Answered step by step

Verified Expert Solution

Question

1 Approved Answer

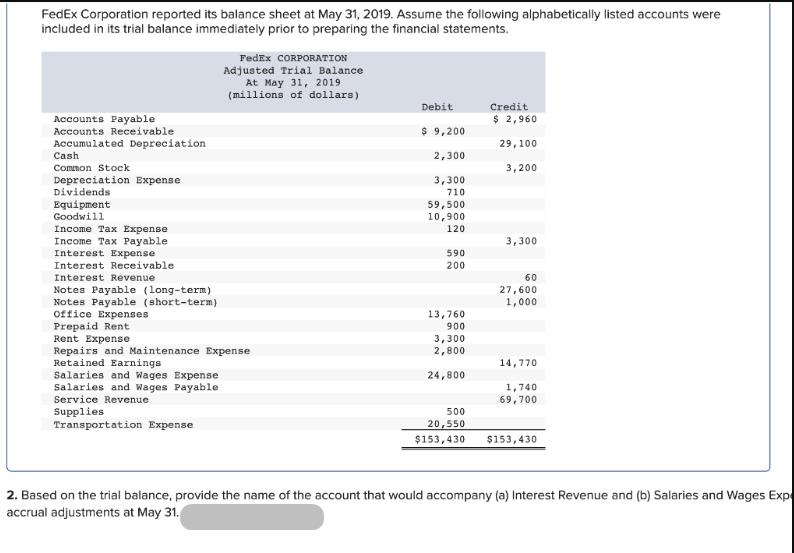

FedEx Corporation reported its balance sheet at May 31, 2019. Assume the following alphabetically listed accounts were included in its trial balance immediately prior

FedEx Corporation reported its balance sheet at May 31, 2019. Assume the following alphabetically listed accounts were included in its trial balance immediately prior to preparing the financial statements. FedEx CORPORATION Adjusted Trial Balance At May 31, 2019 (millions of dollars) Accounts Payable Accounts Receivable. Accumulated Depreciation Cash Common Stock Depreciation Expense Dividends Equipment Goodwill Income Tax Expense Income Tax Payable Interest Expense Interest Receivable Interest Revenue Debit Credit $ 2,960 $ 9,200 29,100 2,300 3,300 710 3,200 59,500 10,900 120 3,300 590 200 Notes Payable (long-term) Notes Payable (short-term) 60 27,600 1,000 Office Expenses 13,760 Prepaid Rent 900 Rent Expense 3,300 Repairs and Maintenance Expense 2,800 Retained Earnings 14,770 Salaries and Wages Expense 24,800 Salaries and Wages Payable Service Revenue 1,740 69,700 Supplies 500 Transportation Expense 20,550 $153,430 $153,430 2. Based on the trial balance, provide the name of the account that would accompany (a) Interest Revenue and (b) Salaries and Wages Exp accrual adjustments at May 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The account that would accompany Interest Rev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664295533d821_978776.pdf

180 KBs PDF File

664295533d821_978776.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started