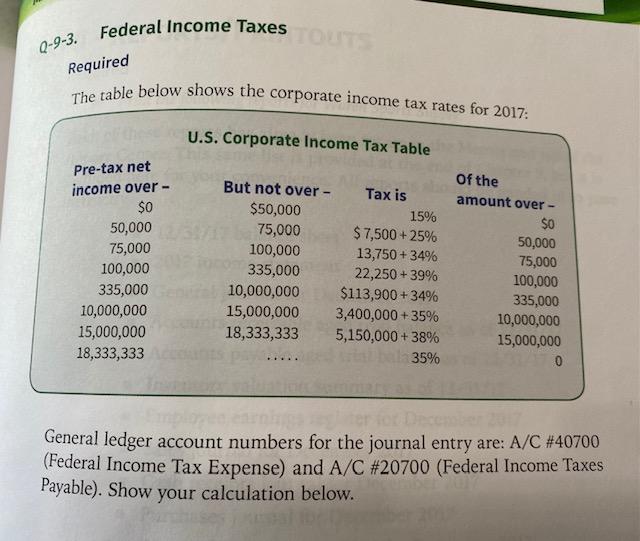

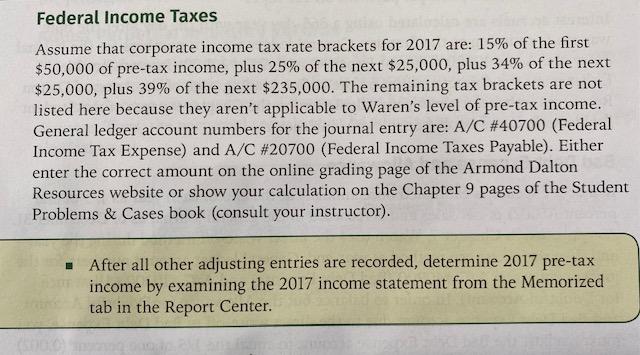

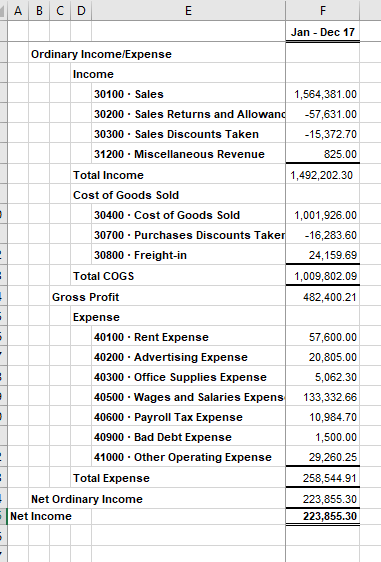

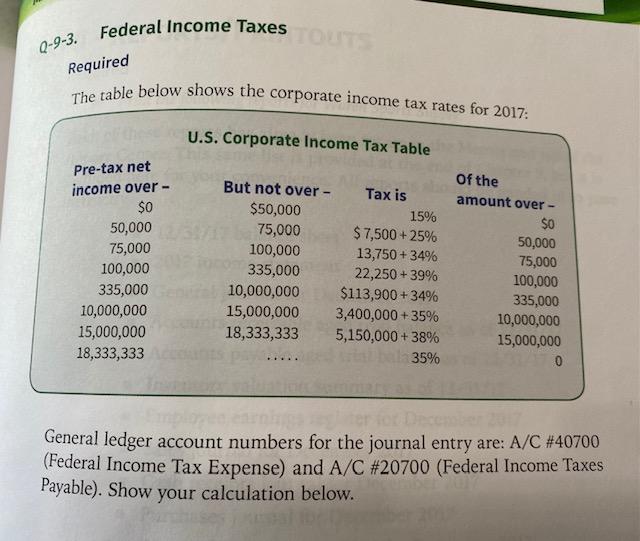

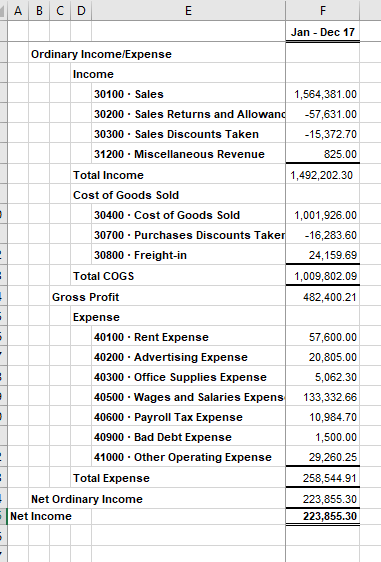

Federal Income Taxes 0-9-3. Required The table below shows the corporate income tax rates for 2017: U.S. Corporate Income Tax Table Pre-tax net income over- $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 But not over- $50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 Taxis 15% $ 7,500 + 25% 13,750 +34% 22,250 + 39% $113,900 +34% 3,400,000 + 35% 5,150,000+ 38% 35% Of the amount over- $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 0 General ledger account numbers for the journal entry are: A/C #40700 (Federal Income Tax Expense) and A/C #20700 (Federal Income Taxes Payable). Show your calculation below. Federal Income Taxes Assume that corporate income tax rate brackets for 2017 are: 15% of the first $50,000 of pre-tax income, plus 25% of the next $25,000, plus 34% of the next $25,000, plus 39% of the next $235,000. The remaining tax brackets are not listed here because they aren't applicable to Waren's level of pre-tax income. General ledger account numbers for the journal entry are: A/C #40700 (Federal Income Tax Expense) and A/C #20700 (Federal Income Taxes Payable). Either enter the correct amount on the online grading page of the Armond Dalton Resources website or show your calculation on the Chapter 9 pages of the Student Problems & Cases book (consult your instructor). . After all other adjusting entries are recorded, determine 2017 pre-tax income by examining the 2017 income statement from the Memorized tab in the Report Center. A B C D E F Jan - Dec 17 Ordinary Income/Expense Income 30100 - Sales 1,564,381.00 30200 - Sales Returns and Allowanc -57,631.00 30300. Sales Discounts Taken -15,372.70 31200 - Miscellaneous Revenue 825.00 Total Income 1,492,202.30 Cost of Goods Sold 30400 - Cost of Goods Sold 1,001,926.00 30700 - Purchases Discounts Taker -16,283.60 30800. Freight-in 24,159.69 Total COGS 1,009,802.09 Gross Profit 482,400.21 Expense 40100 Rent Expense 57,600.00 40200. Advertising Expense 20,805.00 40300. Office Supplies Expense 5,062.30 40500. Wages and Salaries Expens 133,332.66 40600. Payroll Tax Expense 10,984.70 40900 - Bad Debt Expense 1,500.00 - 41000. Other