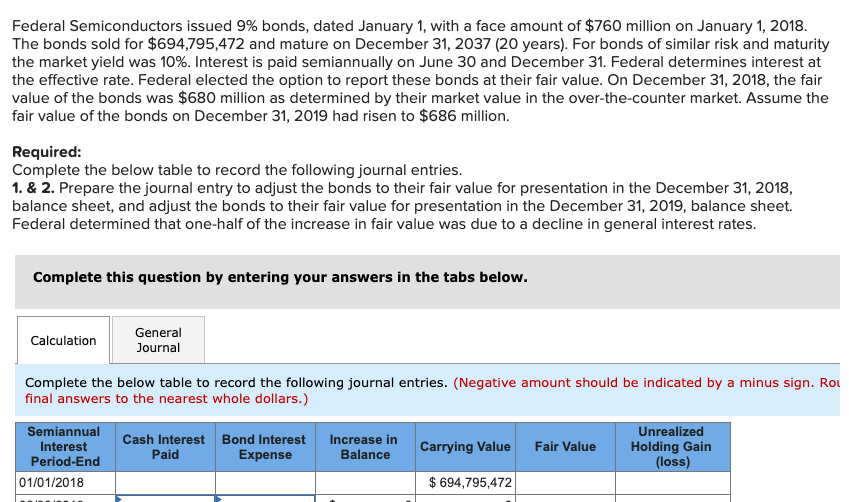

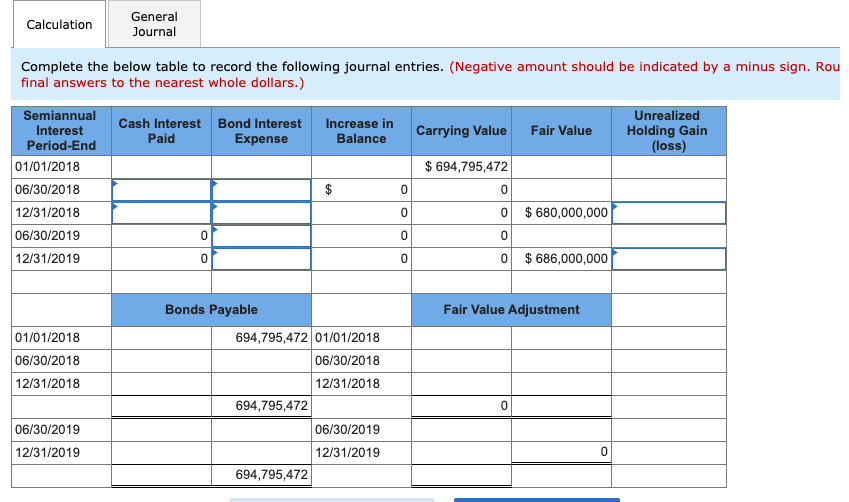

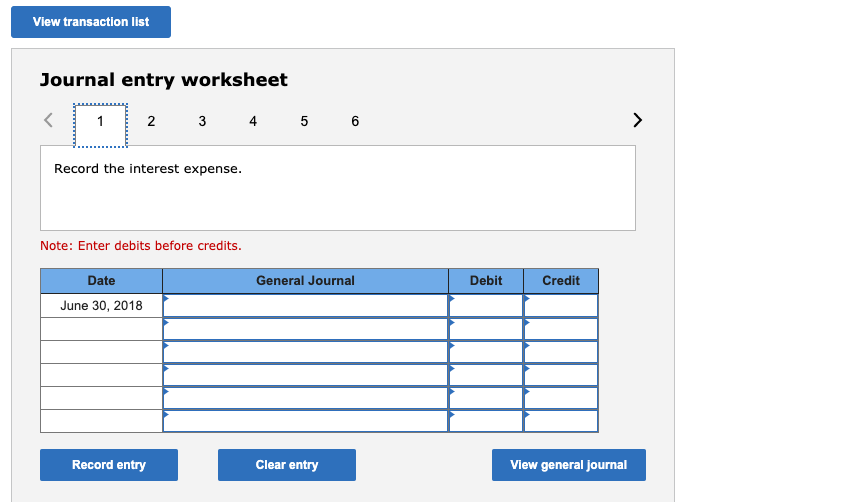

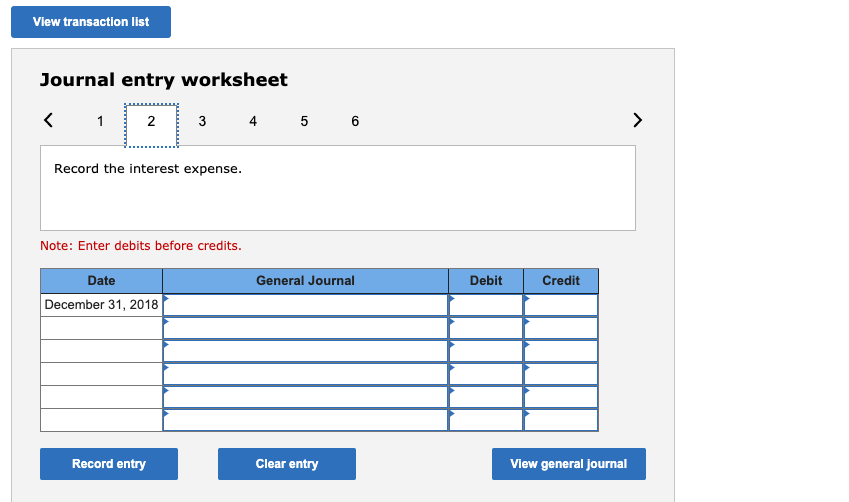

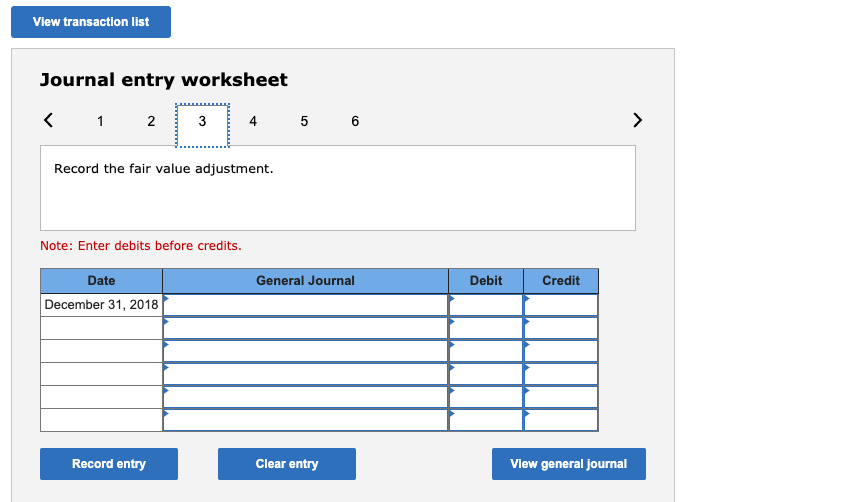

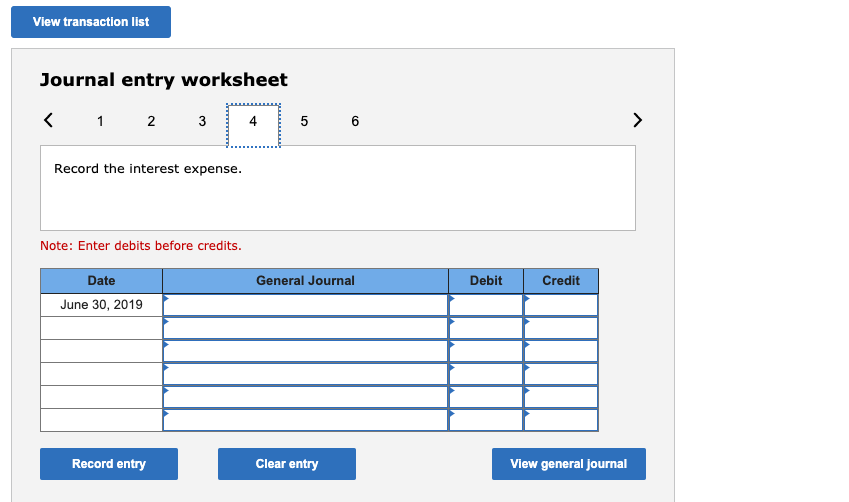

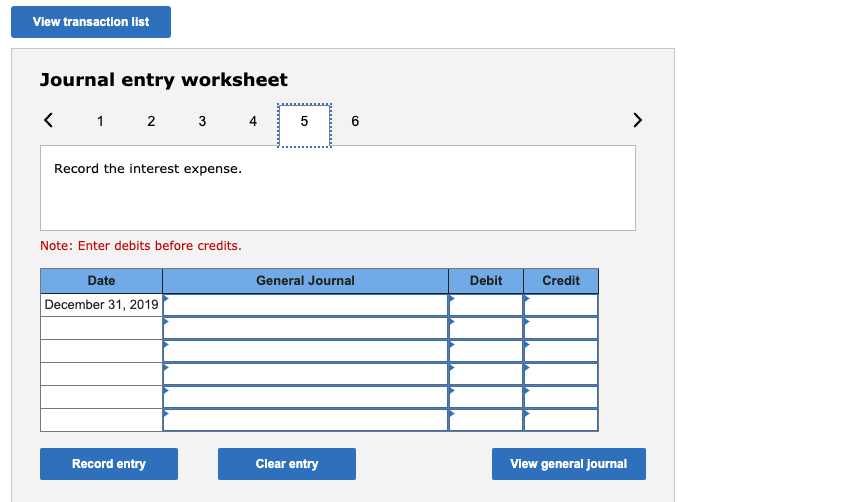

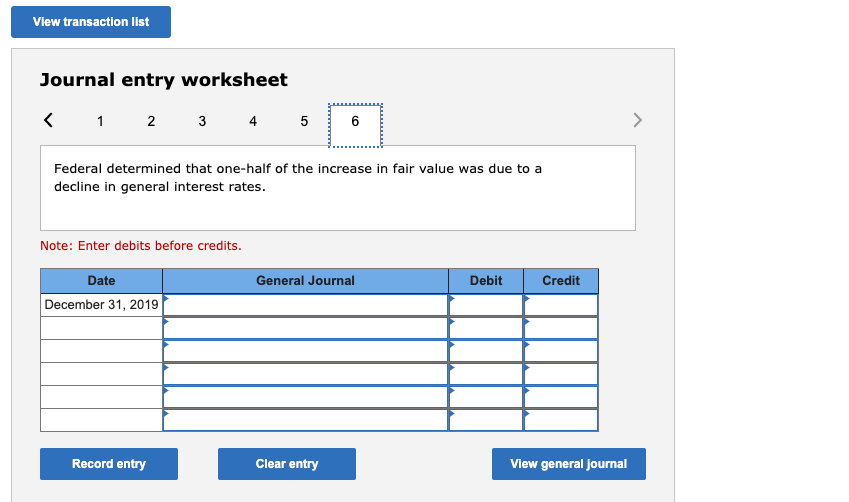

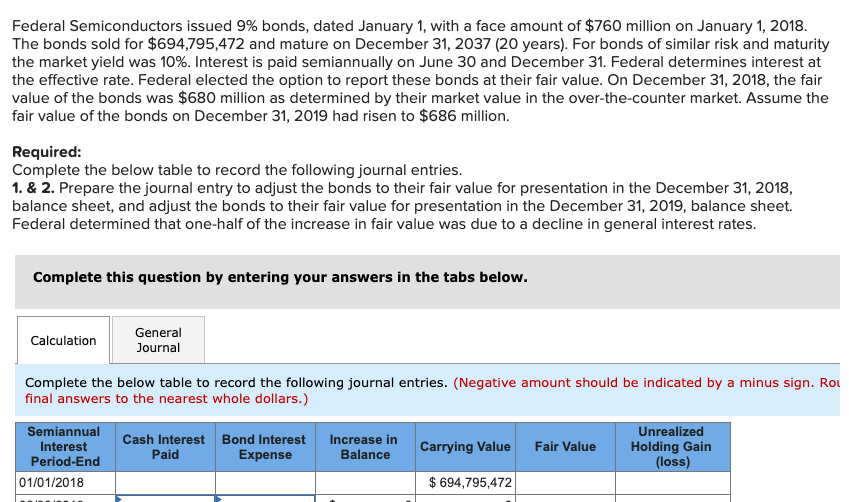

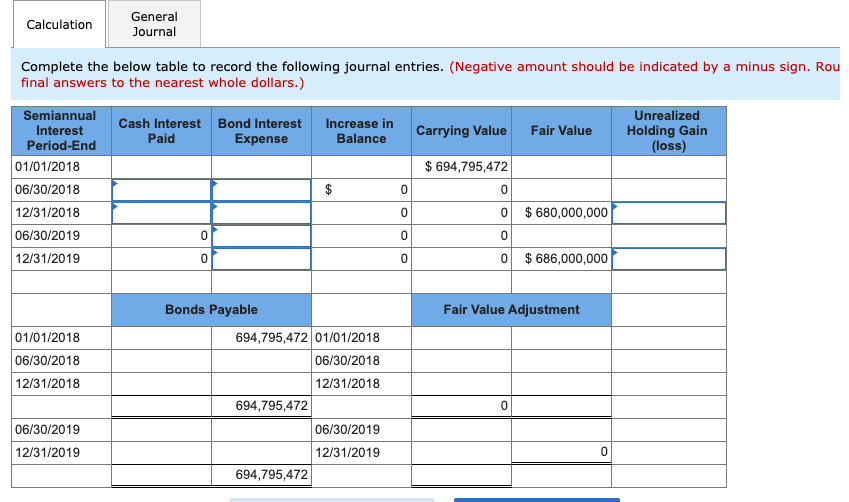

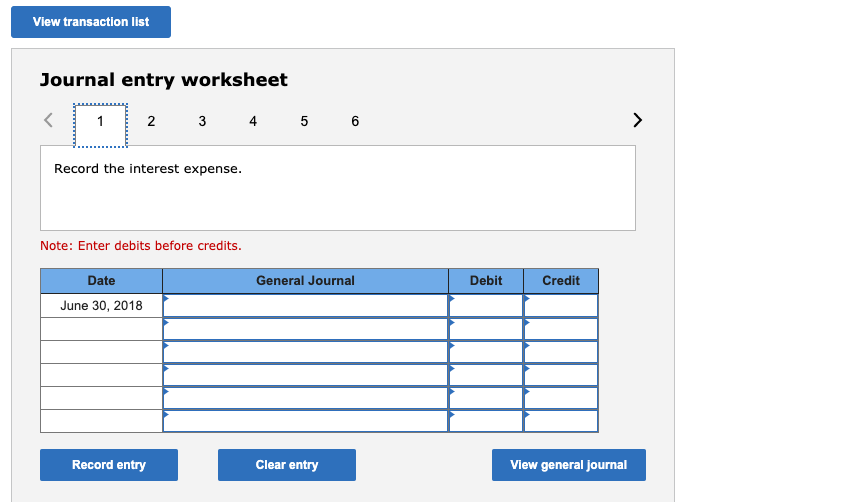

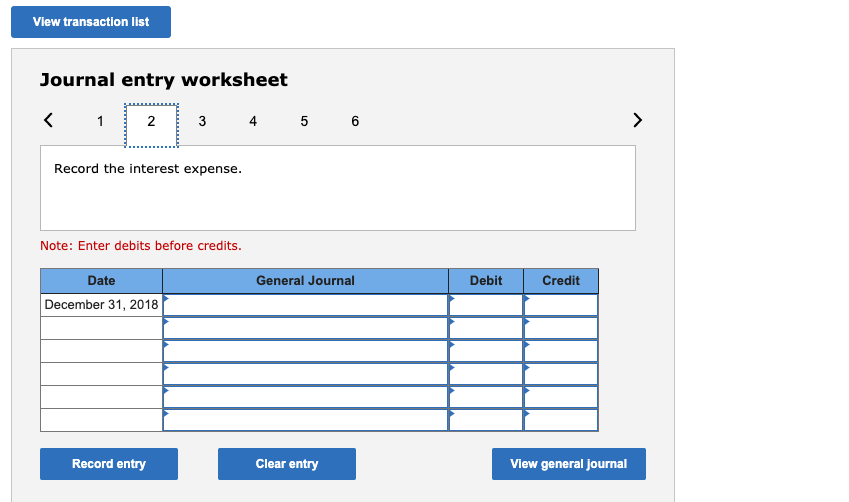

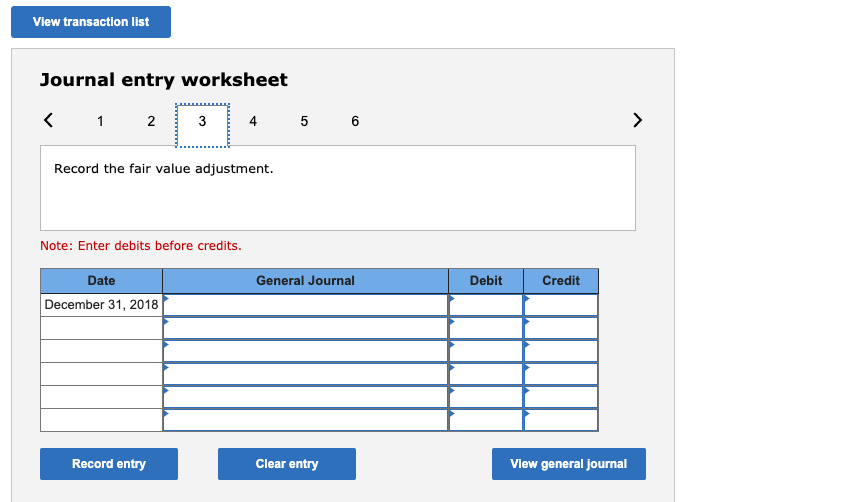

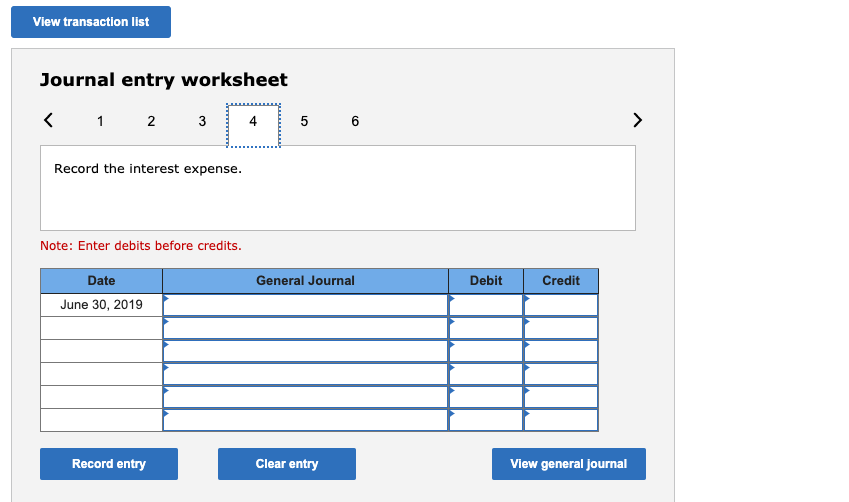

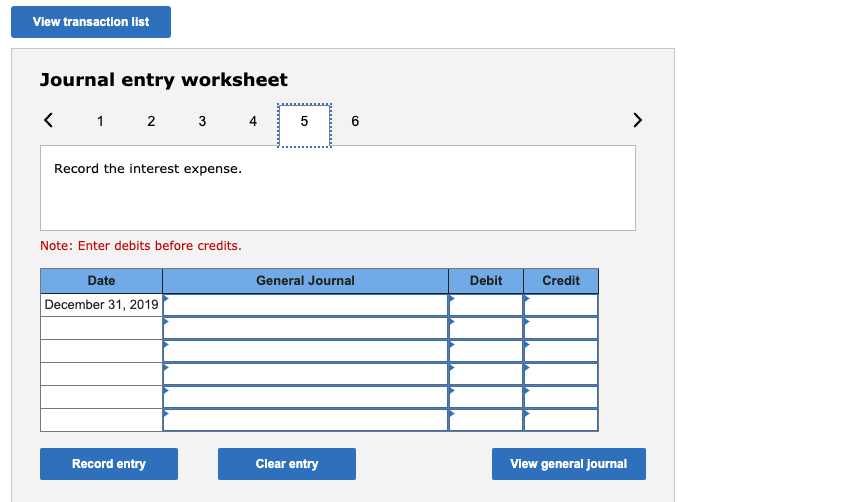

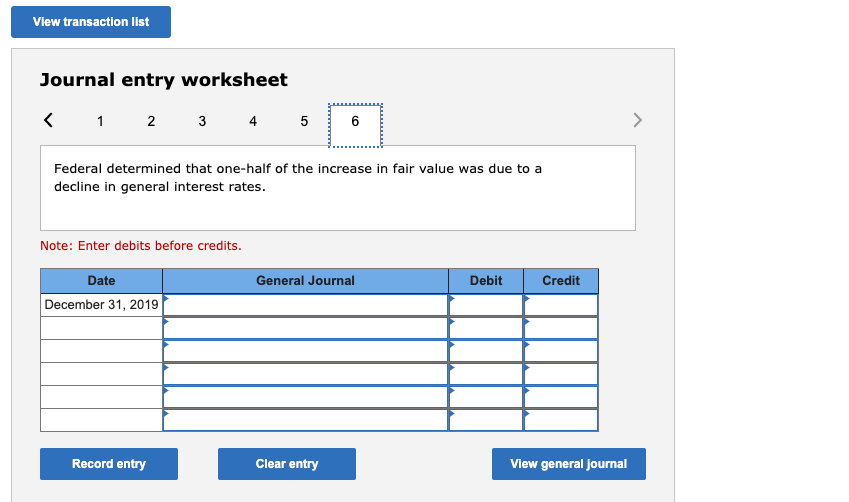

