Answered step by step

Verified Expert Solution

Question

1 Approved Answer

federal income tax question Question 10 of 15. Hailee makes the following contributions in 2019 (all of which she can substantiate): Goodwill, clothing she bought

federal income tax question

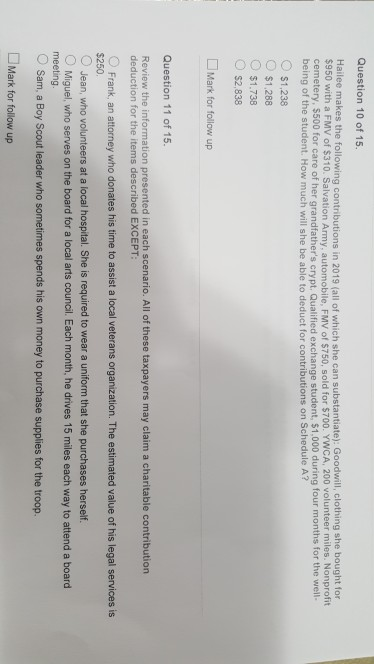

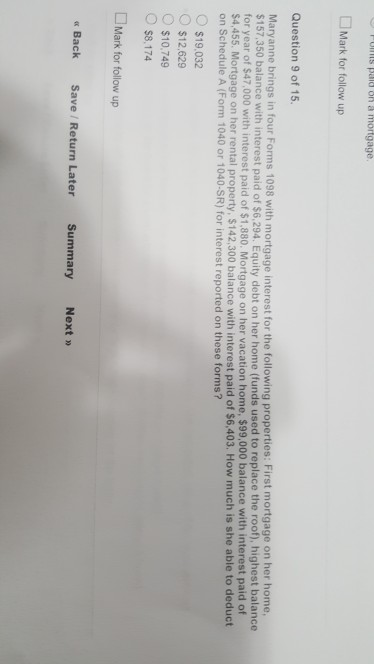

Question 10 of 15. Hailee makes the following contributions in 2019 (all of which she can substantiate): Goodwill, clothing she bought for $950 with a FMV of $310. Salvation Army, automobile, FMV of $750, sold for $700. YWCA, 200 volunteer miles. Nonprofit cemetery, $500 for care of her grandfather's crypt, Qualified exchange student, $1,000 during four months for the well. being of the student. How much will she be able to deduct for contributions on Schedule A? $1,238 $1.288 $1.738 $2,838 Mark for follow up Question 11 of 15. Review the information presented in each scenario. All of these taxpayers may claim a charitable contribution deduction for the items described EXCEPT: Frank, an attorney who donates his time to assist a local veterans organization. The estimated value of his legal services is $250 Jean, who volunteers at a local hospital. She is required to wear a uniform that she purchases herself. Miguel, who serves on the board for a local arts council. Each month, he drives 15 miles each way to attend a board meeting Sam, a Boy Scout leader who sometimes spends his own money to purchase supplies for the troop. Mark for follow up PUMS paid on a mortgage Mark for follow up Question 9 of 15. Maryanne brings in four Forms 1098 with mortgage interest for the following properties: First mortgage on her home, $157,350 balance with interest paid of $6,294. Equity debt on her home (funds used to replace the roof), highest balance for year of $47,000 with interest paid of $1,880. Mortgage on her vacation home, $99,000 balance with interest paid of $4,455. Mortgage on her rental property, $142,300 balance with interest paid of $6,403. How much is she able to deduct on Schedule A (Form 1040 or 1040-SR) for interest reported on these forms? $19.032 $12,629 $10.749 $8.174 Mark for follow up Back Save / Return Later Summary Next >>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started