Operating Expense 29,260.25 Total Expense 258,544.91 Net Ordinary Income 223,855.30 Net Income 223,855.30 . - Federal Income Taxes 0-9-3. Required The table below shows the corporate income tax rates for 2017: U.S. Corporate Income Tax Table Pre-tax net income over- $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 But not over- $50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 Taxis 15% $ 7,500 + 25% 13,750 +34% 22,250 + 39% $113,900 +34% 3,400,000 + 35% 5,150,000+ 38% 35% Of the amount over- $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 0 General ledger account numbers for the journal entry are: A/C #40700 (Federal Income Tax Expense) and A/C #20700 (Federal Income Taxes Payable). Show your calculation below. Federal Income Taxes Assume that corporate income tax rate brackets for 2017 are: 15% of the first $50,000 of pre-tax income, plus 25% of the next $25,000, plus 34% of the next $25,000, plus 39% of the next $235,000. The remaining tax brackets are not listed here because they aren't applicable to Waren's level of pre-tax income. General ledger account numbers for the journal entry are: A/C #40700 (Federal Income Tax Expense) and A/C #20700 (Federal Income Taxes Payable). Either enter the correct amount on the online grading page of the Armond Dalton Resources website or show your calculation on the Chapter 9 pages of the Student Problems & Cases book (consult your instructor). . After all other adjusting entries are recorded, determine 2017 pre-tax income by examining the 2017 income statement from the Memorized tab in the Report Center. A B C D E F Jan - Dec 17 Ordinary Income/Expense Income 30100 - Sales 1,564,381.00 30200 - Sales Returns and Allowanc -57,631.00 30300. Sales Discounts Taken -15,372.70 31200 - Miscellaneous Revenue 825.00 Total Income 1,492,202.30 Cost of Goods Sold 30400 - Cost of Goods Sold 1,001,926.00 30700 - Purchases Discounts Taker -16,283.60 30800. Freight-in 24,159.69 Total COGS 1,009,802.09 Gross Profit 482,400.21 Expense 40100 Rent Expense 57,600.00 40200. Advertising Expense 20,805.00 40300. Office Supplies Expense 5,062.30 40500. Wages and Salaries Expens 133,332.66 40600. Payroll Tax Expense 10,984.70 40900 - Bad Debt Expense 1,500.00 - 41000. Other Operating Expense 29,260.25 Total Expense 258,544.91 Net Ordinary Income 223,855.30 Net Income 223,855.30