Federal Semiconductors issued 9% bonds, dated January 1, with a face amount of $760 million on January 1, 2018. The bonds sold for $694,795,472 and mature on December 31, 2037 (20 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. Federal determines interest at the effective rate. Federal elected the option to report these bonds at their fair value. On December 31, 2018, the fair value of the bonds was $680 million as determined by their market value in the over-the-counter market. Assume the fair value of the bonds on December 31, 2019 had risen to $686 million. Required: Complete the below table to record the following journal entries. 1. & 2. Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet, and adjust the bonds to their fair value for presentation in the December 31, 2019, balance sheet. Federal determined that one-half of the increase in fair value was due to a decline in general interest rates. Complete this question by entering your answers in the tabs below. Calculation General Journal Complete the below table to record the following journal entries. (Negative amount should be indicated by a minus sign. Rou final answers to the nearest whole dollars.) Semiannual Interest Period-End 01/01/2018 Cash Interest Bond Interest Paid Expense Increase in Balance Fair Value Carrying Value Unrealized Holding Gain (loss) $ 694,795,472 Calculation General Journal Complete the below table to record the following journal entries. (Negative amount should be indicated by a minus sign. Rou final answers to the nearest whole dollars.) Semiannual Interest Cash Interest Bond Interest Unrealized Increase in Carrying Value Paid Period-End Balance Expense Fair Value Holding Gain (loss) 01/01/2018 $ 694,795,472 06/30/2018 0 12/31/2018 0 0 $ 680,000,000 06/30/2019 0 0 12/31/2019 0 0 $ 686,000,000 0 0 Fair Value Adjustment 01/01/2018 06/30/2018 12/31/2018 Bonds Payable 694,795,472 01/01/2018 06/30/2018 12/31/2018 694,795,472 06/30/2019 12/31/2019 694,795,472 0 06/30/2019 12/31/2019 0 View transaction list Journal entry worksheet 1 2 3 4 5 6 > Record the interest expense. Note: Enter debits before credits. General Journal Debit Credit Date June 30, 2018 Record entry Clear entry View general Journal View transaction list Journal entry worksheet 1 2 3 4 5 6 > Record the interest expense. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2018 Record entry Clear entry View general Journal View transaction list Journal entry worksheet 1 2 3 4 5 6 > Record the fair value adjustment. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2018 Record entry Clear entry View general Journal View transaction list Journal entry worksheet 1 2 3 4 5 6 > Record the interest expense. Note: Enter debits before credits. General Journal Debit Credit Date June 30, 2019 Record entry Clear entry View general Journal View transaction list Journal entry worksheet 1 2 3 4 5 6 6 > Record the interest expense. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2019 Record entry Clear entry View general Journal View transaction list Journal entry worksheet 1 2 3 4 5 6 6 > Federal determined that one-half of the increase in fair value was due to a decline in general interest rates. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2019 Record entry Clear entry View general Journal