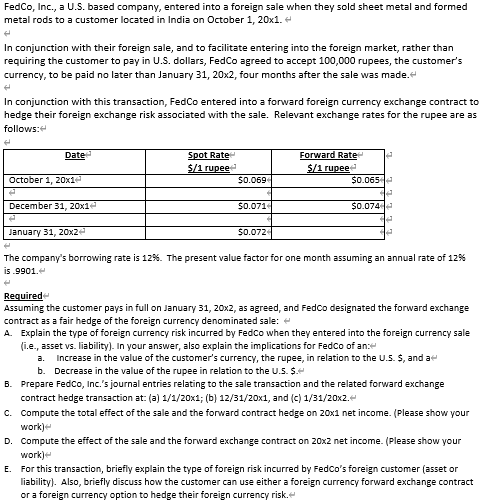

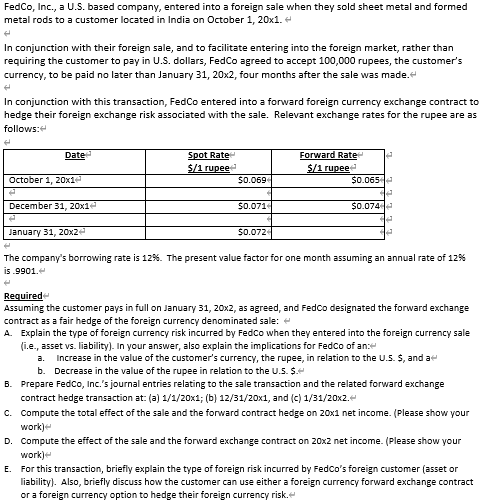

FedCo, Inc., a U.S. based company, entered into a foreign sale when they sold sheet metal and formed metal rods to a customer located in India on October 1, 20x1. In conjunction with their foreign sale, and to facilitate entering into the foreign market, rather than requiring the customer to pay in U.S. dollars, Fedco agreed to accept 100,000 rupees, the customer's currency, to be paid no later than January 31, 20x2, four months after the sale was made. In conjunction with this transaction, FedCo entered into a forward foreign currency exchange contract to hedge their foreign exchange risk associated with the sale. Relevant exchange rates for the rupee are as follows: Date Spot Rate $/1 rupee Forward Rate la 5/1 rupee $0.065 October 1, 20x1 $0.069 December 31, 20x1 5 0.071 $0.074 January 31, 20x2 50.072 The company's borrowing rate is 12%. The present value factor for one month assuming an annual rate of 12% is.9901. Required Assuming the customer pays in full on January 31, 20x2, as agreed, and Fedco designated the forward exchange contract as a fair hedge of the foreign currency denominated sale: A. Explain the type of foreign currency risk incurred by Fedco when they entered into the foreign currency sale (ie, asset vs. liability) in your answer, also explain the implications for Fedco of an a. Increase in the value of the customer's currency, the rupee, in relation to the U.S. 5, and a b. Decrease in the value of the rupee in relation to the U.S. $. B. Prepare Fedco, Inc.'s journal entries relating to the sale transaction and the related forward exchange contract hedge transaction at: (a) 1/1/20x1; (b) 12/31/20x1, and (c) 1/31/20x2. C. Compute the total effect of the sale and the forward contract hedge on 20xi net income. (Please show your work) Compute the effect of the sale and the forward exchange contract on 20x2 net income. (Please show your work) E For this transaction, briefly explain the type of foreign risk incurred by Fedco's foreign customer (asset or liability). Also, briefly discuss how the customer can use either a foreign currency forward exchange contract or a foreign currency option to hedge their foreign currency risk. FedCo, Inc., a U.S. based company, entered into a foreign sale when they sold sheet metal and formed metal rods to a customer located in India on October 1, 20x1. In conjunction with their foreign sale, and to facilitate entering into the foreign market, rather than requiring the customer to pay in U.S. dollars, Fedco agreed to accept 100,000 rupees, the customer's currency, to be paid no later than January 31, 20x2, four months after the sale was made. In conjunction with this transaction, FedCo entered into a forward foreign currency exchange contract to hedge their foreign exchange risk associated with the sale. Relevant exchange rates for the rupee are as follows: Date Spot Rate $/1 rupee Forward Rate la 5/1 rupee $0.065 October 1, 20x1 $0.069 December 31, 20x1 5 0.071 $0.074 January 31, 20x2 50.072 The company's borrowing rate is 12%. The present value factor for one month assuming an annual rate of 12% is.9901. Required Assuming the customer pays in full on January 31, 20x2, as agreed, and Fedco designated the forward exchange contract as a fair hedge of the foreign currency denominated sale: A. Explain the type of foreign currency risk incurred by Fedco when they entered into the foreign currency sale (ie, asset vs. liability) in your answer, also explain the implications for Fedco of an a. Increase in the value of the customer's currency, the rupee, in relation to the U.S. 5, and a b. Decrease in the value of the rupee in relation to the U.S. $. B. Prepare Fedco, Inc.'s journal entries relating to the sale transaction and the related forward exchange contract hedge transaction at: (a) 1/1/20x1; (b) 12/31/20x1, and (c) 1/31/20x2. C. Compute the total effect of the sale and the forward contract hedge on 20xi net income. (Please show your work) Compute the effect of the sale and the forward exchange contract on 20x2 net income. (Please show your work) E For this transaction, briefly explain the type of foreign risk incurred by Fedco's foreign customer (asset or liability). Also, briefly discuss how the customer can use either a foreign currency forward exchange contract or a foreign currency option to hedge their foreign currency risk