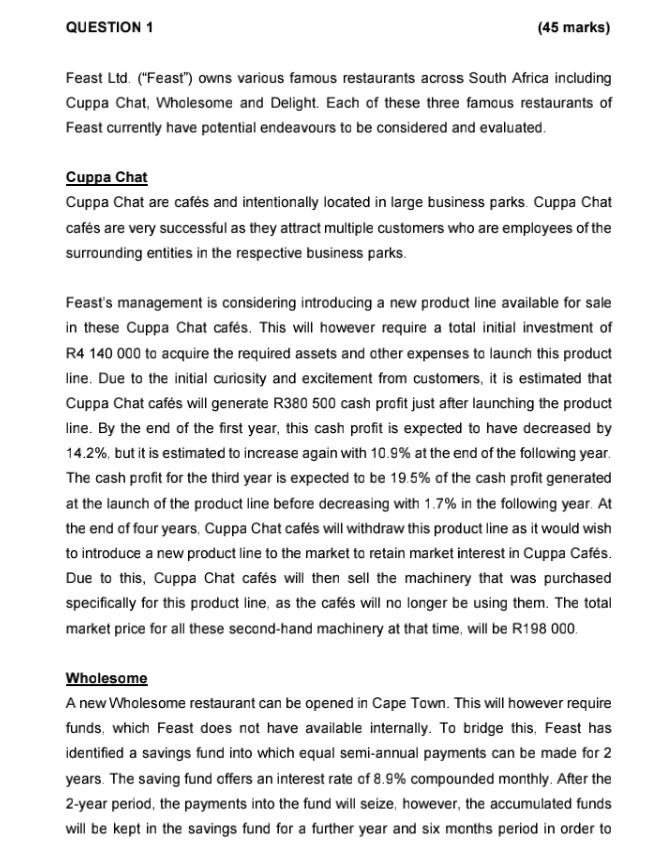

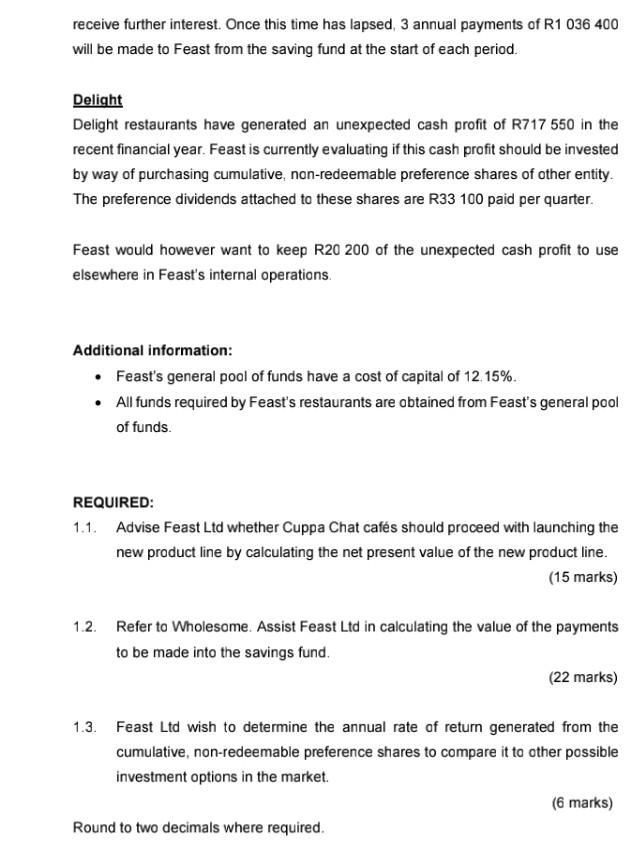

Feast Ltd. ("Feast") owns various famous restaurants across South Africa including Cuppa Chat, Wholesome and Delight. Each of these three famous restaurants of Feast currently have potential endeavours to be considered and evaluated. Cuppa Chat Cuppa Chat are cafs and intentionally located in large business parks. Cuppa Chat cafs are very successful as they attract multiple customers who are employees of the surrounding entities in the respective business parks. Feast's management is considering introducing a new product line available for sale in these Cuppa Chat cafs. This will however require a total initial investment of R4 140000 to acquire the required assets and other expenses to launch this product line. Due to the initial curiosity and excitement from customers, it is estimated that Cuppa Chat cafs will generate R380 500 cash profit just after launching the product line. By the end of the first year, this cash profit is expected to have decreased by 14.2%, but it is estimated to increase again with 10.9% at the end of the following year. The cash profit for the third year is expected to be 19.5% of the cash profit generated at the launch of the product line before decreasing with 1.7% in the following year. At the end of four years, Cuppa Chat cafes will withdraw this product line as it would wish to introduce a new product line to the market to retain market interest in Cuppa Cafs. Due to this, Cuppa Chat cafs will then sell the machinery that was purchased specifically for this product line, as the cafs will no longer be using them. The total market price for all these second-hand machinery at that time, will be R198 000 Wholesome A new Wholesome restaurant can be opened in Cape Town. This will however require funds, which Feast does not have available internally. To bridge this, Feast has identified a savings fund into which equal semi-annual payments can be made for 2 years. The saving fund offers an interest rate of 8.9% compounded monthly. After the 2-year period, the payments into the fund will seize, however, the accumulated funds will be kept in the savings fund for a further year and six months period in order to receive further interest. Once this time has lapsed, 3 annual payments of R1 036400 will be made to Feast from the saving fund at the start of each period. Delight Delight restaurants have generated an unexpected cash profit of R717550 in the recent financial year. Feast is currently evaluating if this cash profit should be invested by way of purchasing cumulative, non-redeemable preference shares of other entity. The preference dividends attached to these shares are R33 100 paid per quarter. Feast would however want to keep R20 200 of the unexpected cash profit to use elsewhere in Feast's internal operations. Additional information: - Feast's general pool of funds have a cost of capital of 12.15%. - All funds required by Feast's restaurants are obtained from Feast's general pool of funds. REQUIRED: 1.1. Advise Feast Ltd whether Cuppa Chat cafs should proceed with launching the new product line by calculating the net present value of the new product line. (15 marks) 1.2. Refer to Wholesome. Assist Feast Ltd in calculating the value of the payments to be made into the savings fund. (22 marks) 1.3. Feast Ltd wish to determine the annual rate of return generated from the cumulative, non-redeemable preference shares to compare it to other possible investment options in the market. (6 marks) Round to two decimals where required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started