Answered step by step

Verified Expert Solution

Question

1 Approved Answer

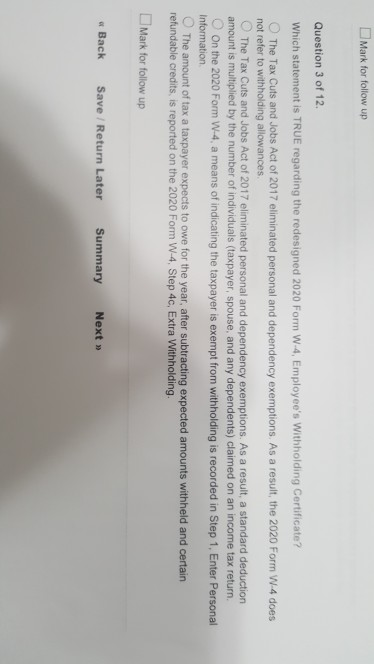

federal income tax question Mark for follow up Question 3 of 12 Which statement is TRUE regarding the redesigned 2020 Form W.4, Employee's Withholding Certificate?

federal income tax question

Mark for follow up Question 3 of 12 Which statement is TRUE regarding the redesigned 2020 Form W.4, Employee's Withholding Certificate? The Tax Cuts and Jobs Act of 2017 eliminated personal and dependency exemptions. As a result, the 2020 Form W4 does not refer to withholding allowances. The Tax Cuts and Jobs Act of 2017 eliminated personal and dependency exemptions. As a result, a standard deduction amount is multiplied by the number of individuals (taxpayer, spouse, and any dependents) claimed on an income tax return On the 2020 Form W-4, a means of indicating the taxpayer is exempt from withholding is recorded in Step 1. Enter Personal Information The amount of tax a taxpayer expects to owe for the year after subtracting expected amounts withheld and certain refundable credits, is reported on the 2020 Form W-4, Step 4c, Extra Withholding Mark for follow up Back Save / Return Later Summary Next >>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started