Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information concerning Game Limited is presented to you: Game Limited is an independent producer of semi-finished and fabricated aluminum products. The directors

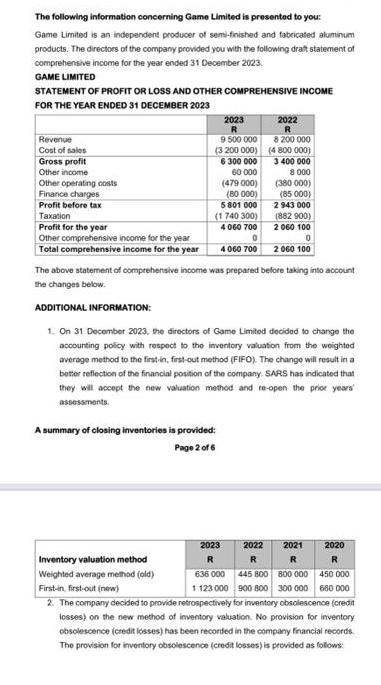

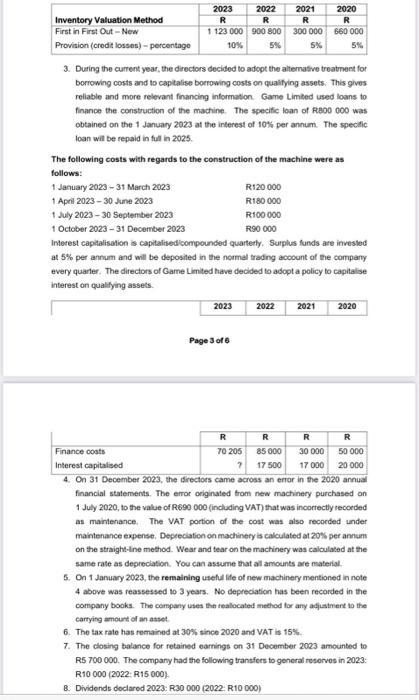

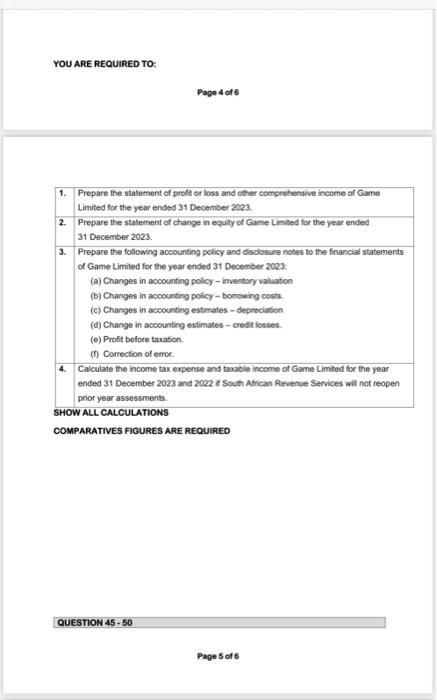

The following information concerning Game Limited is presented to you: Game Limited is an independent producer of semi-finished and fabricated aluminum products. The directors of the company provided you with the following draft statement of comprehensive income for the year ended 31 December 2023. GAME LIMITED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2023 Revenue Cost of sales Gross profit Other income Other operating costs Finance charges Profit before tax Taxation Profit for the year Other comprehensive income for the year Total comprehensive income for the year 2023 R 9 500 000 (3 200 000) 6 300 000 60 000 (479 000) (80 000) 5801 000 (1740 300) 4 060 700 0 4 060 700 A summary of closing inventories is provided: Page 2 of 6 The above statement of comprehensive income was prepared before taking into account the changes below. ADDITIONAL INFORMATION: 1. On 31 December 2023, the directors of Game Limited decided to change the accounting policy with respect to the inventory valuation from the weighted average method to the first-in, first-out method (FIFO). The change will result in a better reflection of the financial position of the company. SARS has indicated that they will accept the new valuation method and re-open the prior years assessments. 2022 R 8 200 000 (4 800 000) 3 400 000 000 8 (380 000) (85 000) 2 943 000 (882 900) 2 060 100 0 2 060 100 2022 R 2021 R 2023 R 636 000 445 800 1123 000 900 800 Inventory valuation method Weighted average method (old) First-in, first-out (new) 2. The company decided to provide retrospectively for inventory obsolescence (credit losses) on the new method of inventory valuation. No provision for inventory obsolescence (credit losses) has been recorded in the company financial records. The provision for inventory obsolescence (credit losses) is provided as follows: 2020 R 800 000 300 000 450 000 660 000 Inventory Valuation Method First in First Out-New Provision (credit losses) - percentage 2023 R 1 123 000 10% 2022 R 2023 900 800 5% 3. During the current year, the directors decided to adopt the alternative treatment for borrowing costs and to capitalise borrowing costs on qualifying assets. This gives reliable and more relevant financing information Game Limited used loans to finance the construction of the machine. The specific loan of R800 000 was obtained on the 1 January 2023 at the interest of 10% per annum. The specific loan will be repaid in full in 2025. Page 3 of 6 The following costs with regards to the construction of the machine were as follows: 1 January 2023-31 March 2023 1 April 2023-30 June 2023 1 July 2023-30 September 2023 1 October 2023-31 December 2023 R 70 205 7 2021 R 300 000 5% R120 000 R180 000 R100 000 R90 000 Interest capitalisation is capitalised/compounded quarterly. Surplus funds are invested at 5% per annum and will be deposited in the normal trading account of the company every quarter. The directors of Game Limited have decided to adopt a policy to capitalise interest on qualifying assets. 2020 R 660 000 5% 2022 2021 2020 R R Finance costs 85 000 30 000 50 000 Interest capitalised 17 000 17 500 20 000 4. On 31 December 2023, the directors came across an error in the 2020 annual financial statements. The error originated from new machinery purchased on 1 July 2020, to the value of R690 000 (including VAT) that was incorrectly recorded as maintenance. The VAT portion of the cost was also recorded under maintenance expense, Depreciation on machinery is calculated at 20% per annum on the straight-line method. Wear and tear on the machinery was calculated at the same rate as depreciation. You can assume that all amounts are material. 5. On 1 January 2023, the remaining useful life of new machinery mentioned in note 4 above was reassessed to 3 years. No depreciation has been recorded in the company books. The company uses the reallocated method for any adjustment to the carrying amount of an asset. 6. The tax rate has remained at 30% since 2020 and VAT is 15%. 7. The closing balance for retained earnings on 31 December 2023 amounted to R5 700 000. The company had the following transfers to general reserves in 2023: R10 000 (2022: R15 000). 8. Dividends declared 2023: R30 000 (2022: R10 000) YOU ARE REQUIRED TO: Page 4 of 6 1. Prepare the statement of profit or loss and other comprehensive income of Game Limited for the year ended 31 December 2023. 2. Prepare the statement of change in equity of Game Limited for the year ended 31 December 2023. 3. Prepare the following accounting policy and disclosure notes to the financial statements of Game Limited for the year ended 31 December 2023 (a) Changes in accounting policy-inventory valuation (b) Changes in accounting policy-bomowing costs. (c) Changes in accounting estimates-depreciation (d) Change in accounting estimates-credit losses. (e) Profit before taxation (1) Correction of error. Calculate the income tax expense and taxable income of Game Limited for the year ended 31 December 2023 and 2022 if South African Revenue Services will not reopen prior year assessments. SHOW ALL CALCULATIONS COMPARATIVES FIGURES ARE REQUIRED QUESTION 45-50 Page 5 of 6

Step by Step Solution

★★★★★

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare the statement of profit or loss and other comprehensive income of Game Limited for the year ended 31 December 2023 Here is the statement of profit or loss and other comprehensive income for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started